|

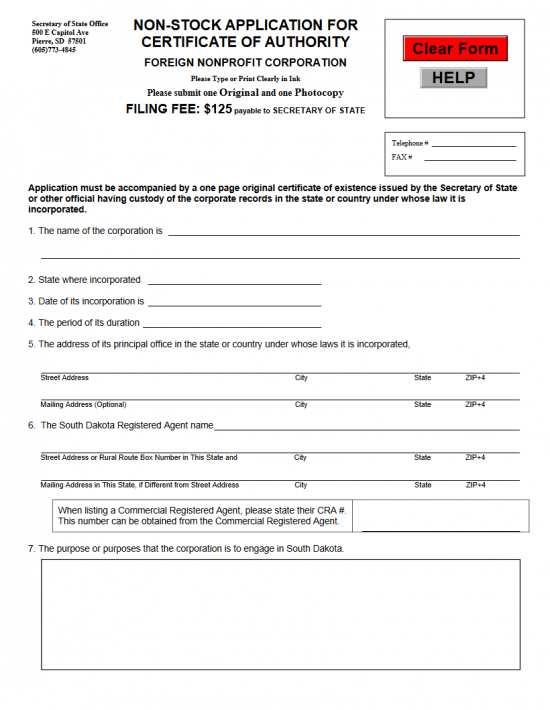

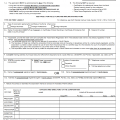

South Dakota Non-Stock Application for Certificate of Authority Foreign Nonprofit Corporation |

The South Dakota Application for Certificate of Authority for a Nonprofit Corporation Foreign Nonprofit Corporation is the application used by the South Dakota Secretary of State when a foreign corporation wishes to apply for a Certificate of Authority. This is the document that foreign nonprofit corporations must obtain in order to operate as such in the State of South Dakota. It should be noted that while this application satisfies one requirement for all foreign nonprofit entity types, additional information may be required depending upon the type of nonprofit corporation applying for this certificate.

There are two staunch requirements that must be met with this application when a foreign nonprofit corporation applies for the South Dakota Certificate of Authority is a full payment of the Filing Fee ($125.00) and the submission of a Certificate of Existence issued from the home state of the applying entity within 30 days of the Filing Date. This application may be submitted by mail to . All payments should be made with a check, payable to “Secretary of State,” for the full amount.

How To File

Step 1 – Select the button labeled “Download File” above. This will download the South Dakota Non-Stock Application for Certificate of Authority to your computer as a PDF file. If you have a PDF editor or something similar, you may fill this out onscreen. If not, then print this form and fill it out.

Step 2 – In the upper right hand corner of the screen, enter the Telephone Number and Fax Number the South Dakota Secretary of State may use as a way of contacting the filing entity regarding this filing.

Step 3 – In Item 1, enter the True Name of the filing entity as it is reported on the Certificate of Existence that will be submitted with this document. This certificate must be issued from the governing authority where the filing entity is incorporated.

Step 4 – In Item 2, document the State where the filing entity is incorporated.

Step 5 – In Item 3, enter the Date the filing entity first incorporated in its state of jurisdiction on the blank line provided.

Step 6 – Item 4 requires you to report on the period of duration of the filing entity. That is, how long will it exist. If there is a specific termination date, enter this on the blank line provided. If not, enter the word “Perpetual.”

Step 7 – In Item 5, you will have two blank lines. Each one will refer to an Address. On the first blank line, enter the Full Street Address, City, State, and Zip Code of the Physical Address where the Principal Office is located. If the Principal Address has a separate Mailing Address, enter this address on the second blank line. If the Principal Office does not have a Mailing Address, you may leave this line blank.

Step 8 – In Item 6, you must report the Identity and Location of the Registered Agent (located in South Dakota) obtained by the foreign nonprofit corporation. On the first line, enter the Full Name of the South Dakota Registered Agent. Then on the second blank line, report the Full Street Address of the Registered Office’s geographical location. If the Registered Office has a Mailing Address, different from the geographical address, then enter the Mailing Address on the second blank line (leave blank if there is no separate Mailing Address). Below this will be a box where you may list the Commercial Registered Agent Number (CRA#). If you have obtained a commercial Registered Agent report his/her/its CRA # on the blank line in the box. If not, you may leave this blank.

Step 9 – In Item 7, describe the Purpose(s) of operating a nonprofit corporation in the State of South Dakota. That is, why is this entity being formed and how will it behave.

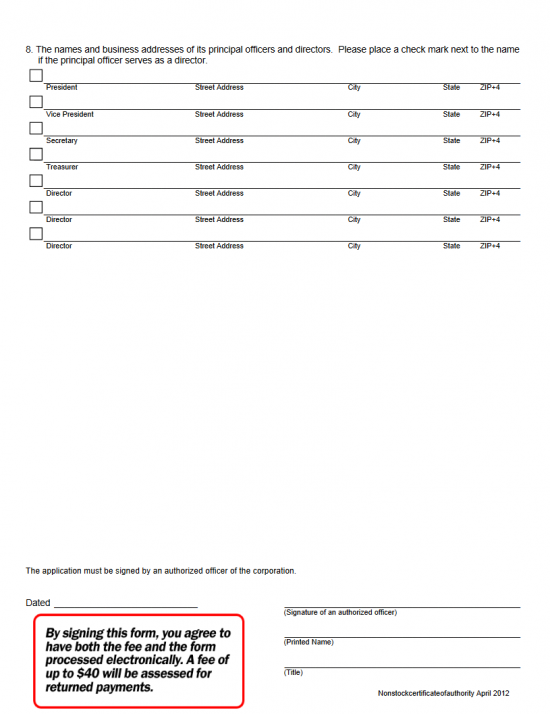

Step 10 – In Item 8 you will need to report the Identity and Addresses of the Officers and Directors serving this corporation. There will be several labeled blank lines for this purposes: President, Vice-President, Secretary, Treasurer, and three lines labeled Director. Each one will have enough space for the Full Name and Full Address of that individual to be reported. Additionally, if the individual being reported acts as a Director, place a check mark in the check box at the start of that line.

Step 11 – At the bottom of the page, you must report the Date of Signing, have Authorized Officer of the corporation Sign his or her Name, Print his or her Name, and enter the Title he or she hold in the filing entity.

Step 12 – Next, you must gather all required documents, including the Certificate of Existence (dated within 30 days of the submission date by the issuing authority), an original and one copy of the South Dakota Non-Stock Application for Certificate of Authority Foreign Nonprofit Corporation and a check for $125.00, payable to Secretary of State, then send by mail to the Secretary of State.

Mail To:

Secretary of State Office

500 E. Capitol Ave

Pierre, SD 57501