|

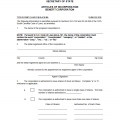

State of South Carolina Articles of Incorporation Profit Corporation |

The State of South Carolina Articles of Incorporation Profit Corporation must be completed and submitted by Incorporators, to the South Carolina Secretary of State, before it is allowed to start its operations. Corporations in this state must obtain a Certificate of Incorporation from the South Carolina Secretary of State in order to legally form and remain in compliance with The South Carolina Code of Laws Title 33 – Corporations, Partnerships and Associations. In addition to these articles, all profit corporations must also obtain a Registered Agent, submit a First Report to Corporations | Form CL-1, and pay the Filing Fee in Full. These are just some examples of what forming corporations are required to fulfill before gaining corporate status in this state. The State of South Carolina Articles of Incorporation Profit Corporation will require information regarding all the basic requirements however in some cases, more information may need to submitted. In fact, some profit corporations such as professional ones will have a specific version of this form (also developed and required by the State of South Carolina) that must be used instead. Incorporators are held responsible in making sure they are fully versed in the process of forming the entity they wish to and in fulfilling all the requirements placed upon them by all governing entities on the state and federal level before attempting to file these articles. If there are any questions, regarding the full process of incorporation, it is strongly recommended to seek the advice of a South Carolina Attorney.

The Filing Fee of the State of South Carolina Articles of Incorporation – Profit Corporation is $135.00. This includes the Filing Fee of the First Report to Corporations | Form CL-1. That is, only these two filings will be covered by this fee. If there are any other filings or statements with fees, the fees must be added to $135.00 for a Full Payment. The articles may be submitted by mail to Secretary of State, 1205 Pendleton Street, Suite 525, Columbia, SC 29201. Payment should be remitted in the form of a check made payable to “Secretary of State.”

How To File

Step 1 –Select and download both of the above links, “Download Articles of Incorporation” and “Download First Report to Corporations,” to your computer. These are PDF files, thus, you may fill them out onscreen (with a PDF program) or print them out then fill them out. If you are filling them in by hand, make sure it is legible and in dark ink.

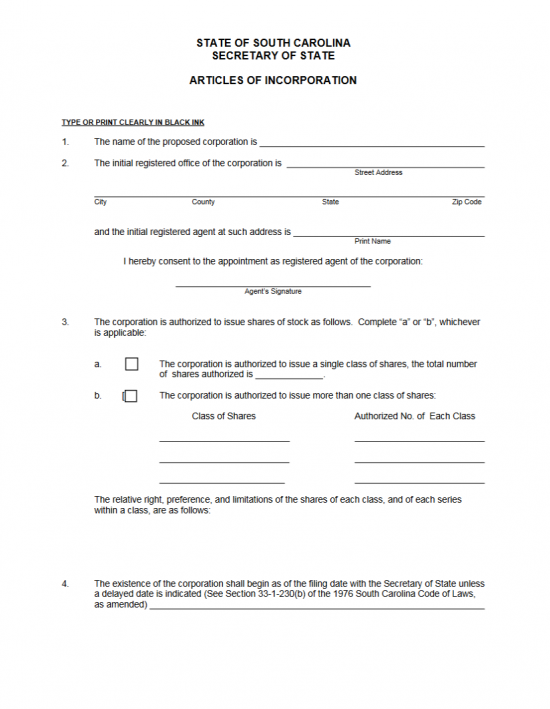

Step 2 – Once you are ready to fill in the State of South Carolina Articles of Incorporation, enter the Full Name of the corporation on the blank line in the first article. This must include a word of incorporation such as Corporation, Incorporated, or a generally accepted abbreviation.

Step 3 – Next, in Article 2, enter the Full Address of the Registered Agent on the blank space following the words “The initial registered office of the corporation is.” This may not be a P.O. Box or a separate mailing address but the geographical location of the Registered Office.

Step 4 – The blank line following the words “and the initial registered agent at such address is” will require the Full Name of the Registered Name acquired for this corporation.

