|

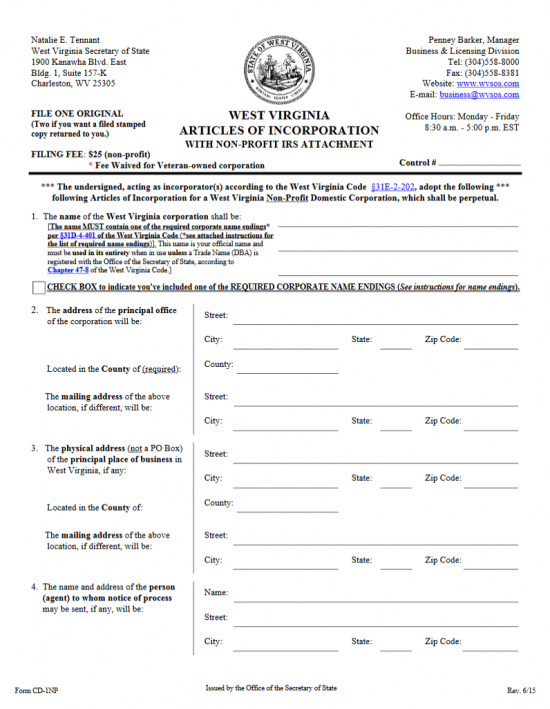

West Virginia Articles of Incorporation with Non-Profit IRS Attachment | Form CD-1NP |

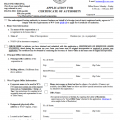

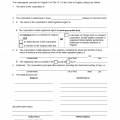

The West Virginia Articles of Incorporation with Non-Profit IRS Attachment | Form CD-1NP must be submitted to the West Virginia Secretary of State in order for an entity, intending to seek Tax Exempt Status, to incorporate legally. The West Virginia Secretary of State will not recognize Tax Exempt Status unless the I.R.S. has granted it to the filing entity however, the I.R.S. will require that specific language be used when an entity submits its articles to incorporate. This language has been made available in the West Virginia Articles of Incorporation with Non-Profit IRS Attachment | Form CD-1NP template form. Incorporators will have to make sure they take the initiative in being completely familiar with this process and are strongly encouraged to seek consultations with appropriate entities such as West Virginia attorneys and/or accountants before filling out and submitting this document.

The West Virginia secretary of State will require at least one original and completed West Virginia Articles of Incorporation with Non-Profit IRS Attachment | Form CD-1NP along with the full payment of the $50.00 Filing Fee. If you would like a stamped copy mailed back to you, upon a successful filing, then you must include an additional copy of the articles. You may request a Certified Copy for the additional fee of $15.00/Certified Copy. You may submit the articles by mail or online. If submitting by mail you must pay with a check made out to West Virginia Secretary of State. If submitting online, then you may pay with a credit card.

How To File

Step 1 – Select “Download File” above or click this link: Form CD-1NP. This is a PDF file thus, you will need the appropriate program or browser to enter information. If necessary, you may also print this file then enter the information with a type writer.

Step 2 – In Article 1, report the Full Name with the appropriate word of incorporation. Remember to place a mark in the check box below Article 1 indicating you have entered this information.

Step 3 – In Article 2, report the Full Address of the Principal Corporation. On the first line, enter the Physical Street Location (Building Number, Street, Unit Number). On the second line enter the City, State, and Zip Code in the spaces provided. Then on the third line, report the County where the Principal Office will be located. Below this, will be spaces for the Mailing Address. If the Principal Office has a separate Mailing Address, you must report this as well.

Step 4 – If there will be a Principal Place of Business separate from the Principal Office in the State of West Virginia, you must report it in Article 3. You will need to report the Physical Location, using the first set of Address Lines (Street, City, State, and Zip Code), and the County where it is located. If the Principal Place of Business has a separate Mailing Address, this must be entered in the second set of Address Lines (Street, City, State, and Zip Code).

Step 5 – If an Agent has been elected to receive court generated documents aimed at the corporation, the Full Name of that Agent and the Physical Address of that Agent must be reported in Article 4. The first line is reserved for the Name and the following lines (Street, City, State, and Zip Code) will require the Address of the Physical Agent.

