|

Nebraska Articles of Incorporation Domestic Nonprofit Corporation |

The Nebraska Articles of Incorporation Domestic Nonprofit Corporation is a form which must be submitted to the Nebraska Secretary of State. The online form is provided by virtue of the Nebraska Secretary of State website. In order to fill in this form you will need to gather information such as the Address of the Principal Office, the Full Name and Address of the Registered Agent, and the Full Name and Addresses of the Incorporators. These are just some of the pieces of information that must be reported to the Nebraska Secretary of State when it is time to submit your documentation. Nearly all the information on these articles becomes a matter of public record thus, it is imperative to be as accurate as possible.

The Nebraska Articles of Incorporation Domestic Nonprofit Corporation must be accompanied with all the required paperwork for the applying entity type to form along with a payment of the Filing Fee. The Filing Fee is $10.00 if filing by mail, however if filing online there will be a $5.00/page charge for each additional page to be entered. You may pay with a check made out to “Secretary of State” if filing by mailing. If filing online, you may pay with a major credit card (Amex, Discover, MasterCard, or Visa). There will also be an additional charge (in most cases $2.00) for filing online. Online filings must be accompanied by a signed form of the Articles of Incorporation but do not need to be filed in duplicate. If filing by mail, send an original and an exact copy of that original. Both should be signed. It should be noted both the online Articles and the PDF form represent the bare minimal requirements of the Nebraska Secretary of State. Additional information may be necessary regardless of your filing method. Incorporators are encouraged to seek legal advice before filing.

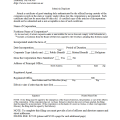

How To File By Mail

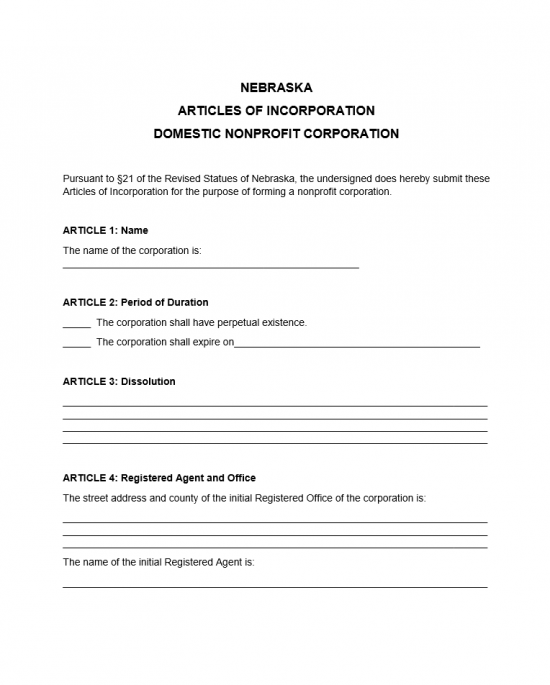

Step 1 – Download the Nebraska Articles of Incorporation Domestic Nonprofit Corporation. This is a PDF file that may be edited onscreen with a PDF program or it may be typed or printed.

Step 2 – Enter the Full Name of the forming Nonprofit Corporation in Article 1. Make sure to include one of the required corporate designation words.

Step 3 – Next, in Article 2, you must define the lifespan of this corporation. If this corporation is being formed to operate indefinitely, place an “X” on the first blank space. If not, then place an “X” on the second blank line and enter the Date of Dissolution on the second blank space.

Step 4 – In Article 3, define the terms of Dissolution on the blank lines present. This should cover how the assets and property of the corporation should be handled among other factors.

