|

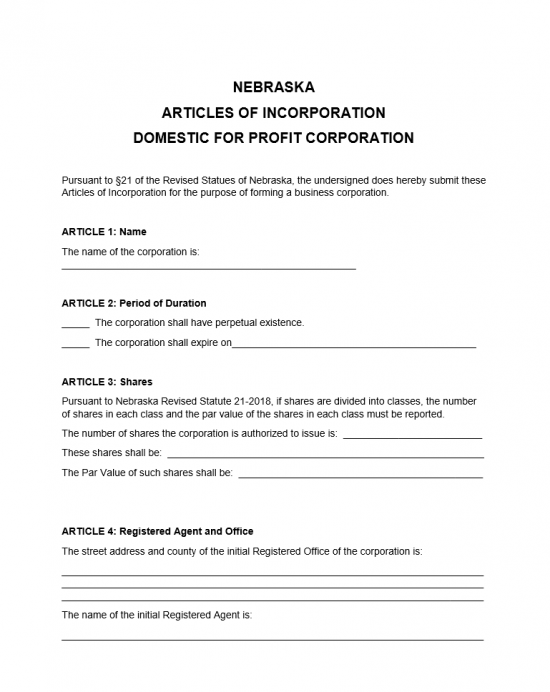

Nebraska Articles of Incorporation for Domestic For Profit Corporation |

The Nebraska Articles of Incorporation for Domestic Profit Corporation is a required filing procedure required by the Nebraska Secretary of State as part of the process of forming a For Profit Corporation in this state. Incorporators are required to submit several pieces of information regarding the corporation they are forming to the Nebraska Secretary of State prior to conducting business. This required information includes, but is not limited to, the unique Name the corporation shall operate under, the Nebraska Address where the domestic corporation is located, the Identity and Address of the Registered Agent for the forming entity and specifics regarding the stock information.

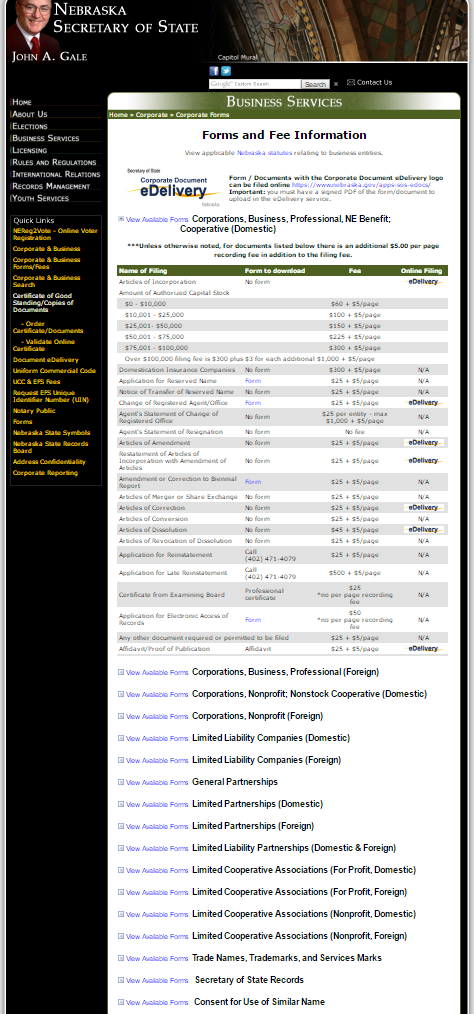

The Nebraska Secretary of State provides a template form for Incorporators to submit information via mail or electronically. Some circumstances, such as entity type, location, or specific conditions may require additional information to be submitted. All documents and required information must be submitted simultaneously with the articles. If filing by mail, clearly label and attach all additional documents while if filing online, organize all documents into a PDF file to upload with your articles. Additionally, all forming entities must pay the Filing Fee to submit these articles. The Filing Fee amount will depend upon the value of the total Capital Stock the forming entity has been authorized to issue and the number of pages accompanying this online form.