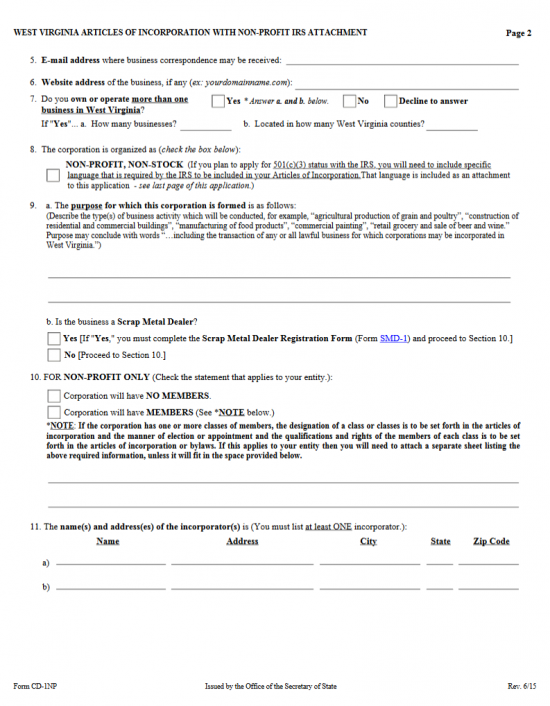

Step 6 – In Article 5, enter the E-Mail Address where correspondence from the West Virginia Secretary of State may be received.

Step 7 – If the nonprofit corporation being formed has a website, then you may report it in Article 6.

Step 8 – In Article 7, you will have a choice in divulging some information about other businesses. If you have more than one business (in West Virginia) mark the box labeled “Yes.” If not, mark the box labeled “No.” You may also choose “Decline to answer” should you not wish to divulge this. If you do answer “Yes,” then, on the next line report how many business you own on the first blank space and how many West Virginia Counties you own or operate a business in.

Step 9 – If intending to apply for Tax Exempt Status, you will need to include specific language (found on the attachment to these articles). Check the box in Article 8 to indicate this will be done. Note: If you do intend to apply for Tax Exempt Status or have been granted Tax Exempt Status by the IRS, it is strongly recommended to consult with the Internal Revenue Service regarding any requirements placed upon registering as a corporation with the West Virginia Secretary of State.

Step 10 – In Article 9a, report the Purpose for the creation of this nonprofit corporation. If the forming nonprofit corporation is a Scrap Metal Dealer then check the box labeled “Yes,” in Article 9b and attach Form SMD-1. If not, then check the box marked “No.”

Step 11 – If the West Virginia nonprofit corporation being formed by these articles will not have Members, then mark the first box in Article 10. If it does have Members, then mark the second box and use the space (or an attachment) to define the Class Designations, Rights, Privileges, Qualifications, and manner of Election/Appointment.

Step 12 – In Article 11, use the columns labeled “Name,” “Address,” “City,” “State,” and “Zip Code” to document each Incorporator of this nonprofit corporation. If there is not enough room you may attach a separate sheet of paper with this information. You must report at least one Incorporator.

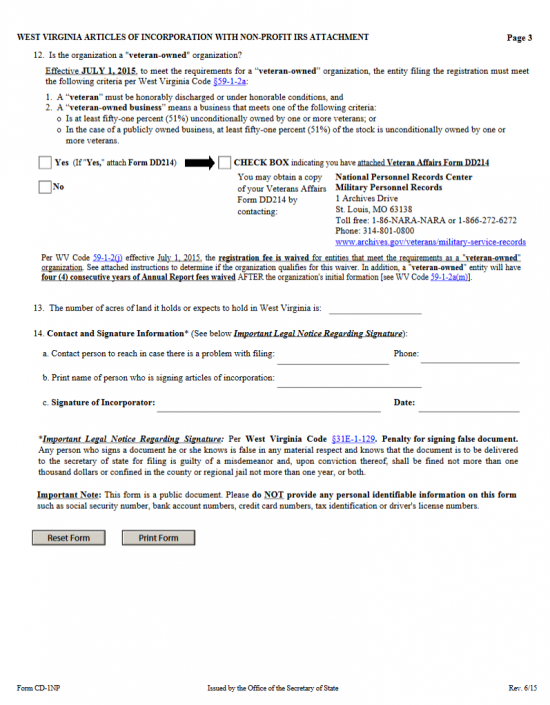

Step 13 – If this is a Veteran Owned organization then mark the box labeled “Yes” in Article 12. Also, mark the box labeled “Check Box,” if you have attached the required paperwork (Form DD214). If not then check the box labeled “No.”

