|

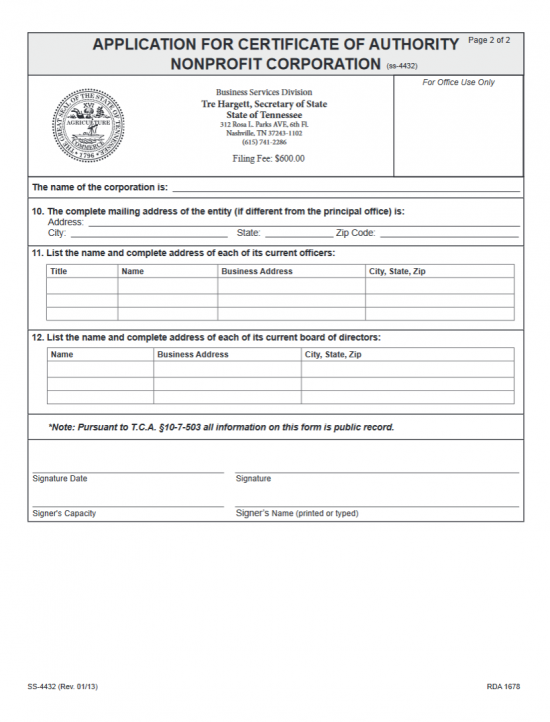

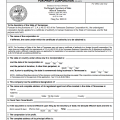

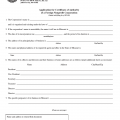

Tennessee Application For Certificate of Authority Nonprofit Corporation | Form SS-4432 |

The Tennessee Application For Certificate of Authority Nonprofit Corporation | Form SS-4432 must be submitted to the Tennessee Secretary of State when a nonprofit corporation, that has incorporated and operates in another state, wishes to conduct business in Tennessee as a nonprofit corporation. This application is necessary in order to gain a Certificate of Authority in the State of Tennessee. While this process mandated by the State of Tennessee, it by no means satisfies all filing requirements, especially those imposed by other governing entities (such as the Tennessee Department of Finance). The specific process will differ depending largely on the type of nonprofit the filing entity is and the locality of precisely where, in Tennessee, it wishes to operate. Filing entities are, therefore, encouraged to make sure they are well aware of requirements their entity type must fulfill on a local, state, and federal level.

This application may be submitted in person, by mail, or electronically and, regardless of specifics, must be submitted with a Certificate of Existence issued within 60 days of the Application Date by the governing authority or recording authority of the jurisdiction it is incorporated in. Payment of the Filing Fee is also mandatory on submission. The Filing Fee of $600.00 may be submitted in the form of a check, cashier’s check, or money order, if one files by mail (Secretary of State’s Office, 6th FL – Snodgrass Tower, ATTN: Corporate Filing, 312 RosaL. Parks Ave, Nashville, TN 37243) or in person (Secretary of State Business Services Division, 6th FL – Snodgrass Tower, 312 Rosa L. Parks Ave, Nashville, TN 37243). Cash will only be accepted when filing in person. If filing online (http://tnbear.tn.gov/NewBiz), you may only pay with a credit card. All payments must be made to the order of “Tennessee Secretary of State.”

How To File

Step 1 – Download the Tennessee Application for Certificate of Authority by selecting the “Download Application” link with your left mouse button or by clicking here: Form SS-4432. This application may be filled out onscreen (with the appropriate PDF program) or printed then filled out. Make sure this is legibly done.

Step 2 – Locate Item 1, on the first blank line, enter the True Name of the foreign nonprofit corporation as it appears on the Certificate of Existence being submitted. This must be an exact match. In some cases, an entity’s Name will not be compliant with T.C.A. §48-54-1. If this is the case, enter the Assumed Name that will be used on the second blank line. In such a case, the filing entity will also need to submit a Registration of an Assumed Corporate Name (this Registration Fee is $20.00).

Step 3 – Item 2 will require definitions for some important information. On the first blank line, enter the jurisdiction where the foreign nonprofit entity is incorporated.

Step 4 – On the second line, of Item 2, enter the Date of Incorporation using the blank spaces labeled “Month,” “Day,” and “Year.”

