|

Tennessee Articles of Incorporation Charter For Profit Corporation | Form SS-4417 |

The Tennessee Articles of Incorporation Charter For Profit Corporation | Form SS-4417 should be filed by mail or online with the Tennessee Secretary of State when an entity is ready to incorporate. This form will act as a method to submit the information required by the Tennessee Secretary of State necessary to issue a Certificate of Authority. The information requested on this form will provide the basic data all for profit corporations will need to report in order to form, but not all. That is, some will require additional information to be presented with these articles. For instance, if the Name of the corporation being formed contains the words “credit union” or “trust,” the Incorporator will first need to obtain permission from the Tennessee Department of Financial Institutions.

The Filing Fee for this form will be $100.00 and must be paid upon submission. If filing online (http://sos.tn.gov/business-services/for-profit-corporations), you may pay this fee with a credit card but will be responsible for a small service charge. If paying by mail, you will need to submit a check for this amount to the Secretary of State. You may mail filings for the Tennessee Articles of Incorporation For Profit Corporation to Secretary of State’s office, 6th FL – Snodgrass Tower, ATTN: Corporate Filing, 312 Rosa L. Parks Ave, Nashville, TN 37243. You may pay in cash but only if you submit in person. You may do this by bringing the paperwork to Secretary of State Business Services Division, 6th FL – Snodgrass Tower, 312 Rosa L. Parks Ave, Nashville, TN 37243.

How To File

Step 1 – Download the the Tennessee Articles of Incorporation Charter For Profit Corporation by selecting the link labeled, “Download Form” above. It is recommended to save this file to your computer. You may use an appropriate PDF editor to fill in the form or you may print it then enter the information on paper.

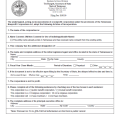

Step 2 – Locate Article 1. On the blank line provided enter the Full Name of the for profit corporation being formed by this charter. This must include an appropriate corporate designator such as “Corporation” or “Incorporated.” Acceptable abbreviations such as “Corp.” and “Inc.” may also be used.

Step 3 – In some rare cases, you may charter a corporation with a similar Name to another. If this is the case, you must check the box in Article 2, then fill out and include the Tennessee Application to Use an Indistinguishable Name with these articles. This will carry an additional $20.00 Filing Fee.

Step 4 – In Article 3 you will need to indicate if the corporation being formed has an additional designation. Additional Designations include: Bank, Captive Insurance Company, Credit Union, Insurance Company, Litigation Financier, Massachusetts Trust, Professional Corporation, and Trust Company. If any of these apply, enter the appropriate Additional Designation. Note: In most, if not all, of these examples you will need to gain specific permission from a regulatory board or commission.

Step 5 – On the blank line labeled “Name,” in Article 4, enter the Full Name of the Tennessee Registered Agent obtained for this corporation.

Step 6 – On the blank line labeled “Address,” in Article 4, enter the Full Street Address of the Registered Agent’s Registered Office. This may not be a P.O. Box and must be where the Registered Office is physically located.

Step 7 – On the blank lines labeled “City,” “Zip Code,” and “County,” in Article 4, report the City, Zip Code, and County (respectively) where the Registered Office is physically located.

Step 8 – In Article 5, report the Fiscal Year Close Month on the blank line provided. The Default for this Article will be December for the current year. Also, in this article, locate the words “Period of Duration.” If the corporation being chartered here intends to operate indefinitely then check the box labeled “Perpetual.” If there is a specific Date where this corporation will terminate then, mark the box labeled “Other” and enter the Date of Termination on the blank line provided.

Step 9 – Article 7 will name the forming entity as being a For Profit Corporation.

Step 10 – In Article 8, enter the Total Number of Shares the forming corporation has been authorized to issue on the blank line provided.

Step 11 – On the blank line labeled “Address,” in Article 9, report the Physical Street Address for the Principal Office being chartered by these articles. Note: Separate Mailing Addresses and P.O. Boxes are not acceptable here.

