|

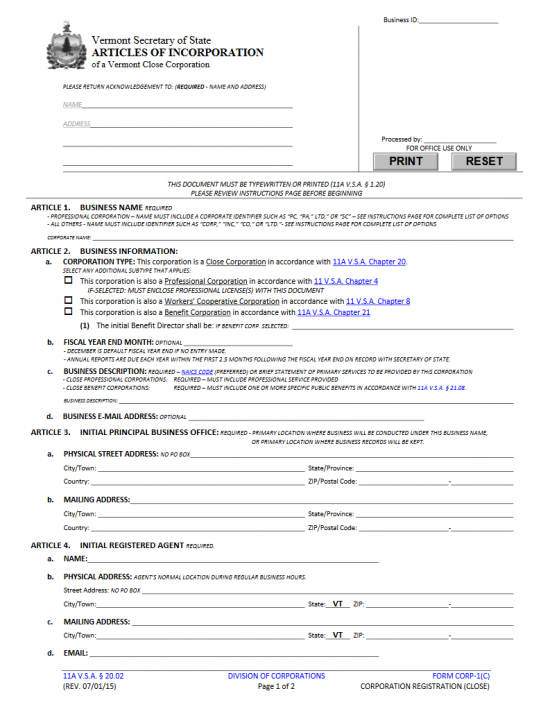

Vermont Articles of Incorporation Vermont Close Corporation | Form Corp-1(C) |

The Vermont Articles of Incorporation Vermont Close Corporation | Form Corp-1(C) should be filed, by entities wishing to incorporate while retaining most of the decision making power in small group, with the Vermont Secretary of State Corporations Division. Close Corporations in Vermont, enjoy the structure, liability protection, and some of the tax benefits incorporation provides while still retaining a small business approach in management. The stock of a close corporation is not publicly traded so most if not all of the stockholders tend to be directly involved in the running of the corporation. Typically this is kept to a relatively small number of people.

The Vermont Secretary of State Corporations Division requires the Vermont Articles of Incorporation Vermont Close Corporation be submitted in duplicate with a self addressed stamped envelope and payment of the Filing Fee ($125.00). If you are filing this by mail, you will need to remit payment with a check or money order made out to “VT SOS.” You may file this in person, by mail, or online. You may only use a credit card or an echeck if you are filing online.

How To File

Step 1 – You may download the Vermont Articles of Incorporation Vermont Close Corporation by clicking on the link labeled “Download Form.” To fill this out onscreen, you will need a PDF program. Otherwise, you may print it and supply the information using a typewriter.

Step 2 – In the upper left hand corner of this page, report the Mailing Address the Vermont Secretary of State Corporations Division should send documents regarding this filing. Enter the Name of the recipient on the line labeled “Name.” Then on the second line, labeled “Address,” provide the Mailing Address.

Step 3 – Locate Article 2, “Business Name,” then enter the Name you wish the close corporation being formed to be known as on the record books. This should be the Full Name of the corporation including the appropriate word of incorporation. Professional close corporations may use corporate designators such as “professional corporation” or “P.C.” while close corporations should use corporate designators such as “Incorporated” or “Corp.”

Step 4 – Article 2a will bind the entity being formed to behaving as a close corporation (as per 11A V.S.A. Chapter 2), however there are additional sub types to this category. There are three main sub types: Professional Corporation, Worker’s Cooperative Corporation, and Benefit Corporation. Select the first box to indicate the forming entity is a Professional Corporation, the second box for Worker’s Cooperative Corporation, or the third box to indicate this is a Benefit Corporation. You will need to report the Initial Benefit Director on the blank line following the words, “The initial Benefit Director shall be: If Benefit Corp. Selected,” if you mark the third box. If this is a Professional Corporation you must submit the Professional Licenses with these articles.

Step 5 – In Article 2b, enter the last Month of the Fiscal Year on the blank space provided. If this is not filled out, the last Month of the Fiscal Year will default to December.

Step 6 – In Article 2c, locate the blank line labeled “Business Description.” Here you may enter either the NAICS code for your corporation’s industry or you may write out a brief description of the type of corporation being formed and how it will operate.

Step 7 – Article 2d is optional. If desired, you may report the Email Address the close corporation will use for electronic correspondence.

