|

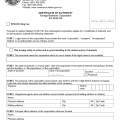

New York Certificate of Incorporation – Business Corporation | Form DOS 1239-f |

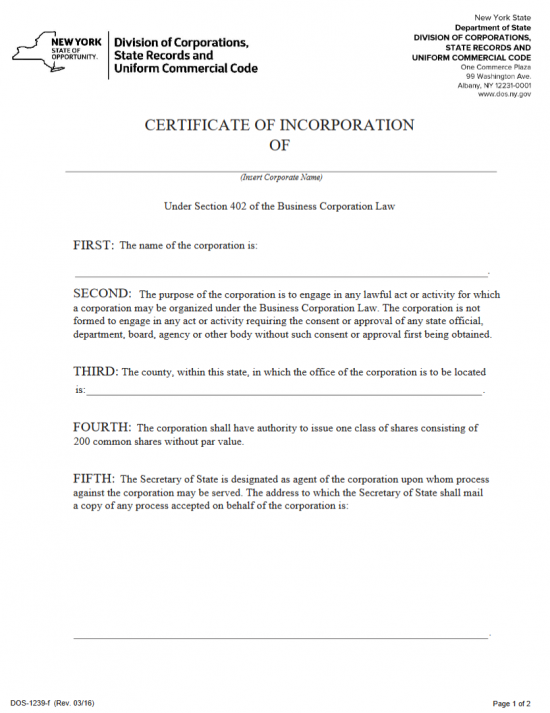

The New York Certificate of Incorporation – Business Corporation | Form DOS 1239-f fulfills one of the final requirements of the New York State Department, Division of Corporations. This form provides a structure for the minimum amount of information that all business corporations must report. It may be used as is or you may draw up your own Certificate of Incorporation with additional articles. Any form drawn up for this purpose must contain the information requested on this template form. It is imperative that Incorporators know all the requirements of the incorporation process specific for the type of corporation being formed. In truth, it is generally recommended that Incorporators seek counsel with appropriate professionals such as a New York attorney or accountant.

The New York Department of State Division of Corporations will accept filings by mail or online. If filing by mail you must send all required documents with The New York Certificate of Incorporation to Department of State, Division of Corporations, State Records and Uniform Commercial Code, One Commerce Plaza, 99 Washington Ave, Albany, NY 12231-0001 or you may file online at https://appext20.dos.ny.gov/ecorp_public/f?p=201:17. The $125.00 Filing Fee may be paid for using a check (payable to Department of State) when filing by mail or a credit card when filing online.

How To File

Step 1 – The form above (Form DOS 1239-f) must be downloaded then filled out onscreen using an appropriate program or printed then filled out manually.

Step 2 – Just below the Title, “Certificate of Incorporation for,” enter the Full Name of the New York business corporation being formed by this document. This must name must include a word of incorporation.

Step 3 – You will also need to report this corporation’s Name on the blank line in the First Article.

Step 4 – The Second Article will bind the corporation being formed by this document to the Purpose listed here. Make sure this paragraph is fully read and understood.

Step 5 – Report the New York State County where the Office of the corporation will be located on the blank line in the Third Article.

Step 6 – The Fourth Article shall verify and require the corporation being formed has the authority to issue 200 Common Shares without Par Value for one Class of Shares. If this is not the case, you must delete this paragraph or draw up a new document where the Fourth Article reports the Total Number of Shares for each Class of Stock this corporation has been authorized to issue along with a statement either naming the par value or reporting there is no par value. There will be a minimum of $10.00 in tax to be paid with the default statement. The Tax is $10.00 so long as the corporation is authorized to issue up to 200 Shares of Common Stock with No Par Value or a Par Value of under $20,000.00 (for the Total Number of Shares). Otherwise, you will need to calculate the tax rate at 5 cents per share (no par value stock) or 0.01% (1/20 of one percent) for Shares with a State Par Value, as per Section 180 of the Tax Law.

Step 7 – The Fifth Article shall name the New York Secretary of State as the Agent where a service of process against the corporation may be served. The New York Secretary of State requires the Full Address where the corporation being formed will be able to receive such documents. All copies of any such court documents received by the New York Secretary of State for this corporation will be sent to this Address.

