|

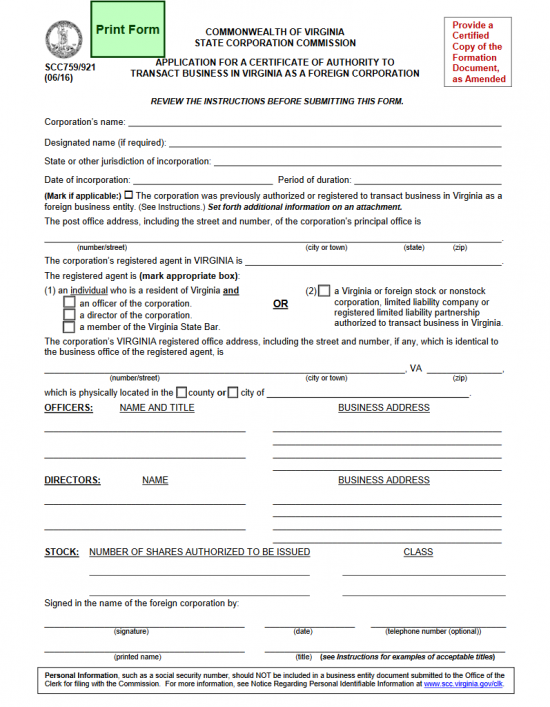

Virginia Application for a Certificate of Authority to Transact Business in Virginia as a Foreign Corporation | Form SCC759 |

The Virginia Application for a Certificate of Authority to Transact Business in Virginia as a Foreign Corporation | Form SCC759 is the form required, by the Virginia State Corporation Commission, of foreign corporations wishing to apply for a Certificate of Authority to act as a corporation in the State of Virginia. The filing entity or applicant must submit a certified or authenticated copy of its articles of incorporation (or similar applicable document) as well as all subsequent amendments and corrections with this application. This accompanying paperwork must be a “true and correct” copy as verified by the appropriate governing body of the filing entity’s Tome state and must have an authentication or certification Date within 12 months prior to the Application Date. Note: A Certificate of Good Standing or Certificate of Existence will not be an acceptable substitute for this requirement.

The Virginia State Corporation Commission will accept an original and completed Virginia Application for a Certificate of Authority to Transact Business in Virginia as a Foreign Corporation, the certified copy of the filing entity’s original articles of incorporation (plus amendments), and payment of the Entrance Fee and/or Filing Fee at Office of the Clerk,, State Corporation Commission, P.O. Box 1197, Richmond, Virginia 23218-119. Profit corporation with stock will need to pay an Entrance Fee based on the amount of Authorized Stock issued to the entity (on its original articles of incorporation) plus $25.00 Filing Fee while nonstock nonprofit corporations will need to pay a standard total of $75.00 (Filing Fee + Entrance Fee). All checks made out to pay for these fees should be payable to State Corporation Commission.

How To File

Step 1 – Select the link (“Download Application”) above. This is a PDF form that may be filled out using an appropriate PDF program or printed then have the information typed in. Do not enter the information by hand. If you do not have enough room, you may continue the section you are filling out on a separate sheet of 8 1/2″ by 11″ sheet of paper that is clearly labeled, have one inch margins on each border, and contains information on only one side.

Step 2 – On the first line, labeled “Corporation’s Name,” enter the Full Name of the filing entity precisely as it appears, on the certified copies of its articles of incorporation and subsequent amendments, being submitted with this application.

Step 3 – The second blank line is only required if the True Name of the filing entity does not comply with §§ 13.1-762 and 13.1-924 of the Code of Virginia, the filing entity will need to operate under a Designated Name. If so, report this Designated Name on the second blank line. Do not attempt to operate under a Designated Name if the True Name of the filing entity meets the requirements set forth in §§ 13.1-762 and 13.1-924 of the Code of Virginia.

Step 4 – On the third blank line, report the State or Jurisdiction where the filing entity is incorporated.

Step 5 – Locate the blank space labeled Date of Incorporation then report the exact Date the filing entity incorporated in its home state on the blank space. On the blank space next to this, labeled “Period of duration,” indicate if this corporation will operated indefinitely by entering the word “Perpetual” or entering the amount of time until the filing entity dissolves.

Step 6 – If the filing entity was incorporated in Virginia previously, mark the box labeled “Mark if applicable,” on the next line. You will then need to attach the entity’s Name, Type, State/other Jurisdiction, and ID Number issued by the State Corporation Commission when the filing entity was operating as a corporation in the State of Virginia.

Step 7 – Locate the line beginning with the word’s “The post office address…” Here, you must enter the Mailing Address of the foreign corporation’s Principal Office on the blank line provided. There will be an area for the Building Number, Street, Suite Number, City, State, and Zip Code.

Step 8 – On the next line, you will need to report the corporation’s Virginia Registered Agent’s Full Name. Below this, you will need to define the Virginia Registered Agent’s entity type. If this is an Officer in the corporation, Director of the corporation or a Virginia State Bar Member then mark the appropriately labeled box in section 1. If this is a business acceptable business entity (stock/nonstock corporation, LLC, or LLP authorized to operate in the State of Virginia), then mark the box in section 2. Below the entity type will be a blank line where you must report the Physical Address (Number/Street/Unit Number, City/Town, Zip Code) of the Virginia Registered Agent’s Registered Office. You must report either the County or the City on the next line. If reporting a County, then mark the first box in the statement “which is physically located…” If you are reporting the City, then mark the second box in this statement

Step 9 – Next there will be two sections “Officers” and “Directors.” You must document and submit a full Roster consisting of the First Name, Last Name, Title (where applicable), and Business Address of each Officer and each Director. If there is not enough room for this in either or both sections then you must continue on a separate document that is clearly labeled as either “Officers” or “Directors.” Do not report both on the same document. Make sure that each additional page has a one inch margin and is printed on only on side.

Step 10 – In the section labeled “Stock,” report the Total Number of Shares Authorized to be Issued for each Class of Stock. Once again, if there is not enough room, you may continue this section on a separate document that is clearly labeled.

Step 11 – The next area is the Signature area. Here, a Chairman, Vice Chairman, or Authorized Officer must provide his or her Signature, Date of Signature, Phone Number (optional), Printed Name, and Title.

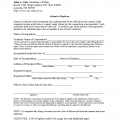

Step 12 – If this is a stock corporation you will need to calculate the Entrance Fee. This is done by dividing the Total Number of Authorized Shares at this corporation’s disposal by 25,000 then multiplying the result by $50.00. Add this number to the Filing Fee of $25.00. This is the amount you must pay to submit this application. The minimum Entrance Fee is $50.00. If the applying entity is a nonstock corporation, the total payment will be $75.00 (Entrance Fee plus Filing Fee).

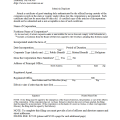

Step 13 – You must submit the completed Virginia Application for a Certificate of Authority to Transact Business in Virginia as a Foreign Corporation | Form SCC759, the certified/authenticated original articles of incorporation (plus subsequent amendments, filings, etc.) from the filing entity’s home state, a check payable to State Corporation Commission for the Total Entrance and Filing Fees by mail.

Mail To:

Office of the Clerk

State Corporation Commission

P.O. Box 1197

Richmond, Virginia 23218-119