Step 12 – On the the blank lines (in Article 9) labeled “City,” “State,” “Zip Code,” and “County,” enter the City, State, Zip Code, and County for the Principal Office of the corporation being chartered by these articles.

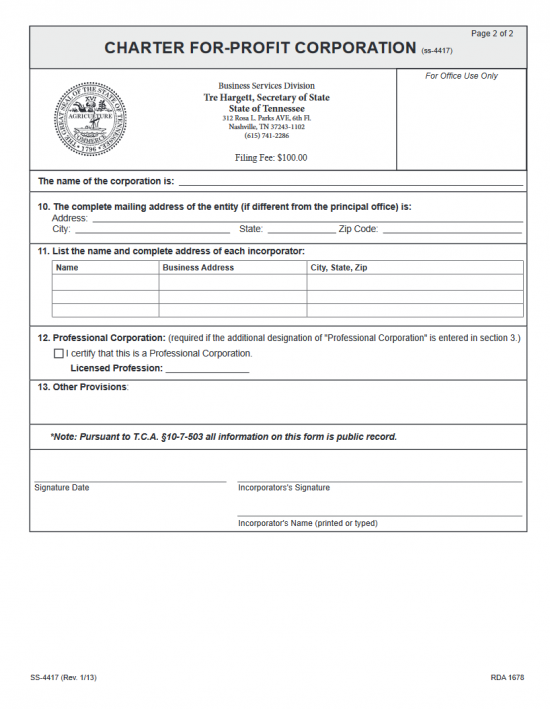

Step 13 – Article 10 should only be filled out if the corporation has a separate Mailing Address. If this is the case, enter the Full Mailing Address of the corporation being chartered by these articles on the blank line provided. If there is no such address, you may leave this line blank.

Step 14 – There will be a table in Article 11 where you must report the Full Name and Business Address of each Incorporator for this corporation. In the Name column, enter the Full Name of an Incorporator. On the corresponding line, in the “Business Address” column, enter the Building Number, Street, and Suite Number (if applicable) of the Incorporator being reported. Then in the next column, labeled “City, State, Zip,” enter the City, State, and Zip Code for the Incorporator being reported.

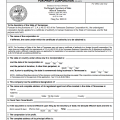

Step 15 – If this is a Professional Corporation, then you must check the box, in Article 12, labeled “I certify that this is a Professional Corporation.” Then enter the Licensed Profession for the services rendered on the blank line provided.

Step 16 – If there are any Other Provisions that must be documented for this charter, they may be documented in Article 13.

Step 17 – At the end of this document, one of the Incorporators listed in Article 11 must provide a Signature Date, Sign his or her Name on the blank line labeled “Incorporator’s Signature,” then Print his or her Name on the blank line labeled “Incorporator’s Name (printed or typed).

Step 18 – Next, you must gather all additional filings and documents required for this filing into one package. This must be mailed or brought in to the Tennessee Secretary of State for filing. If filing by mail you may only pay the $100.00 Filing Fee for the Tennessee Articles of Incorporation Charter For Profit Corporation with a check, cashier’s check, or money order (payable to Secretary of State).

Mail To:

Secretary of State’s Office

6th FL – Snodgrass Tower

ATTN: Corporate Filing

312 Rosa L. Parks Ave

Nashville, TN 37243.

File In Person At:

Secretary of State Business Services Division

6th FL – Snodgrass Tower

312 Rosa L. Parks Ave

Nashville, TN 37243

How To File Electronically

Step 1 – Go to the Tennessee Secretary of State Corporations page at: http://sos.tn.gov/business-services/for-profit-corporations

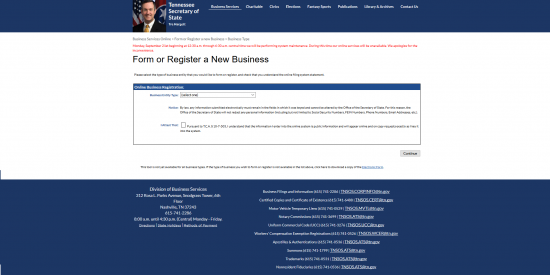

Step 2 – Locate the link labeled “Form or Register a New Business,” near the bottom of the page, then select it. Note: This is the heading of a small paragraph.