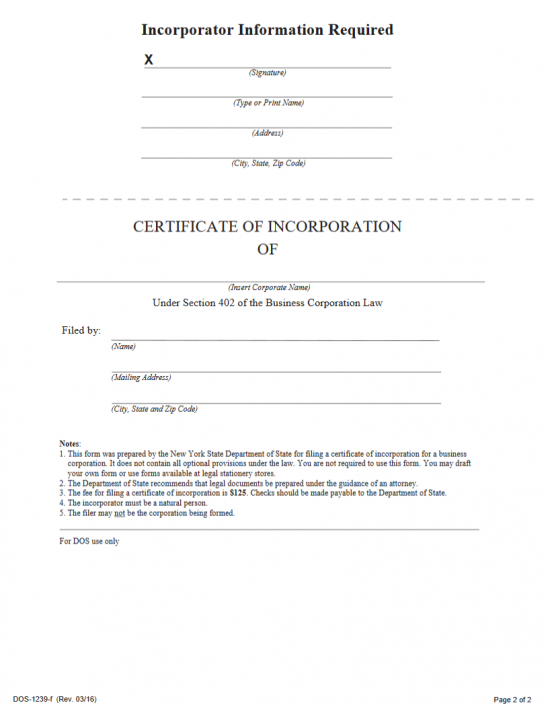

Step 8 – On the next page, under the heading “Incorporator Information Required,” each Incorporator must Sign then Print his or her Name then provide his or her Complete Address. There is only enough room for one however if there are more, you may add enough space by editing this document.

Step 9 – Locate the heading “Certificate of Incorporation Of” and enter the Full Name of the corporation being formed on the blank line available.

Step 10 – The Submitter of this Certificate of Incorporation must Print his/her Name then report his/her Mailing Address on the appropriate lines next to the words “Filed By.”

Step 11 – The New York Certificate of Incorporation, when submitted by mail, must be accompanied by a check for $125.00 payable to “Department of State,” plus payment of the $10.00 Tax. You will need to draw up a separate form if the corporation being formed has more than the Shares listed in the Fourth Article and pay an additional amount in taxes.

Mail To:

New York Certificate of Incorporation to Department of State

Division of Corporations

State Records and Uniform Commercial Code

One Commerce Plaza

99 Washington Ave

Albany, NY 12231-0001

In Person:

Department of State Division of Corporations

One Commerce Plaza

99 Washington Avenue, 6th Floor

Albany, NY 12231

By Fax:

(518) 474-1418

(Requires Credit Card Authorization Form)

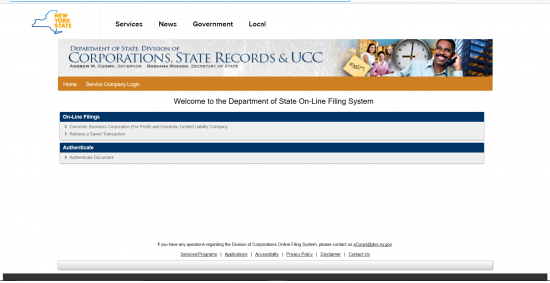

How To File Online

Step 1 – Go to https://appext20.dos.ny.gov/ecorp_public/f?p=201:17 then select the link labeled “Domestic Business Corporation (For Profit) and Domestic Limited Liability Company.”

Step 2 – On this page, locate then select the link labeled “Certificate of Incorporation for a Domestic Business Corporation (not for professional service corporations).

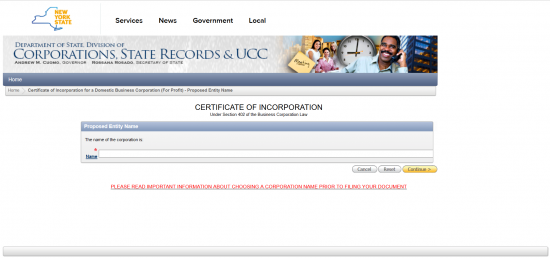

Step 3 – In the text field labeled “Name,” enter the Full Name of the corporation being formed. Make sure it is unique and utilizes a corporate designator such as “Corporation” or “Inc.” Select the button labeled “Continue” to proceed.

Step 4 – If desired, click in the check box labeled “I, the undersigned, a natural person, of at least 18 years of age, for the purpose of forming a corporation under Section 402 of the Business Corporation Law of the State of New York.” This is a traditional introductory statement and is optional to include.

Step 5 – Enter the Full Name the corporation being formed shall be known as and operate under in the State of New York in the field labeled “Name.” If the Name has a foreign language in it, enter the English version in the field labeled “English Translation.”

Step 6 – Entities incorporating in the State of New York must report their corporate Purpose. A generic one is included and will be considered binding. If the Purpose of the forming corporation needs to be more specific then you must file the articles by paper (see above instructions).

Step 7 – Locate the heading “County.” Use the drop down list present in the field labeled “County” to report the County where the corporation’s Office is located.

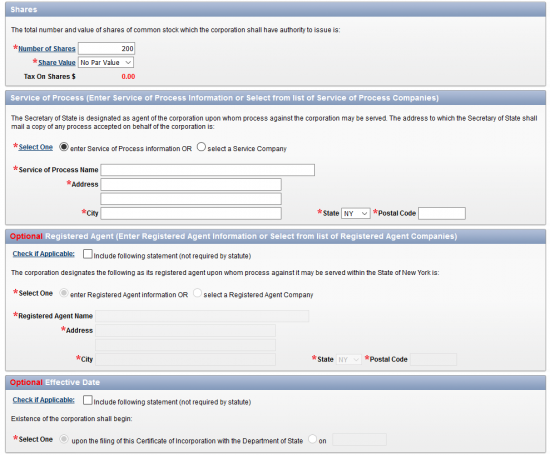

Step 8 – Under the heading, “Shares,” report the Total Number of Shares this corporation has been authorized to issue in the field labeled “Number of Shares.” Next, use the drop down list in the field labeled “Share Value” to indicate if the Shares being reported have Par Value or No Par Value. Notice the Taxes will be automatically calculated. Note: If the stock is divided into more than one class, you will need to file by paper so that you may report this information for each Class of Stock.