Step 5 – If this corporation will operate perpetually (without a defined Date of Dissolution), leave the third line of Item 2 blank. If the foreign nonprofit corporation does operate under a Date of Dissolution, report this Date on the blank spaces labeled “Month,” “Day,” and “Year” located in the third line of Item 2.

Step 3 – If the foreign nonprofit corporation has transacted any corporate business before filing this application the Date when the foreign nonprofit corporation first started conducting business in Tennessee must be reported on the fourth line of Item 2. Use the “Month,” “Day,” and “Year” to report this Date. Otherwise you may leave this blank.

Step 4 – If this nonprofit corporation is an entity type with an Additional Designation then, report the Additional Designation on the blank line in Item 3. Examples of entity types that must fulfill this requirement are: Banks, Captive Insurance Companies, Credit Unions, Insurance Companies, Litigation Financiers, Massachusetts Trusts, and Trust Companies. You may leave this item blank, if your foreign nonprofit corporation does not fit into this category.

Step 5 – Next, in Item 4, you must report the Tennessee Registered Agent and his/her/its Registered Office. First, report the Full Name of the Tennessee Registered Agent on the blank line next to the word “Name.” Below this, on the blank line labeled “Address,” enter the Building Number, Street, and any applicable Unit Number where the Registered Office may be physically found. Next report the City, Zip Code, and County on the blank spaces on the third line.

Step 6 – Enter the last Fiscal Month of the Year on the blank line in Item 5.

Step 7 – In Item 6, you may note an Effective Date where the Certificate of Authority becomes active between the Filing Date and 90 days past the Filing Date by entering the Month, Day, Year, and Time on the blank spaces provided. If you wish the Effective Date to be immediate upon a successful Filing then leave this item blank.

Step 8 – Item 7 will bind the foreign nonprofit corporation to behaving as a nonprofit corporation in the State of Tennessee.

Step 9 – Next, in Item 8, locate the first line, beginning with “If incorporated in Tennessee…” If this corporation will behave as a Public Benefit Corporation then mark the first box. If this corporation will behave as a Mutual Benefit Corporation then mark the second box. You must choose one.

Step 10 – On the second line of Item 8, mark the first box if the foreign nonprofit has Members. If the foreign nonprofit does not have Members then mark the second box.

Step 11 – In Item 9, you must document the Principal Executive Office of the foreign nonprofit corporation submitting this application. This must be the Physical Location, if the Principal Executive Office has a different Mailing Address, this will be addressed in the next item. On the first blank space in Item 9, enter the Name of the Principal Executive Office on the first line. Then on the “Address” line, enter the Building Number, the Street, and any applicable Unit Number of the Principal Executive Office. Finally on the third line, enter the City, State, and Zip Code. Note: A P.O. Box being entered in Item 9 may slow down or halt the application process.

Step 12 – On the last line of page 1 of this application, the Submitter must enter his/her Name and Phone Number on the first and second blank space, respectively.

Step 13 – Next on the first line of the second page, report the Full True Name of the nonprofit corporation applying for a Certificate of Authority with this application.

Step 13 – Next on the first line of the second page, report the Full True Name of the nonprofit corporation applying for a Certificate of Authority with this application.

Step 14 – In Item 10, you may report the Mailing Address of the Executive Principal Office of the foreign nonprofit corporation if it differs from the Physical Location of the Executive Principal Office. On the first line, enter the Full Street Address of the Mailing Address. Then report the City in the first space on the second line. In the second space on the second line, report the State for the Mailing Address of the Principal Executive Office. Finally, enter the Zip Code of the Mailing Address in the third space on the second line.

Step 15 – Item 11 will provide a table with the following columns: Title, Name, Business Address,and City, State, Zip. Each column will require the appropriate information relating to an Officer, of the foreign nonprofit corporation, to be entered. Each Officer serving this foreign nonprofit corporation must have his or her information entered in Item 11. Note: Title refers to the position held such as “President” or “Vice-President.”

Step 16 – In Item 12, there will also be a table. This will have the following columns: Name, Business Address, and City, State, Zip. Enter this information for each of the Directors currently serving on the foreign nonprofit corporation’s Board of Directors. Each Director entered must have his or her own line.

Step 17 – At the end of this application, on the left, locate the blank line labeled “Signature Date.” Here the Signature Party must enter the Date he or she is signing this application.

Step 18 – Next to the Signature Date, on the line labeled “Signature,” the Signature Party must Sign his or her Name.