Step 2 – Read the statements on the left of the page. If you qualify to file online, then select the red button labeled “Start Now.”

Step 3 – On this next page, use the drop down list labeled “Business Entity Type” to select “For Profit Corporation.” Then click on the box next to the words “I Attest That.” Make sure to read the statement next to this box. When ready, select the button labeled “Continue.”

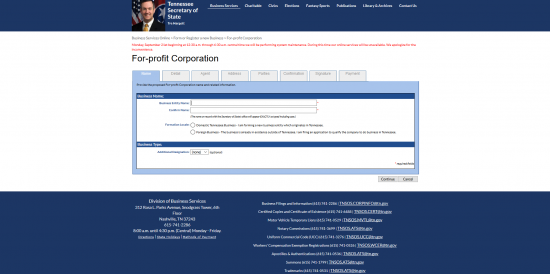

Step 4 – In the first text field, labeled “Business Entity Name,” enter the Full Name of the corporation you wish to form. Make sure to include a word of incorporation, as this is a requirement of the Tennessee Secretary of State.

Step 5 – In the next text field, labeled “Confirm Name,” re-enter the Name of the corporation you have entered in the previous field. This must be entered exactly as it was in the first field.

Step 6 – Next, you will see two radio buttons next to the words “Formation Locale.” Select the first radio button, with you mouse, labeled “Domestic Tennessee Business…”

Step 7 – If your corporation has an Additional Designation, you must choose the appropriate one from the last drop down list on this page. You may choose from: Captive Insurance Company, For Profit Benefit, Insurance Company, Litigation Financier, Massachusetts Trust, Professional, or Trust Company. If the forming corporation does not have an Additional Designation, then you may leave this field blank. When ready, select the button labeled “Continue.”

Step 8 – In the first field of this page, labeled “Period of Duration,” indicate how long this corporation intends to operate. If this corporation will operate without a Termination Date then select the word “Perpetual.” Otherwise you may choose either Expires – 5 years or Expires – 50 years. If none of these choices are accurate, select the word labeled “Expires.” This will prompt a Date field to appear. If you have chosen “Expires,” enter the Calendar Date of the Termination Date in the Calendar field labeled “Expiration Date.”

Step 9 – Next, locate the field labeled “Fiscal Year Close.” Use this drop down list, to choose the Month that ends the Fiscal Year of the corporation being chartered by this form.

Step 10 – Locate the field labeled “Delayed Effective Date.” If you wish to designate the a specific day where these articles take Effect, then enter this desired Date of Effect here. If not, leave this blank and the Filing Date will be the Effective Date of the articles.

Step 11 – The last field on this page, “Shares of Stock,” requires you enter the Total Number of Authorized Shares this corporation may issue.

Step 12 – If you wish to include other Provisions, then check the box labeled “I wish to include a statement of other provisions.” This will generate a text field where you may report the Provisions you wish documented. You may leave this box unchecked if there are no additional provisions. When ready, select the button labeled “Continue.”

Step 13 – Next, you will need to solidify the Identity and Location of the Registered Agent who will accept service of process on behalf of the corporation being formed. If this corporation will represent itself then select the first check box on this page, labeled “This business entity will represent itself.” You will need to (also) select one of the radio buttons to indicate the Type of Agent. You may choose either, “Individual” or “Organization.” If this company is not representing itself, you will need to enter the “SOS Control Number” assigned to your Registered Agent. For our purposes, place a check mark in the box labeled “This business entity will represent itself” and select the radio button labeled “Individual.”