Regardless of the method of filing, the Filing Fee schedule is as follows. If the forming entity has been authorized to issue $10,000 or less worth of Capital Stock, the filing fee will be $60.00. If the corporation has been authorized to issue between $10,001 and $25,000 worth of Capital Stock, the filing fee will be $100.00. If the corporation has been authorized to issue between $25,001 to $50,000 worth of stock, the filing fee will be $150.00. If the corporation has been authorized to issue between $50,001 and $75,000 then you must pay a filing fee of $225.00. If the corporation has been authorized to issue between $75,001 to $100,000, the filing fee will be $300.00. If the corporation has been authorized to issue over $100,001 worth of stock the filing fee will be $300.00 and an additional $3.00 for each $1,000 increment above. If submitting online, you must pay an additional $5.00 for each page you are submitting in the PDF. You may submit your articles of incorporation here: http://www.sos.ne.gov/business/corp_serv/corp_form.html regardless of whether you have obtained a login with this state however, if you are filing multiple documents (such as other filings), a login is recommended.

How To File By Mail

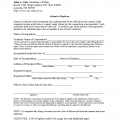

Step 1 – Download the Nebraska Articles of Incorporation For Profit Corporation by clicking on the “Download Form” above. This is a PDF which may be edited with a PDF program or may be printed then type written.

Step 2 – Report the Full Name of the Nebraska For Profit Corporation being formed in the First Article.

Step 3 – Report the Period of Duration in the Second Article. If this corporate entity is forming with the intent to operate indefinitely then place an “X” in the first space. If there is a specific date where the corporation will cease to exist, place an “X” in the second space, then, on the blank line following the statement “The corporation shall expire on” enter the Date of Expiration (dd/mm/yyyy).

Step 4 – In Article 3, report the Total Number of Shares this corporation has been authorized to issue on the first line in the blank space provided. Then on the second line indicate whether there are classes or if this common stock on the blank space provided. Finally, report the Par Value for each share on the blank space available on the third. Note: If this corporation has different classes of shares, the Total Number of Each Class must be reported with the Par Value for each Share in each Class. If there is not enough room, attach a clearly labeled schedule.

Step 5 – In Article 4, report the physical location for the Registered Office where the Registered Agent may be found on the first set of blank lines following the statement “The street address and county of the initial Registered Office of the corporation is.” This should not contain a P.O. Box.

Step 6 – Also, in Article 4, report the Full Name of the Registered Agent on the blank line following the statement “The name of the initial Registered Agent is:”

Step 7 – The last section of Article 4 should only be filled out if the Registered Agent receives his/her/its mail in a location other than the Physical Address listed. If this is the case, report the Mailing Address on the last set of blank lines in this Article. If the Registered Agent does not have a separate Mailing Address, you may leave this section blank.

Step 8 – In Article 5, report the Full Address of the Principal Office for this corporation on the blank lines following the statement “The street address of the principal office of the corporation is:”

Step 9 – In the next section of Article 5, report the County where the Principal Office is located on the blank line following the statement “The County of the Principal Office is:”

Step 10 – The Full Name and Full Address of each initial Director must be reported in the Table in Article 6. The left column is reserved for the Name and the right column is reserved for the Address. There will be enough room for four Directors to be listed however, if there are more, this should be continued on a separate sheet of paper.

Step 11 – If there are any additional provisions to these articles (i.e. liability/indemnification/privileges) they should be listed in Article 7. If there is not enough room, you may continue this in a separate attached document.

Step 12 – Article 8 shall require the Purpose of the corporation to be defined. This should be a statement(s) listing why the corporation is being formed and its nature or method of conducting business. If there is not enough room, continue this in a clearly labeled document then attach it.

Step 13 – In Article 9, place an “X” on the first blank space if you wish the Date of Effect to be immediate upon filing. If you wish the Effect Date to be delayed then place an “X” on the second blank line, then enter the Date of Effect on the blank space provided.