Step 14 – Report the Total Number of Acres of Land the nonprofit corporation will (or expects to) hold in the State of West Virginia on the blank space provided.

Step 15 – Enter the Name of a Contact Person the West Virginia Secretary of State may correspond with concerning these articles on the first blank space in Article 14a. Then on the second blank space, report this Contact Person’s Phone Number.

Step 16 – In Article 14b, Print the Full Name of the party who will be providing a Signature.

Step 17 – In Article 14c, an Incorporator must Sign his/her Name, then provide the Date of this Signature.

Step 18 – Next, you will need to calculate your Total Payment. This will be the Filing Fee plus the Excess Acreage Fee plus all other applicable Fees (i.e. if you are filing other documents that require payment). The Filing Fee is $25.00 for this form. The Excess Acreage Fee applies to corporations that own more than 10,000 acres of land. If this is the case, you must pay $0.05 per acre. All Fees are payable with a Check made out to West Virginia Secretary of State. Do not send cash. If you wish to have a Certified Copy returned then you must request one and add $15.00 for every Certified Copy you wish.

Step 19 – Gather your documents and at least one completed original West Virginia Articles of Incorporation with Non-Profit IRS Attachment | Form CD-1NP into one package with your total Payment then mail it to the West Virginia Secretary of State.

Mail To

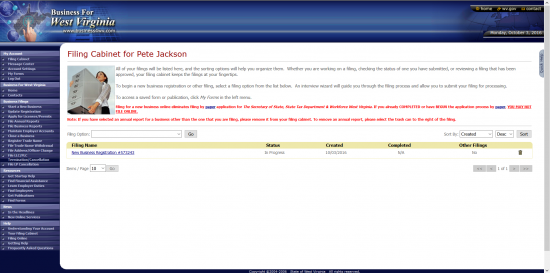

How To File Online

Step 1 – Go to the West Virginia Secretary of State home page: http://www.sos.wv.gov/Pages/default.aspx. Locate the drop down list, near the center of the page underneath the heading “Business and Licensing.”

Step 2 – Select “Online Business Registration.” (You will be prompted to log into your account).

Step 3 – After logging in, locate the words “Filing Option” in the center of the page. Select “Register a New Business” from the drop down list here. When you are ready click on the button labeled “Go.”

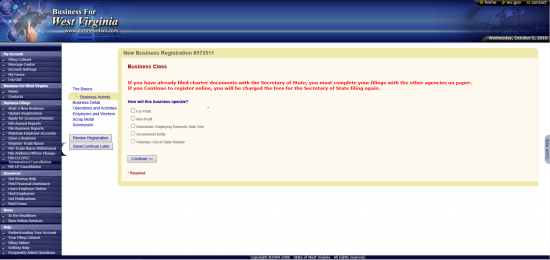

Step 4 – Select the radio button labeled “Nonprofit” then click on the “Continue” button.

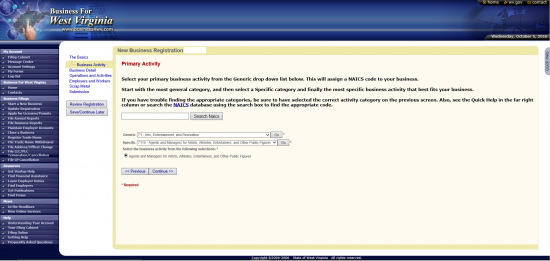

Step 6 – You will need to report your NAICS code. You may enter a term then select “Search NAICS” or you may select from the drop down list labeled “Generic.” For our purposes, select “71 – Arts, Entertainment, and Recreation” in the “Generic” field. This will prompt a “Specific” drop down list to appear. Again, for our purposes, select “7114 – Agents and Managers for Artists, Athletes, Entertainers, and Other Public Figures.” Then, on the next line, select the radio button labeled “Agents and Managers for Artists, Athletes, Entertainers, and Other Public Figures.” Once done, click on the “Continue” button.

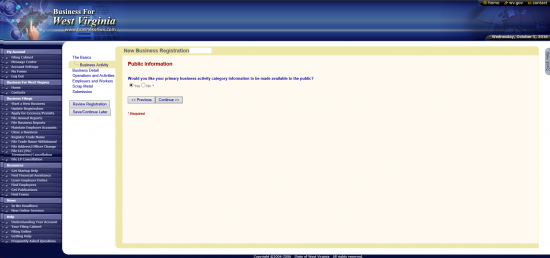

Step 7 – If you would like the information you are entering here to be public, select “Yes.” If not, select “No.” In some cases, information must be made public however some of it will remain private if you select “No.” Make your selection then click on “Continue.”