Step 14 – The Name will be autopopulated with the Name of the corporation being formed (otherwise be prepared to either enter the First, Middle and Last Name of the Registered Agent or the Name of the Organization acting as a Registered Agent. Enter the Street Address of the physical location of the Registered Agent in the “Address” field (Building & Street Number). In the second text field under “Address,” enter any Unit Number or Suite Number that applies. If a Contact Name is required for the Registered Agent to receive information, on behalf of the corporation being chartered, then enter this individual’s Name in the field labeled “Attention Name.” Next enter the City and Postal Code for the Registered Office’s physical location. Next, use the drop down menu to select the County where the Registered Agent is located. When ready, select the button labeled “Continue.” (Note: If allowed, you may use this Address for the Principal Office Address by checking the box at the bottom of the page labeled “Use this address s the Principal Office as well.”

Step 15 – On this page, you must enter the Physical Address of your corporation’s Principal Office. If the Principal Office has a separate Mailing Address, there will be a separate area. The top part of this page requires the Address of the Physical Location of the Principal Office. Select the Country where the Registered Office from the drop down list at the top of the page. Then use the Address, Ste/Apt/FL, Attention, City, Postal Code, County, and Phone fields to report the Full Address and Phone Number of the Principal Office’s Physical Address. If there is a separate Mailing Address, locate the heading “Mailing Address” near the bottom of the page. Here, you may enter a separate Mailing Address. You may use the field labeled “Address” for the Building Number and Street. The field labeled STE/APT/FL to report an applicable Unit Number associated with the Mailing Address, use the Attention field to enter the Contact Name (if any), use the “City” field to report the City in the Mailing Address, and the “Postal Code” field to report the Zip Code associated with the Mailing Address. If there is no separate Mailing Address, you may leave this section blank. When ready, select the button labeled “Continue.”

Step 16 – On this next page, you must report the Name and Address of each Incorporator. Do this by using the First Name, Middle Initial (labeled “MI”), and Last Name fields to report the Full Name of an Incorporator.

Step 17 – Next, select the Country associated with the Incorporator’s Address from the first drop down list field on the right. Next, enter the Building Number and Street, of the Incorporator being reported, in the “Address” field. You may report the Unit Number for this party in the field labeled “STE/APT/FL.” In the field labeled “Attention,” you may document any Contact Name where mail may be addressed. Finally, in the last three fields (“City,” “State,” and “Zip”) enter the City, State, and Zip Code for the Incorporator Address being reported. When you are done select the button labeled “Add.” This will display the Incorporator information you just entered in a table format just above the “Add/Edit Incorporators” section. You may add as many Incorporators as you wish. When ready, select the button labeled “Continue.”

Step 18 – The next page will afford you the opportunity to review all the information you have just entered. If any information needs to be corrected, you may use the tabs near the top of this screen to navigate to the section you wish then correct that information. When ready, select the “Continue” button.

Step 20 – The next section will act as a Signature for the submitter of this filing. Here you must read the top of the page, then click on the button labeled “I certify,” leaving a check mark in the box.

Step 21 – In the field labeled “Incorporator’s First Name,” one of the Incorporators listed previously must enter his/her First Name. This party may then enter his/her Middle Initial in the field labeled “MI.” In the field labeled “Last Name,” the Signature Party must then enter his/her Last Name. Below this, the Signature Party must enter his/her Phone Number in the fields labeled “Contact Phone” and “Confirm Phone.” Next, the Incorporator must enter his/her Email in the fields labeled “Contact Email” and “Confirm Email.” When ready, select “Continue.” This will direct you to the final area of this form where you must enter the Credit Card information for the Card Holder who will be paying for this filing. The Tennessee Articles of Incorporation Charter For Profit Corporation is $100.00. This filing will not be processed until the Filing Fee has been successfully processed.