Step 5 – Below the words “I hereby consent to the appointment as registered agent of the corporation,” the Registered Agent must sign his or her Name of the space labeled “Agent’s Signature.”

Step 6 – In Article III, it will be time to define the authorized stock the corporate entity being created may dispense. This section is divided into two section, you may only fill in one. If the corporation may only issue a single Class of shares then mark the box labeled “a” and fill in the Total Number of Shares the corporation may dispense. If the corporation is authorized to issue multiple share Classes then mark the box labeled “b.” If you chose “b,” you must document the Class of Shares and the Total Number of Shares in each class in the columns “Class of Shares” and “Authorized No. of Each Class” (respectively). Below this, you must then define the rights, preferences, and limitations of each class in the space provided below this table.

Step 7 – In Article IV, you have the option of choosing a Delayed Date of Effect for the Articles. If you wish to postpone the Date these articles become Effective until after the Filing Date, indicate the desired Date and Time of Effect on the blank line provided. If no time is specified, it shall be considered in effect at the close of the Date you have entered. If you do not wish a Delayed Date of Effect, leave this line blank.

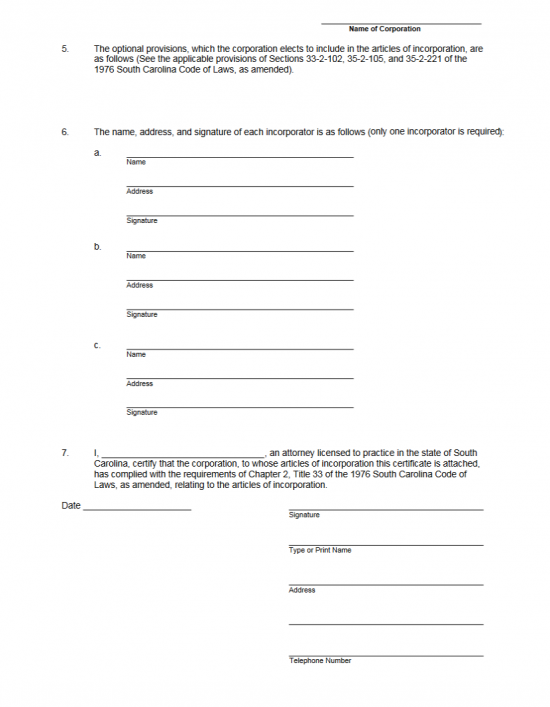

Step 8 – On the top of the next page, enter the Name of the forming entity exactly as it was reported in Article I on the line labeled “Name of Corporation.”

Step 9 – Article V will allow for additional Provisions to be included in these articles. You may document such Provisions in the space available in Article V or you may attach a separate sheet of paper that is clearly labeled with said Provisions.

Step 10 – In Article VI, document the Full Name and Full Address of each Incorporator. All Incorporators should be listed here and all Incorporators should provide his or her Signature. There will be enough room for three Incorporators, however you may continue this Roster on a separate sheet of paper. The first line of each entry should bear the Incorporator’s Full Name, the second line should bear the Incorporator’s Full Address, and the third line should bear the Incorporator’s Signature.

Step 11 – Article VII will require a licensed Attorney of South Carolina to Print his or her Name on the blank space in the first paragraph. Below this on the left the Signature Date should be entered on the blank line labeled “Date.” The right will be reserved for a Signature Line where the Attorney must sign his/her Name, a Printed Name Line so that he or she may Print his/her Name, an Address Line where the Attorney Address must be entered, and a Telephone Number Line where the Attorney’s Phone Number must be entered.

Step 12 – Fill out the First Report to Corporations then attach this and all other required documents to the South Carolina Articles of Incorporation – Profit Corporation. This package must include a check for $135.00 to cover the Filing Fee of the South Carolina Articles of Incorporation – Profit Corporation and the First Report To Corporations. Make this check payable to “Secretary of State.”

Mail To:

Secretary of State

1205 Pendleton Street Suite 525

Columbia, SC 29201