Step 4 – If the NAICS code you have selected earlier covers %100 of the nonprofit corporation’s activities then select “Yes.” If not then select “No.” When ready, click on the “Continue” button. For the purposes of these instructions, select “Yes.”

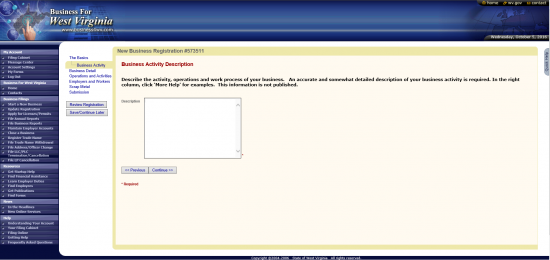

Step 5 – Next, report the Purpose of forming this corporation or define its activities in West Virginia in the text box provided.

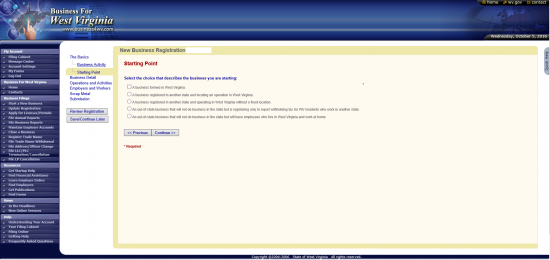

Step 6 – You will need to select the best description for the corporation being formed from a list with corresponding radio buttons. The choices provided, on this page, are in this order: A business formed in West Virginia, A business located in another state and locating an operation in West Virginia, A business located in another state and operating in West Virginia without a fixed location, An out of state business that will not do business in the state but is registering only to report withholding tax for WV residents, who work in another state, or An out of state business that will not do business in this state but will have employees who live in West Virginia and work at home. Select the best choice. For our purposes, select the first radio button. Then click “Continue.”

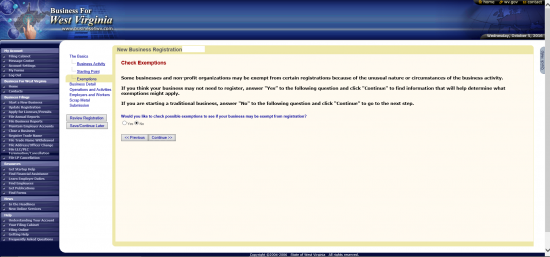

Step 7 – Next you will be asked if you would like to check for exemptions. You may select either “Yes” or “No” to go through a wizard. For our purposes, select the radio button labeled “No.” Then click on the “Continue” button.

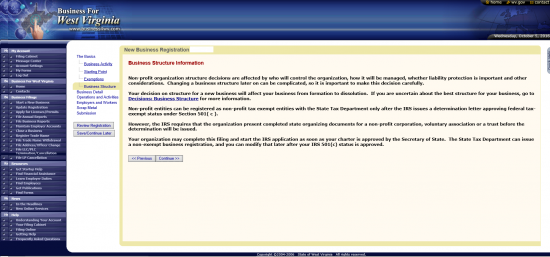

Step 8 – Read this page then select “Continue.” This will contain valuable information regarding the West Virginia Secretary of State Department, the I.R.S., and Tax-Exempt Status.

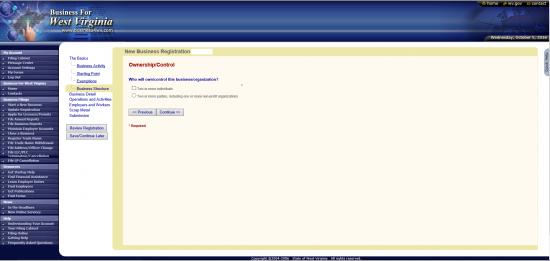

Step 9 – Next, you must give a statement regarding Ownership and Control. If this corporation will be controlled by two or more individuals then select the first radio button. If it will be controlled by organizations or individuals and organizations then select the second radio button. Once you are ready select “Continue.”