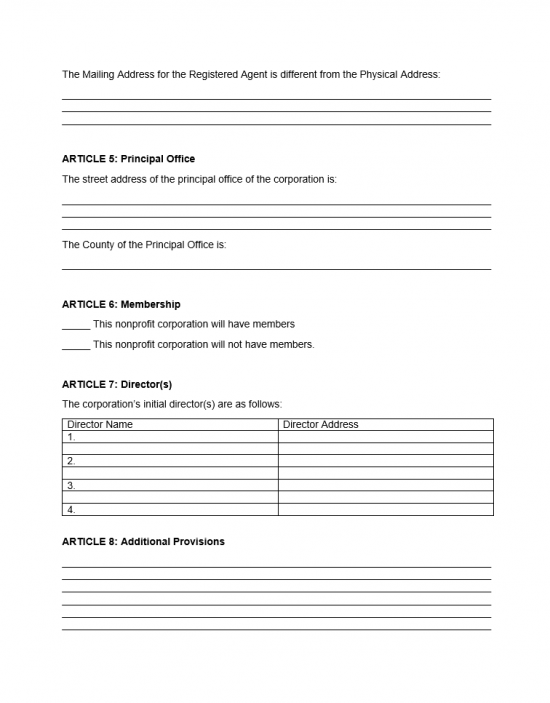

Step 5 – In Article 4, report the Street Address of the Registered Agent in the first section. This should be the Physical Address of the actual location. Then on the blank line following the words “The Name of the initial Registered Agent,” enter the Full Name of the Registered Agent. Finally (on the next page) under the words “The Mailing Address for the Registered Agent is different from the Physical Address” you may report the Mailing Address of the Registered Agent if he/she/it has a Mailing Address different from the actual location of the Registered Office. If the Registered Agent receives its mail at the same address as its Physical location, you may leave this last set of lines blank.

Step 6 – In Article 5, report the Physical Address (Building Number, Street, Suite Number, City, State, and Zip Code) of the Principal Office of the forming nonprofit. Then on the last line enter the County where the Principal Office is located.

Step 7 – In Article 6, report on whether this nonprofit shall have Members or not. If so, place an “X” on the first blank line. If not, then place an “X” on the second blank line.

Step 8 – Article 7 shall require a full roster of all the Directors sitting on the initial Board of Directors. Report the Full Name in the first column, then in the second column, report the Address for the Director named on that row. There is enough room for four Directors however you may continue this list on a separate document if there is not enough room.

Step 9 – Article 8 provides the opportunity to document any additional provisions that should accompany these articles. If there is not enough room to document all provision, amendments, etc. you may attach a separate clearly labeled document then document the title of this document in this section.

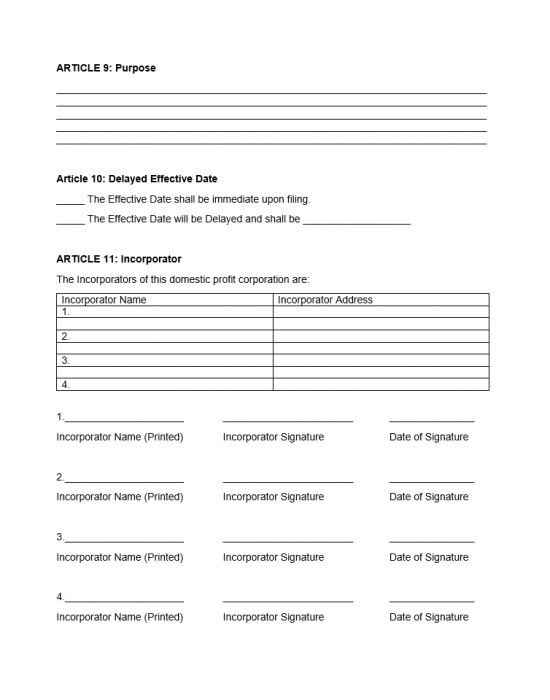

Step 10 – In Article 9, report the Purpose of this nonprofit corporation. Make sure you indicate the reason for forming this corporation and how it will conduct its business affairs in Nebraska. Note: If this entity plans on applying for Tax-Exempt Status it may do so with the I.R.S. In such cases, the entity may require very specific 501(c)(3) compliant language in this article and it is strongly recommended to confer with the Internal Revenue Service before filling out this section or submitting these articles.

Step 11 – In Article 10, you must report on the desired Effective Date of these articles. That is, if the articles are to go in effect upon filing or if you would like them to go in effect after the filing date. If the articles are to be effective upon filing, place an “X” in the first space. If the articles are to go in effect after filing, place an “X” in the first space on the second line then document an Effective Date within 90 days of the filing date.