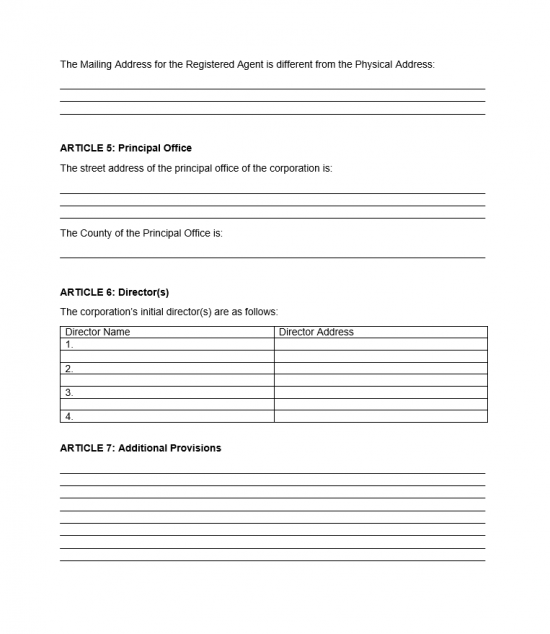

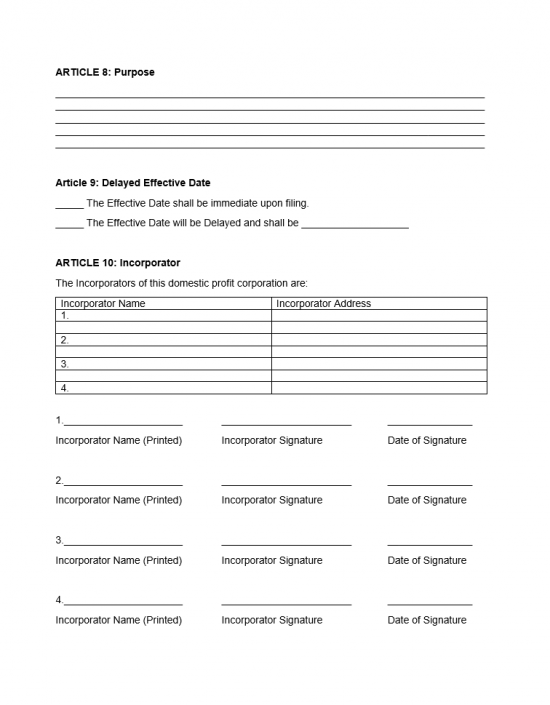

Step 14 – In Article 10, report the Full Name and Full Address of each Incorporator using the left column to report the Name and the right column to report the Address. There will be enough room for four Incorporators to be listed. If there are more than four, you must continue the list in a separate document that is clearly labeled.

Step 15 – Below the Incorporator list, each Incorporator reported must Print and Sign his/her Name then provide a Date for this Signature. If there is not enough room you may continue this in another document and attach it.

Step 16 – Next you must calculate your Filing Fee. This is done by taking the Total Value of the Total Number of Authorized Shares available to this corporation then finding the corresponding range for the Filing Fee Table listed here:

Thus, if the total value of Authorized Shares is $52,000.00, the Filing Fee will be $100.00. If the total value of Authorized Shares is $100,550.00 the Filing Fee would be $300.00 + $18.00= $318.00.

Step 17 – Next, you must organize all your documents with the Nebraska Articles of Incorporation For Profit Corporation you have drawn up into one package. Make sure to include a check or money order payable to “Secretary of State.”

Mail To:

Secretary of State

Room 1301, State Capitol, P.O. Box 94608

Lincoln, NE 68509

How To File

Step 1 – Go to the Business Services page of the Nebraska Secretary of State site here: http://www.sos.ne.gov/business/corp_serv/corp_form.html. Then locate the heading “Corporations, Business, Professional, NE Benefit, Cooperative (Domestic) and click on it. This will open drop down area.

Step 2 – From the “Corporations, Business, Professional, NE Benefit, Cooperative (Domestic) page, select the words “eDelivery.” This is on the top line of the section beginning with the words “Articles of Incorporation.”