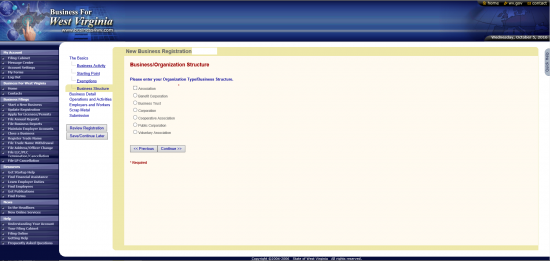

Step 10 – Next you must indicate the type of entity being formed. Select the choice labeled “Corporation.”

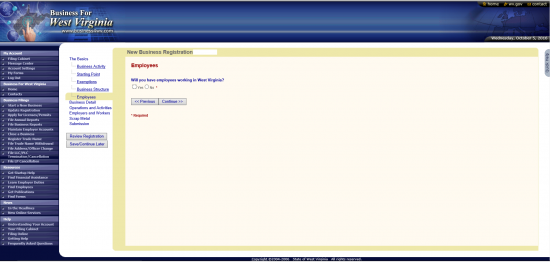

Step 11 – If you will have employees, then select “Yes.” For our purposes, select “No.” When ready, click on the “Continue” button.

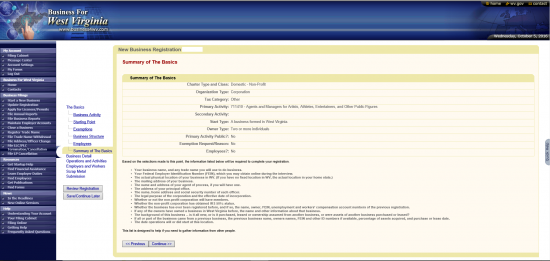

Step 12 – This page will give the opportunity to review the basic information you have entered. You may use the “Previous” button to go back or you may select one of the appropriate section on the left to navigate there should anything need to be corrected. When you are ready, select the “Continue” button.

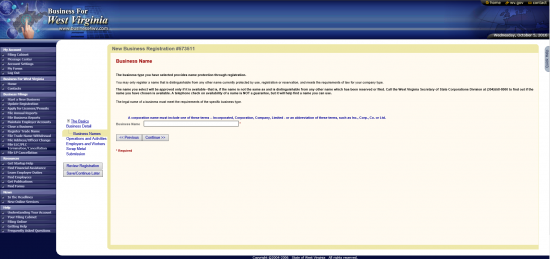

Step 13 – Next, enter the Full Name of the nonprofit corporation that will be formed by the West Virginia Articles of Incorporation online form you are filling out. Make sure this includes a word of incorporation. When you are ready, select “Continue.”

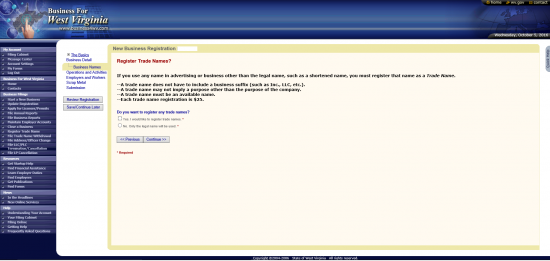

Step 14 – If the Name is available you will be allowed to proceed to this page. If you would like to register a Trade Name, select the first radio button. If not, select the second radio button. Note: You will need to enter the Trade Name if you select the first radio button. For our purposes select the second one labeled “No only the legal name will be used.” When you are ready, click on the “Continue” button.

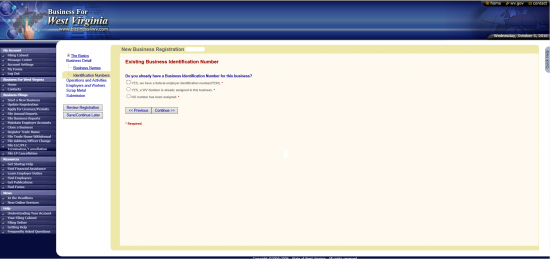

Step 15 – Next you will need to indicate if you have been assigned an FEIN (select first radio button), a WV Number (select second radio button), or if you do not have either (select the third radio button). For our purposes select the third button however, since a corporation is being formed, you will need to report the FEIN number. Proceed to the next page by selecting Continue when you are ready.