Step 12 – List all the Incorporators’ Full Names and Full Addresses in the table present in Article 11. There is enough room for four Directors. If there are more, you must provide a full Roster on a separate sheet of paper (make sure it is clearly titled).

Step 13 – Below Article 11, each Incorporator must Print his/her Name, Sign his/her Name, then provide a Date for the Signature.

Step 14 – The Filing Fee for the Nebraska Articles of Incorporation for Domestic Nonprofit Corporation is $10.00. If filing by mail, you must pay this with a check made out to “Secretary of State.” Include this payment with two copies (one being the original) Nebraska Articles of Incorporation for Domestic Nonprofit Corporation and any and all required documentation then mail to the Nebraska Secretary of State.

Mail To:

Secretary of State

Room 1301, State Capitol, P.O. Box 94608

Lincoln, NE 68509

How To File Electronically

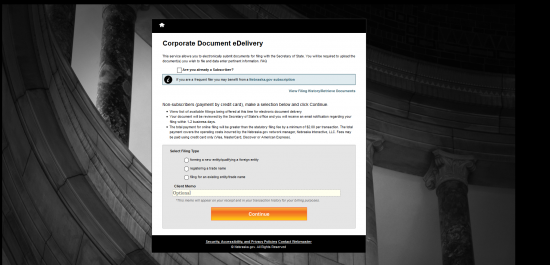

Step 1 – Go to the Corporate Document Delivery page of the Nebraska Secretary of State website here: https://www.nebraska.gov/apps-sos-edocs/

Step 2 – Read the introduction, then, in the box labeled “Filing Type,” select the radio button labeled “forming a new entity/qualifying a foreign entity.” This will cause a drop down list labeled “Select Entity Type” to appear. Make sure to select “Domestic Non-Profit Corporation.” If you wish, you may enter a Client Memo in the field below.

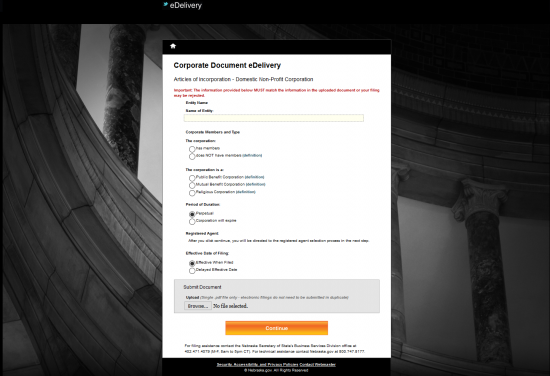

Step 3 – Under “Entity Name,” in “Name of Entity,” enter the Full Name of the nonprofit corporation being formed.

Step 4 – The next section, “Corporate Members and Type,” requires you to indicate if the forming entity will have members or not. If so, then select the first radio button. If not, select the second radio button.

Step 5 – A further definition for the type of nonprofit corporation being formed will be required under the heading “The corporation is a.” If the corporation is a Public Benefit Corporation, then select the first radio button. If the corporation being formed is a Mutual Benefit Corporation then select the second radio button. If the corporation being formed is a Religious Corporation then select the third radio button. You may choose only one.

Step 6 – Under the next heading, “Period of Duration,” you must indicate how long the corporation shall exist and engage in its business. If the nonprofit being formed does not intend to dissolve then mark the first radio button. If there is a specific date that has been named as the Dissolution Date then select the second radio button then enter the Date of Dissolution in the text field provided.

Step 7 – The next area requiring attention is labeled “Effective Date of Filing.” If you wish the filing to be effective immediately upon a successful review, select the first radio button in this area. If you wish a Delayed Date of Effect, then select the second radio button then enter the desired Date of Effect (must be within 90 days) in the text box that appears.

Step 8 – In the box labeled “Submit Document,” you may upload a PDF with your filing information or any required documentation. Keep in mind, you may only upload one PDF file so if you have multiple required files organize them into one PDF file. Use the “Browse” button to do this. When you have completed this task, select the button labeled “Continue.”