Step 19 – Below the Signature Date line, the Signature Party must report his or her position in the foreign nonprofit corporation on the line labeled “Signer’s Capacity.”

Step 20 – Below the Signature line, the Signature Party must Print or Type his or her Name on the line labeled “Signer’s Name (printed or typed). This must be perfectly legible if filling out manually.

Step 21 – Now that you have finished entering the information required on the Tennessee Application for Certificate of Authority | Form SS-4432, you must organize and attach all required documentation and additional filings with this application in one package. This must include full payment for the Filing Fee of this application plus any additional fees. The Filing Fee for this application is $600.00. You may pay this by check, cashier’s check, and money order if submitting in person or by mail. You may only pay in cash if you are submitting in person. Any payment made for this purpose must be payable to Tennessee Secretary of State.

Mail To:

Secretary of State’s Office

6th FL – Snodgrass Tower

ATTN: Corporate Filing

312 Rosa L. Parks Ave

Nashville, TN 37243

Bring To:

Secretary of State Business Services Division

6th FL – Snodgrass Tower

312 Rosa L. Parks Ave

Nashville, TN 37243

How To File Electronically

Step 1 – To file begin the online application process for the Tennessee Application for Certificate of Authority Foreign Nonprofit Corporation, go to: http://sos.tn.gov/business-services/non-profit-corporations

Step 2 – Near the bottom of the page locate the words “Form or Register a New Business.” This heading is a link to the online application. Select it.

Step 3 – Read the information on this page then select the button labeled “Start Now.”

Step 4 –On this page, select “Nonprofit Corporation” from the drop down list labeled “Business Entity Type.” Then read the rest of the page and check the box labeled “I Attest To.” Once you have done this select the button labeled “Continue.”

Step 5 – In the first field on the Name page, “Business Entity Name” you must enter the True Name of the foreign corporation applying for the Certificate of Authority.

Step 6 –Re-enter the True Name of the foreign corporation in the field labeled “Confirm Name.” This must match that entered in “Business Entity Name,” and both must match what is reported as the foreign nonprofit corporation’s Certificate of Existence.

Step 7 – Select the radio button labeled “Foreign Business” next to the words “Formation Locale.” This will trigger several more fields, specific to foreign entities to appear below.

Step 8 – Under the heading “Foreign Entity Detail,” locate the drop down list labeled “State or Country of Formation.” Select the State or Country where the filing entity is incorporated. This should be the same governing authority issuing the Certificate of Existence.

Step 9 – In the next field, labeled “Formed On,” enter the exact Date the filing entity was officially incorporated in the jurisdiction of its incorporation.

Step 10 – Next, you must indicate if this corporation has already conducted business or not in the State of Tennessee. If so, then enter the first Date the filing entity conducted corporate business in Tennessee, in the field labeled “Commenced Doing Business in TN On.” If not, then check the box labeled “This business entity has not yet commenced doing business in Tennessee.”

Step 11 – In the field labeled “Certificate of Existence Date,” report the Date of the Certificate of Existence being submitted. Note: This must be within 60 days of the filing date.

Step 12 – The final field will only apply to certain entity types. Some will require an Additional Designation. If this is such an entity then you must report what type of entity by reporting the Additional Designation by choosing Captive Insurance Company, Insurance Company, Litigation Financier, Massachusetts Trust, National Bank (Corp), or Trust Company. If this is not such an entity, you may leave this field blank. When you are done entering all the required information on this page, select the button labeled “Continue.”

Step 13 –In the first field of the Detail page, “Period of Duration,” define the lifespan of the corporation. If the nonprofit corporation intends to operate indefinitely, without an Expiration Date, select “Perpetual” from the drop down list. If the nonprofit corporation will cease activities or dissolve in 5 or 50 years, you may choose either “Expires – 5 years” or “Expires – 50 years.” This will display the appropriate date below this field. If there is a specific Date of Dissolution then select “Expires.” This will generate a Date Field directly below this field where you may enter the exact Date of Dissolution.

Step 13 –In the first field of the Detail page, “Period of Duration,” define the lifespan of the corporation. If the nonprofit corporation intends to operate indefinitely, without an Expiration Date, select “Perpetual” from the drop down list. If the nonprofit corporation will cease activities or dissolve in 5 or 50 years, you may choose either “Expires – 5 years” or “Expires – 50 years.” This will display the appropriate date below this field. If there is a specific Date of Dissolution then select “Expires.” This will generate a Date Field directly below this field where you may enter the exact Date of Dissolution.