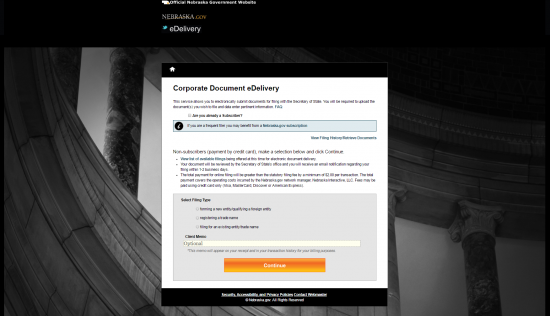

Step 2 – Read the introductory paragraphs then, under “Select Filing Type,” select the radio button labeled “Enter a new entity/qualifying entity.”

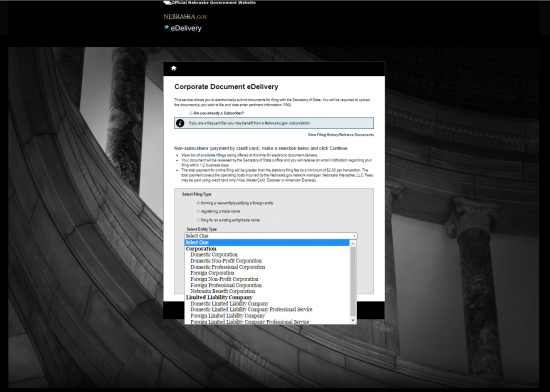

Step 3 – After selecting the appropriate choice a new area with a drop down menu shall appear. You must use this drop down menu to select the entity type you are forming. ‘For the purposes of this article select “Domestic Corporation.” Once you have done this select the yellow button labeled “Continue.”

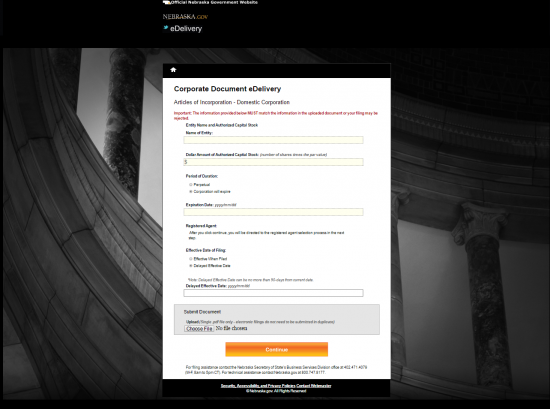

Step 3 – In the first field of this page, enter the Full Name of the entity being formed, under the words “Name of Entity.”

Step 4 – In the second field on this page, enter the total monetary worth of the Capital Stock this corporation may issue. Enter this under the words “Dollar Amount of Authorized Capital Stock.”

Step 5 – Next, under the heading “Period of Duration,” select either “Perpetual” or “Corporation will expire.” If this corporation does not have an expiration date, then you may proceed to the next section. If you select “Corporation will expire,” a field labeled “Expiration Date” will appear and you must enter the Date of Expiration here.

Step 6 – Locate the heading “Effective Date of Filing.” Here you may indicate whether you want the Date of Effect for these articles (when you may conduct business) to be immediate by selecting “Effective when Filed” or you may choose a date within 90 days of this filing by selecting “Delayed Effective Date.” If you choose “Delayed Effective Date” a text box labeled “Delayed Effective Date” will appear. Enter the desired date in this box.

Step 7 – If you have any documents that need to be submitted with the Nebraska Articles of Incorporation, you may do so by selecting the “Choose File” button under the “Submit Document” section. This will allow you to choose the file location for such documents. Note: This must be a PDF file. All the information on this page, must be present in the PDF file. That is, the PDF file must provide support for this information. When you have done this, you may select the “Continue” button.

