|

South Carolina Application by a Foreign Nonprofit Corporation for a Certificate of Authority in the State of South Carolina |

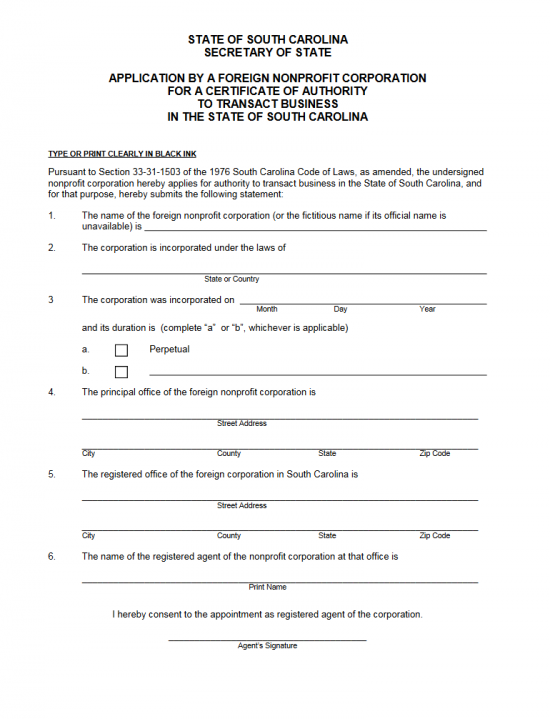

The South Carolina Application by a Foreign Nonprofit Corporation for a Certificate of Authority in the State of South Carolina should be submitted by foreign nonprofit corporations to the South Carolina Secretary of State prior to attempting to operate as such in this state. This form was developed by the South Carolina Secretary of State to cover satisfy the minimum filing requirements placed on filing entities and applies to all foreign nonprofit corporations applying for a Certificate of Authority in this state. That is, there may be additional requirements placed on an entity depending upon the nature of the foreign nonprofit corporation. Filing entities should seek consultation with a South Carolina attorney before filling out this form if any part of the filing process or its requirements are unclear.

The Filing Fee for the South Carolina Application by a Foreign Nonprofit Corporation for a Certificate of Authority in the State of South Carolina is $10.00. This may be remitted with a check payable to “Secretary of State.” This filing should be submitted by mail to Secretary of State, 1205 Pendleton Street, Suite 525, Columbia SC 29201. This filing must be made in duplicate and include a self addressed stamped envelope. You may either send two originals or one original and one exact copy.

How To File

Step 1 – Download the South Carolina Application by a Foreign Nonprofit Corporation for a Certificate of Authority in the State of South Carolina by selecting the link labeled “Download Application.” If the True Name of the foreign corporation is unavailable for use in this state, select the link “Download Statement of Fictitious Name” as well since it will need to be filled out and submitted as well. Both of these files are PDF programs so they may be edited with a PDF editor or printed then filled out.

Step 2 – On the blank line in Item 1, report the Full Name of the foreign nonprofit corporation as it appears on the Certificate of Existence that will be submitted with this application. If the Name is unavailable, enter the Fictitious Name the foreign corporation will operate under. Make sure to include a resolution to use a Fictitious Name if the foreign corporation must use a Fictitious Name.

Step 3 – On the blank line labeled “State or Country” in Item 2, report the jurisdiction where the foreign corporation is located.

Step 4 – On the blank line in Item 3, enter the Month, Calendar Day, and Year this entity was incorporated in its home state.

Step 5 – In the next section of Item 3, check the first box if the foreign corporation operates without a Date of Dissolution. If there is a specific Date when this corporation will cease its activities, then place a mark in the second box and enter the Date of Dissolution on the blank line provided.

Step 6 – In Item 4, report the Street Address, City, County, State, and Zip Code where the foreign corporation’s Principal Office is located.

Step 7 – In Item 5, enter the Street Address, City, County, State, and Zip Code of the Registered Office where the Registered Agent may be physically located. This may not be a P.O. Box as it must be the geographical location of the Registered Agent’s Registered Office.

Step 8- In Item 6, enter the Full Name of the Registered Agent on the first blank line, then have that Registered Agent Sign his or her Name on the second blank line.

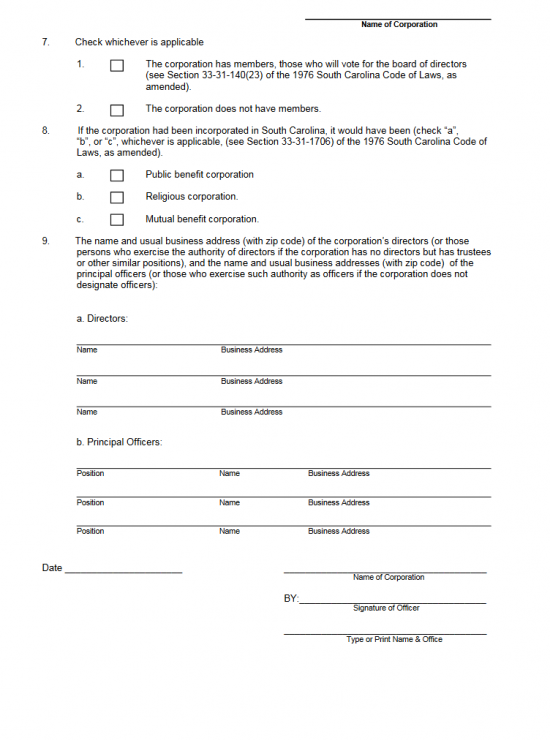

Step 9 – Locate the line labeled “Name of Corporation,” in the upper right hand corner of the second page. Enter the Name of the filing entity here.

Step 9 – Locate the line labeled “Name of Corporation,” in the upper right hand corner of the second page. Enter the Name of the filing entity here.

Step 10 – In Item 7, check the first box if the foreign nonprofit corporation has members. If the foreign nonprofit corporation does not have members then place a mark in the second box.

Step 11 – Define what type of foreign nonprofit corporation in Item 8. If this is a Public Benefit Corporation, place a mark in the first box. If this is a Religious Corporation, then place a mark in the second box. If this is a Mutual Benefit Corporation then place a mark in the third box.

Step 12 – In Item 9, report the Full Name and Business Address of all the Directors (or if there are none, those who exercise the same authority as a Director), in section 9a, “Directors.” Then in section 9b, “Principal Officers,” enter the Title, Full Name, and Full Business Address of each of the Principal Officers serving this corporation.

Step 13 – Locate the blank line, labeled “Date,” at the bottom of this application. Enter the Date this document is being signed.

Step 14 – The binding Signature area will be located in the lower right hand part of this application. Here, you must enter the Full Name of the foreign corporation on the blank line labeled “Name of Corporation.” Then an Officer of the filing entity must provide his or her Signature on the Signature Line then Print his/her Title and Full Name on the last blank line, labeled “Type or Print Name & Office.”

Step 15 – Next, you will need to submit the South Carolina Application by a Foreign Nonprofit Corporation for a Certificate of Authority in the State of South Carolina in duplicate. This means you will need to submit either two originals or one original and one exact copy. This must be accompanied any additional required paperwork for this entity’s filing and a self addressed stamped envelope. You will also need to send a check covering the Filing Fee of $10.00 plus any additional applicable fees. This must be payable to Secretary of State. Mail this package to the South Carolina Secretary of State.

Mail To:

Secretary of State

1205 Pendleton Street Suite 525

Columbia SC 29201