Step 14 –Next, in the field labeled “Fiscal Year Close,” select the filing entity’s Close Month for the Fiscal Year from the drop down list.

Step 15 – The next field, “Delayed Effective Date,” provides the ability to select a Date the Certificate of Authority (if granted) takes Effect. If the filing entity would like this to be immediate upon a successful filing then leave this field blank. Otherwise, you may enter the desired Delayed Effective Date so long as it is within 90 days of the Filing Date.

Step 16 – Locate the words, “This would be.” If the foreign nonprofit corporation will operate as a Public Benefit Corporation then select the first radio button here. If the foreign nonprofit corporation will operate as a Mutual Benefit Corporation then select the second radio button. You must choose one.

Step 17 – Locate the words, “This corporation.” If the filing entity has Members then select the first radio button in this section. If the filing entity does not have Members then select the second radio button. You must choose one of these descriptions. Once all the information required by this page has been entered, select the button labeled “Continue.”

Step 18 –The Agent page will require information concerning the Identity and Location of the Tennessee Registered Agent obtained by the foreign nonprofit corporation. If the foreign nonprofit corporation will maintain a Registered Office physically located in the State of Tennessee, then check the box labeled “This business entity will represent itself.” This will auto-populate the Name. Otherwise you may leave this box blank.

Step 18 –The Agent page will require information concerning the Identity and Location of the Tennessee Registered Agent obtained by the foreign nonprofit corporation. If the foreign nonprofit corporation will maintain a Registered Office physically located in the State of Tennessee, then check the box labeled “This business entity will represent itself.” This will auto-populate the Name. Otherwise you may leave this box blank.

Step 19 – Then you must indicate the “Agent Type” (of the Registered Agent) by selecting the radio button labeled “Individual” or “Organization.” If the Registered Agent is an Individual, you must enter the First Name, Middle Name, and Last Name of the Registered Agent in the fields provided. If the Registered Agent is an Organization, then you must enter the SOS # (Secretary of State Number) in the text field provided. The appropriate fields will appear when you select either “Individual” or “Organization.” You must choose one of these.

Step 20 – In the “Address” field, enter the actual Street Address of the Registered Office. You may also use the “STE/APT/FL,” to report an appropriate Unit Number associated with the Physical Location of the Registered Office.

Step 21 –If the Registered Office has provided a Contact Name for the filing entity, report the Name of this party in the text box labeled “Attention.”

Step 22 –Next, enter the City where the Registered Office is located in the text field labeled “City.” Notice that “State” and “Country” have been filled in. This is because the Registered Office of the Registered Agent must be in Tennessee.

Step 23 – In the field labeled “Postal Code,” enter the Zip Code where the Registered Office is located.

Step 24 – Finally, use the “County” field to select the County where the Registered Office is located.

Step 25 – If the Principal Office and the Registered Office’s physical location share the exact same Address, then check the box at the bottom labeled “Use this address as the Principal Office Address also.” If not, leave this box blank. Once you have entered all the information on this page, select the button labeled “Continue.”

Step 26 – The Address page requires a report on the actual location of the Principal Office of the foreign nonprofit corporation filing this application. There will be a section for the Physical Address in the top section and a section for the Mailing Address in the second section. You will only need to fill in the Mailing Address if it is different from the actual location or Physical Address of the foreign nonprofit corporation’s Principal Office Address. Select the Country where the filing entity is located from the drop down list in the first field.

Step 27 –Next, enter the Building Number and Street of the actual location of the Principal Office in the field labeled “Address.”

Step 28 –In the field labeled “STE/APT/FL,” you may enter any additional qualifiers used in the Address of the actual location of the Principal Office (i.e. 7th Floor, Unit #15, etc.).

Step 29 – If there is a Contact Name the Tennessee Secretary of State to use, then report this Name in the field labeled “Attention.”

Step 30 – Report the City, State, and the Zip Code where the Principal Office is located in the text fields named “City,” “State,” and “Postal Code.”

Step 31 – Use the drop down list in the “County” field to select the County where the Principal Office is located.