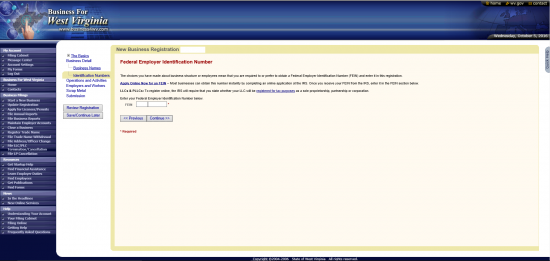

Step 16 – Enter your FEIN Number. If you do not have one you should select the link labeled “Apply online for an FEIN” in the paragraph above, obtain an FEIN Number then return to this application. When ready select “Continue.”

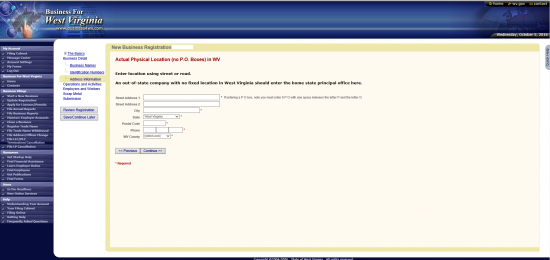

Step 17 – Next, enter the Actual Physical Location of the corporation using the fields labeled “Street Address 1,” “Street Address 2,” “City,” “State,” and “Postal Code.” Below this enter the Phone Number of this location in the field labeled “Phone.” Finally from the drop down list, select the West Virginia County where the Physical Location is.

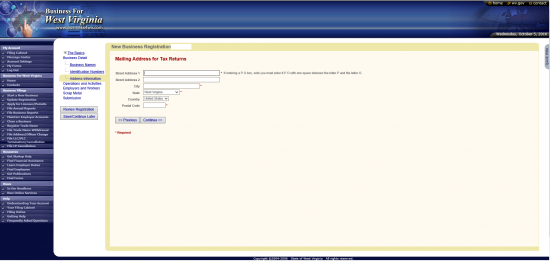

Step 18 – Next, using the Address Lines in this screen, report the Mailing Address you would like Tax Returns for this entity to be sent to.

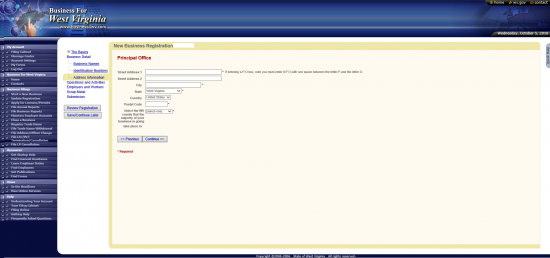

Step 19 – Next enter the Principal Office Address using the Address Lines (Street Address 1, Street Address 2, City, State, Country, and Postal Code). Below this use the drop down list to select the West Virginia County where the corporation will be located.

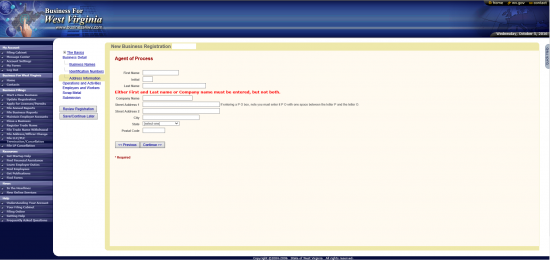

Step 20 – On this screen you will need to enter information as to the identity of your Agent of Process. You may either use the first three fields to report the Full Name of an Individual, then the Address lines for the Physical Location or you may use the field labeled “Company Name” to enter the Name of a Company and the Address Lines below for the Physical Location of that company. Once you are ready, select the button labeled “Continue.”

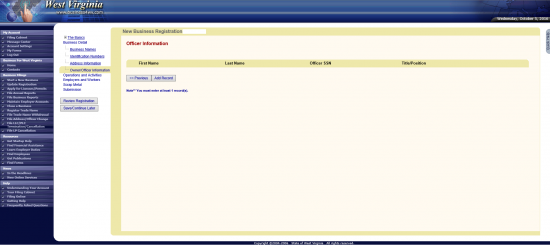

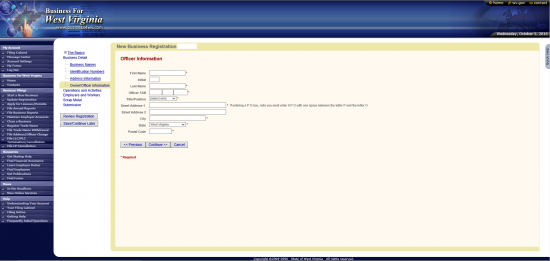

Step 22 – Next you will need to enter some Officer Information. To begin, select the button labeled “Add Record.”