Step 9 – The next section requiring attention, “Service of Process,” will require information be entered in the event the corporation is ever sued. By default, the New York Secretary of State will be named as the Registered Agent to receive such documents on behalf of the corporation being formed. The New York Secretary of State will require the Corporate Address where copies of such documents may be sent and received by the corporation being formed. If you wish to enter the information manually, then select the first bubble, labeled “enter Service of Process information.” If your Registered Office is a service company, you may select the bubble labeled “select Service Company,” then use the drop down list that is generated to select the Service Company by this corporation. If you do enter information manually, make sure to enter the Full Name of the recipient in the field labeled “Service of Process Name,” the Street Address in the field labeled “Address,” and the City, State, and Zip Code in the “City,” “State,” and “Postal Code” fields (respectively).

Step 10 – The section titled “Registered Agent” is optional. If the forming corporation has obtained a separate entity as a Registered Agent that is not in the Service Company List, then click the first check box in the section. If the Registered Agent information must be filled in, mark the first bubble (labeled “enter Registered Agent information.” Then enter the Full Name and Complete Address of the Registered Agent obtained by this corporation. If the Registered Agent information may be selected from a list of Registered Agent Companies, select the bubble labeled “select a Registered Company” then use the drop down list that is generated to select the company the corporation has obtained. Note: This must be the physical location of the Registered Office and may not contain a PO Box.

Step 11 – The section titled “Effective Date” is also optional. If you wish to include information from this section then mark the first check box. Here there will be a choice, upon a successful filing, as to when this form is approved. If you wish this Effective Date to be the same as the Filing Date then mark the bubble labeled “upon the filing of this Certificate of Incorporation with the Department of State.” If you wish a separate Date (that is within 90 Days of the Filing Date) then mark the second bubble. This will generate an additional field in which you may enter the desired Date of Effect for these articles.

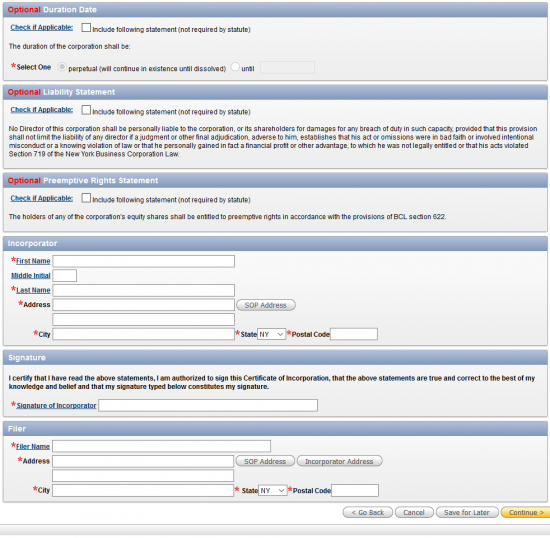

Step 12 – The next section, “Duration Date,” is also optional. If you wish to include it, select the first check box. Then, check the first bubble if this corporation has no intention of terminating. If it does, you may select the second bubble, labeled “until,” then enter the Date of Termination in the blank field provided.

Step 13 – The section, “Liability Statement,” is also optional. If the corporation wishes to extend Liability Protection to the Directors (within the confines of the law) then click the check box in this section.

Step 14 – If the equity shareholders are entitled to Preemptive Rights then check the box under the heading, “Preemptive Rights Statement.” If not, leave this section blank.

Step 15 – In the section labeled “Incorporator,” you must report the Name and Address of the Incorporator of this entity. Enter the Incorporator’s Full Name using the “First Name,” “Middle Initial,” and “Last Name.” Then you may fill in the Incorporator’s Address. You may auto populate the Address fields with the Service of Process Address (if it is the Incorporator’s Address) by selecting the button labeled “SOP Address.” Note: If more than one Incorporator must be reported then you must file a paper form.

Step 16 – In the field labeled “Signature of Incorporator,” the Incorporator must type in his or her Name. This will act as a Digital Signature.

Step 17 – In the section labeled “Filer,” enter the Full Name of the individual submitting this document in the field labeled “Filer Name.” Then you must report this party’s Address. If it is the same as the Service of Process Address or the Incorporator Address, you may auto populate these fields by selecting the button labeled “SOP Address” or “Incorporator Address” as appropriate. Once you are done, select the “Continue” button. This will direct you to an area where you may pay for this Filing by entering your credit card information. The Filing Fee will be $125.00 plus all applicable taxes.