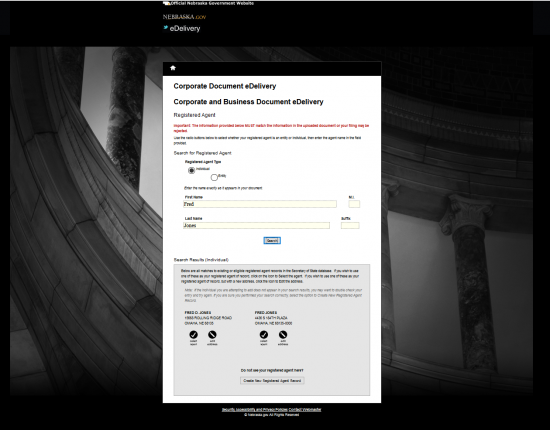

Step 9 – The next page will seek to define the type of Registered Agent you have obtained. If you have obtained a Registered Agent that is an individual, select the first radio button. If you have obtained a business entity for a Registered Agent, select the second radio button. For our purposes, select the first radio button. Once you selected a radio button a new section, appropriate to your choice, will open requiring the Name of the Registered Agent be entered. In the case of an Individual, this will consist of two fields “First Name” and “Last Name.” Enter the Registered Agent’s Name then select “Search.”

Step 10 – The Registered Agent’s Name will appear in a table below. You may choose to “Select Agent” by selecting the button with the check mark, edit the information with the “Edit Address” button below the Registered Agent’s Name, or “Create New Registered Agent Record” to enter a new one. For our purposes, select “Create New Registered Agent Record.” This will produce a pop up window.

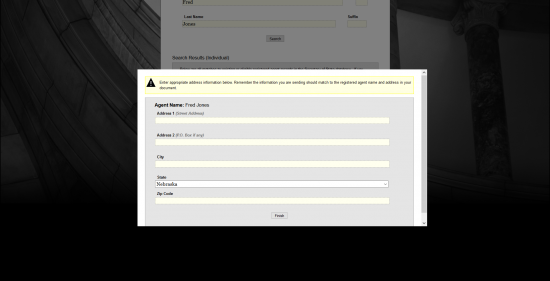

Step 11 – In the pop up window, the Registered Agent’s Name will be at the top of the pop up. Below this, enter the Street Address of the Registered Agent in the “Address 1” line (you may continue it on Address 2 if you wish), then enter the City and Zip Code in the “City” and “Zip Code” fields respectively.

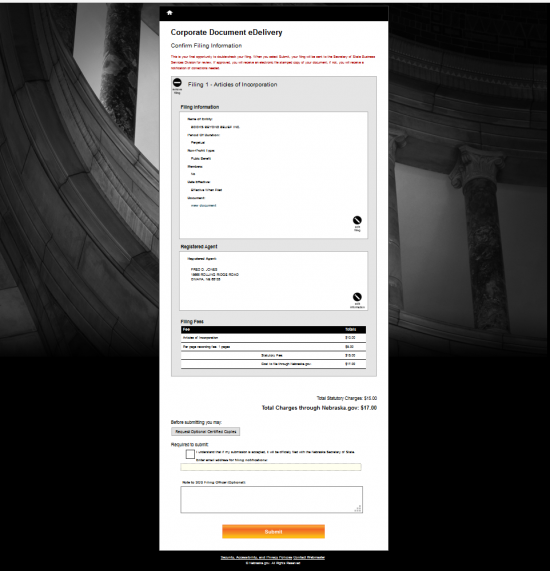

Step 12 – The next section will give you the opportunity to review your information. Each section will be displayed with an “Edit” button, which should be used for navigation to edit said information. Below this will be a sum of the fees involved. There is a $10.00 Filing Fee for the Nebraska Articles of Incorporation for a Nonprofit Corporation, a $5.00/page fee for the uploaded PDF, and a $2.00 Fee for filing through the website. Below the total, you may use the “Request Optional Certified Copies” button to order a Certified Copy at $10.00 per copy. This will give you the option of having it sent to another Address. Next, place a check mark in the box under “Required to Submit.” Then click on the “Submit” Button. This will direct you to an area where you may enter your credit card information for payment. This document will not be processed without payment.