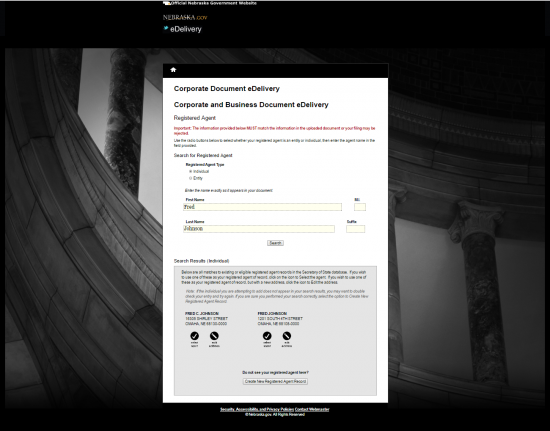

Step 8 – Next, you will need to define the Registered Agent that has agreed to receive court issued service of process on behalf of the corporation being formed. You may select either “Individual” or “Entity.” Regardless of your choice, you will need to enter the Full Name of the Registered Agent as it will appear in Nebraska Secretary of State records. Once done, select the “Search” button. This will produce a box displaying Registered Agents matching your criteria. You may either select the appropriate party by selecting the check mark button beneath that entry or you may enter a Registered Agent who is not on display by selecting the button labeled “Create New Registered Agent.” For out purposes, we shall create a new Registered Agent.

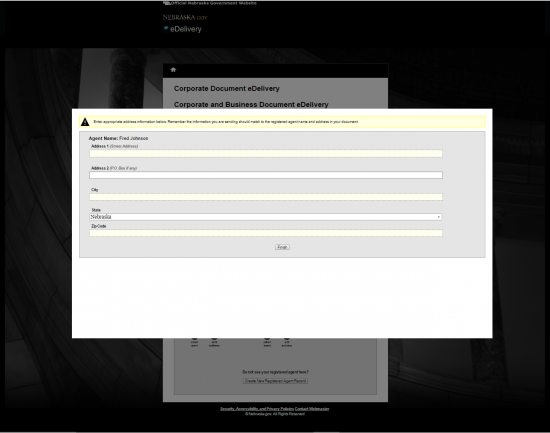

Step 9 – After selecting “Create New Registered Agent,” a pop up window will appear. Here you must enter the Address for the physical location of the Registered Agent you have entered. In “Address 1,” you must enter the Building Number, Street, and Suite Number (“Address 2” is a field provided should you require more room). Then enter the City, County, or Township of the Registered Agent in the field labeled “City.” Finally, enter the “Zip Code.” This must be an address in the State of Nebraska, hence this information is autopopulated. When you have entered the information, select the word “Finish”

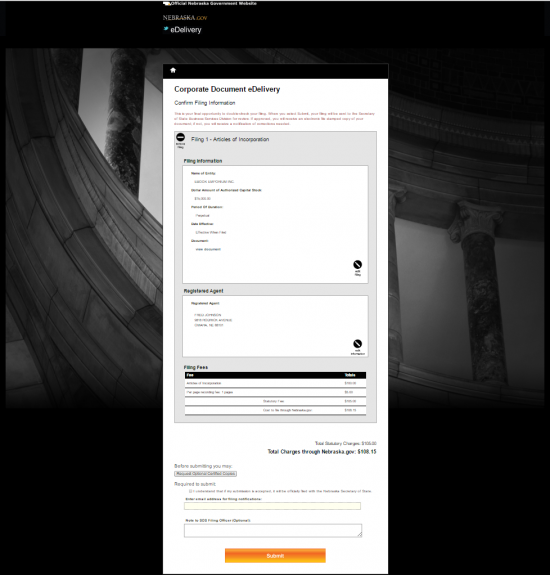

Step 10 – This page will contain all the information you have just entered. This is your final chance to review what you are reporting. If any information needs to be edited, then select the round button labeled “Edit Filing” in the “Articles of Incorporation” section. There will also be an “Edit Information” button in the Registered Agent section. The “Filing Fees” section will contain the total amount that must be paid. Below this will be a button where you may “Request Optional Certified Copies.” Selecting this will allow you to enter your mailing information to receive these copies as well as defining how many you would like (each certified copy will cost an additional $10.00).

Step 11 – Below the “Required to Submit” heading, you must check the box next to the acknowledgment statement. Then in the first text box, enter your Email Address. The field below this provides the option of making a note to the Secretary of State Officer reviewing your articles. Once you have verified all information is accurate and provided your acknowledgment and Email Address, select the yellow button labeled “Submit.” This will direct you to a page where you may pay the filing fee with your credit card.