Step 8 – Article 3, “Initial Principal Business Office,” will require the Complete Address of the close corporation’s Principal Office. You will need to report the “Physical Street Address” in Article 3a and, if different, the Principal Office’s Mailing Address. Only enter the Mailing Address if it is not the same as the Physical Address of the Registered Office. In each section, use the first line to enter the appropriate Street Address (Building Number, Street, Suite Number). Then, on the second line, enter the City and the State in the spaces provided. On the third line, report the Country and Zip Code. Keep in mind you may not enter a P.O. Box in section a.

Step 9 – Article 4 will requite the Name and Location of the Initial Vermont Registered Agent. Use the blank line in Article 4a to report the Name of the Vermont Registered Agent. Then in Article 4b, report the Street Address on the first line then the City and Zip Cod on the second line. This must be the Physical Address of the Vermont Registered Office and may not contain a P.O. Box. If the Registered Agent receives mail at a separate location then report the Mailing Address in the spaces provided in Article 4c. In Article 4d, report the Registered Agent’s Email Address.

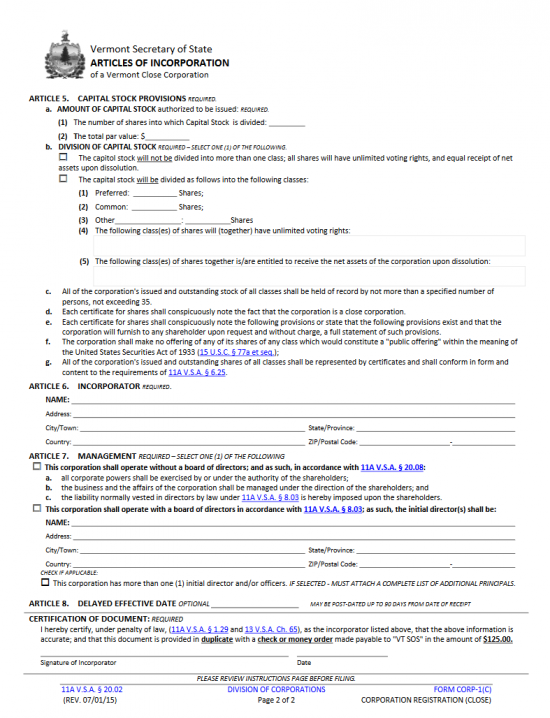

Step 10 – Locate Article 5. There will be two parts you may use to report the stock information. In item 1 of Article 5a, enter the Total Number of Shares available to the close corporation on the blank line provided. Then in item 2 of Article 5b, report the Total Par Value of this stock.

Step 11 – In Article 5b, you will need to select one of the boxes to define the stock available. If there is only one Class of Stock then check the first box. If there is more than one class of stock, mark the second box. If you checked the second box then enter the Total Number of Shares of Preferred stock in item 1, the Total Number of Common Shares in item 2, the Total Number of any other available classes in item 3, which Classes of Shares with unlimited voting rights in item 4, and which classes may receive the net assets upon dissolution of the corporation in item 5.

Step 12 – In Article 6, enter the Full Name of the Incorporator on the first line. Then on the second line, enter the Building Number, Street, and Suite Number of the Incorporator’s Address. On the third line, report the Incorporator’s City and State on the first and second spaces (respectively). On the last line of this article, enter the Incorporator’s Country on the first blank space and the Incorporator’s Zip/Postal Code on the second blank space.

Step 13 – Article 7, or “Management,” will provide two choices in defining how this close corporation shall be operated. If this close corporation shall operate without a Board of Directors then check the first box. If this corporation shall operate with a Board of Directors check the second box and report the Name and Address of the Initial Director. If there is more than one Initial Director, check the box labeled “This corporation has more than (1) initial director and/or officers,” then draw up a full Roster containing the Full Name and Complete Address (Building Number/Street/Suite, City/State/Country/Zip Code) of each of these individuals.

Step 14 – In Article 8, you may choose to report a Delayed Effective Date (when the close corporation officially incorporates) on the blank line provided. You may choose any Date up to 90 days after the receipt of these articles. If you leave this line blank, the articles will go into Effect as soon as they are successfully filed by the Vermont Secretary of State Corporations Division.

Step 15 – Next, the Incorporator of this close corporation must provide his or her Signature, on the line labeled “Signature of Incorporator,” then report the Date of Signing on the space labeled “Date.”

Step 16 – You may now submit the Vermont Articles of Incorporation Close Corporation to the Vermont Secretary of State Corporations Division by mail or in person. Make sure this is submitted in duplicate with at least one of the articles being the original, with a self addressed stamped envelope, a check or money order for $125.00 (payable to VT SOS), and any required paperwork for your entity type.

Submit To