Step 32 – Enter the Phone Number the Tennessee Secretary of State may use to contact this entity.

Step 33 –Select the box labeled “Use this address as the Mailing Address also” if both the actual location’s Address and the Mailing Address are identical. If not, then you must enter this information manually in the Mailing Address section by filling in the fields provided (Country, Address, STE/APT/FL, Attention, City, State, and Postal Code). Note: Country and State are both drop down lists where you may make the appropriate choice while STE/APT/FL and Attention are both optional.

Step 34 – The Parties page will ask that a Full Roster of the Officers and Directors be provided. Locate the first section, on this page, labeled “Directors.” If the Board of Directors being reported and the Officers being reported are the same then mark the box labeled “Board of Directors are the same as the Officers listed.” If not, then leave this box unmarked.

Step 35 –Next locate the third section, Add/Edit Officers and Directors, here you must enter the Title, Full Name, and Address of each Director and Officer serving the foreign nonprofit corporation. If you the Directors differ from the Officers and you did not check the box in the Directors section, then locate the word “Type” and select either the radio button labeled “Officer” or the radio button labeled “Director” to indicate who is being reported. Then in the field labeled “Title,” report the position held by the party being reported (i.e. President, Treasurer, Director of…, etc.). Next, enter the First Name, Middle Initial, and Last Name of this party using the next three text fields.

Step 36 – Locate the field labeled “Country,” in the right half of this section then select the Country where the Officer or Director’s Address is.

Step 37 – Enter the Street Address (Building Number/Street) in the field labeled “Address.”

Step 38 – If there is a Unit Number or something similar in the Officer or Director’s Address, this may be entered in the field labeled “STE/APT/FL.” This field is optional.

Step 39 – If there is a specific Contact Name for this party (i.e. an assistant), you may report the Identity of the Contact for this Officer or Director in the field labeled “Attention.”

Step 40 –Enter the City in the Officer or Director’s Address in the field labeled “City.” Then enter the two letter abbreviation for the State in the Officer or Director’s Address in the “State” field. Finally, enter the Zip Code in the Officer or Director’s Address in the “Zip” field. Once you have completed an entry, you may select the “Add” button. This information will remain on the screen in the table above this section (you may edit or delete each row). You may enter as many Officers and Directors as necessary. When you are done, select the button labeled “Continue.” Note: You may auto-populate these fields with the Principal Office Address by selecting the link below the “Zip” field labeled “Use the Principal Office Address.”

Step 41 – The Confirmation page is provided as a courtesy so that you may review all the information you have entered simultaneously and edit any sections (using the tabs to navigate). This information must be correct. Verify it, then select the button labeled “Continue.”

Step 42 – The Signature/Upload page will require an individual Authorized by the foreign nonprofit corporation to sign this document for the purposes of verifying its legitimacy. The Authorized party should read this entire page then click in the box labeled “I Certify That.” Below this, the Authorized Party must enter his or her Full Name using the fields labeled “First Name,” “MI” (Middle Initial),” and “Last Name.” The Signing Party must then enter his/her Phone Number in both the “Contact Phone” and “Confirm Phone” fields then enter his/her Email Address in the “Contact Email” and “Confirm Email” fields.

Step 42 – The Signature/Upload page will require an individual Authorized by the foreign nonprofit corporation to sign this document for the purposes of verifying its legitimacy. The Authorized party should read this entire page then click in the box labeled “I Certify That.” Below this, the Authorized Party must enter his or her Full Name using the fields labeled “First Name,” “MI” (Middle Initial),” and “Last Name.” The Signing Party must then enter his/her Phone Number in both the “Contact Phone” and “Confirm Phone” fields then enter his/her Email Address in the “Contact Email” and “Confirm Email” fields.

Step 43 – If you intend to File Electronically you must select the radio button labeled “I will upload the required document(s)…” then use the button labeled “Browse” to upload the filing entity’s Certificate of Existence (dated with 60 Days of the Filing Date and issued by the governing body of the entity’s state of jurisdiction and formation). If you do not do this, you will be given an opportunity to Print this form to submit by mail. When you have finished uploading your file, select “Continue.” This will direct the browser to the Payment section of the site where you may enter the Cardholder information to pay the $600.00 Filing Fee. This Fee and all applicable charges must be submitted at the time of filing.