Step 23 – The Officer Information screen will require the Name entered using the “First Name,” “Initial” (optional), and “Last Name” fields. Enter the Officer’s Social Security Number in the “Officer SSN” field. Below this, you may use the drop down list labeled “Title/Position” to indicate the position this individual holds (i.e. President, Secretary, etc.). Then use the Address Lines to enter the Full Address of this party.

Step 24 – This screen will display the Officer information in the table presented (you may edit or delete an entry by using the icons at the end of its row). You may select “Add Record,” to add another Officer’s information, or you may select “Continue” when you are done. Once you have entered all the information required select “Continue.”

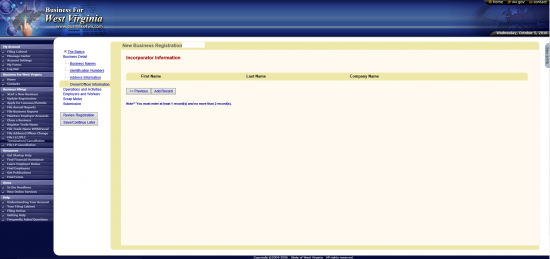

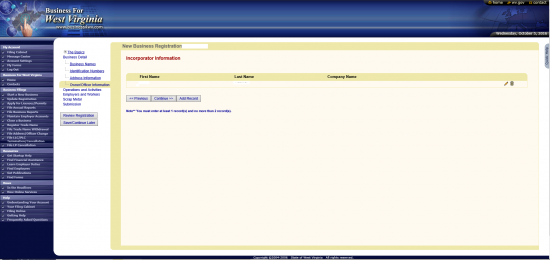

Step 25 – Next, you will need to enter information regarding the Incorporators of this entity. To begin, select the button labeled “Add Record.”

Step 26 – This page will require either the Full Name or the Company Name of the Incorporator being reported. You must fill in the Address Lines (Street 1, Street 2, City, State, and Postal Code). Once you are done, select the “Continue” button.

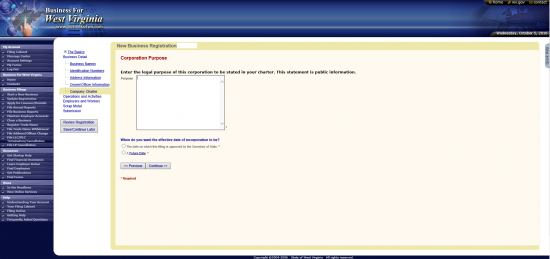

Step 27 – In this screen you will need to report the Corporate Purpose in the text box provided.

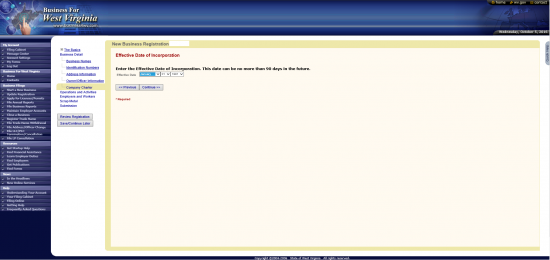

Step 28 – Below the Corporate Purpose box, indicate if you would like the Effective Date to be the Filing Date (select the first radio button) or if you would like the Effective Date to be at a future time (must be within 90 Days of the Filing Date). For our purposes select the second radio to indicate you would like the Effective Date to be different from the Filing Date then select “Continue.”

Step 29 – Enter the Date you wish the articles being submitted to go into Effect. This must be within 90 Days of the Filing Date. When you are done select “Continue.”

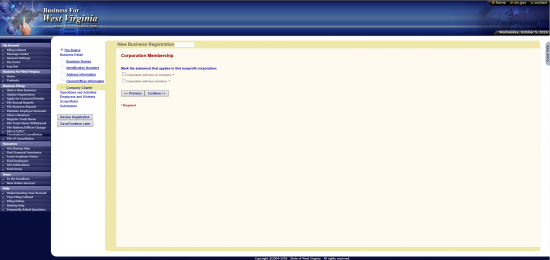

Step 30 – If this corporation will not have Members then select the first radio button on this page. If this corporation will have Members then select the second radio button. When ready, select “Continue.” (For our purposes select the second radio button)

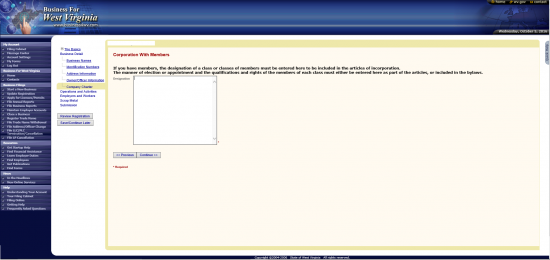

Step 31 – In this screen, report the rights, qualifications, privileges, and limitations of each class and how members of this class will be elected/appointed in the text box provided.

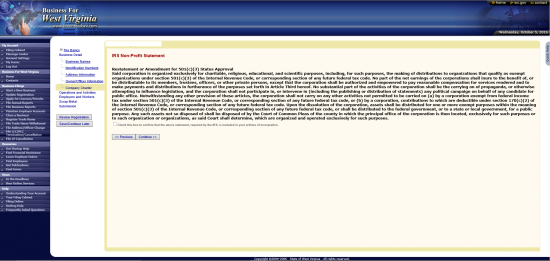

Step 32 – If you plan on applying for Tax Exempt Status, place a check mark in the box at the end of the IRS 501(c)(3) compliant paragraph that will be included in your articles. Otherwise, select “No.” When you are ready, select “Continue.”

Step 33 – Next, indicate if the owners of this business have ever owned a business in the State of West Virginia. If so, mark the first radio button. If not, mark the second radio button. Select “Continue” when you are ready. (For our purposes select the second radio button)

Step 34 – Next you must indicate the statement that best describes the forming nonprofit corporation. For our purposes, select the first radio button labeled “ALL NEW – This business is completely new, and no part of the business came from another business.” Select “Continue” when you are ready.

Step 35 – Next use the drop down list in the date fields to indicate when the corporation will (or has) begin operations. When you are ready, select “Continue.”

Step 36 – In the first question you will be asked to indicate an estimate of the Annual Gross Income for the location of the business. If it is $20,000 or under, select the first radio button. If it is over $20,000.00 select the second radio button. The second question on this page will ask if this business or another location of this business has earned more than $4,000.00 in the past year. Select “Yes” if so. If not, select “No.” When you are ready select the “Continue” button.

Step 37 – If the corporation’s location will be performing any retail sales or maintenance/service work activities then select “Yes.” If not, select “No.” Once done, select “Continue.”

Step 38 – Several products are considered “Special Sales” in the State of West Virginia. If the corporation will be selling any of the products listed (Alcoholic Beverages, Tobacco Products, Motor Fuels, Soft Drinks) then select the corresponding check boxes. If not then select the last one. When ready, click on “Continue.” (For our purposes, select the last check box)

Step 39 – Some Business Activities are considered Special in this state. If your corporation will be engaged in any of these, then place a check mark in the appropriate check box (Health Care, Natural Gas, Natural Resources, Public Utilities, Telecommunications, Transportation). The last check box will be to indicate your corporation will not participate in any of these activities. For our purposes, select the last check box then select “Continue.”

Step 40 – If the corporation being formed will provide any of the Financial Services, Employment Services, or Sales Services listed on this page, you must indicate so by placing a mark in the appropriate check box. For our purposes, select the last check box indicating none of these services will be provided. When you are ready, select the “Continue” button.

Step 41 – If this business will use special equipment, such as scales, then mark the “Yes” radio button in the first statement. Otherwise mark the “No” radio button. Next, in the second statement, select the “Yes” radio button if this corporation will be buying out of state items for use or resale in West Virginia. Otherwise, select the second radio button. For our purposes, select the second radio button for both questions.

Step 42 – Report the Last Month of the corporation’s Fiscal Year by selecting it from the drop down list. When you are ready, select the button labeled “Continue.”

Step 43 – If the corporation being formed is a subsidiary then select the radio button labeled “Yes.” If not, then select the radio button labeled “No.” (For our purposes select “No). When you are ready, select the button labeled “Continue.”

Step 44 – Read the information here, then select “Continue.” The next few screens will deal with Payroll and must be filled out whether you intend on hiring any employees in the nonprofit corporation or not.

Step 45 – As indicated earlier, the nonprofit corporation we are setting up in these instructions will not have any employees and does not intend to hire any in the near future. Select the first radio button to verify this fact and the acknowledgement that you will submit the appropriate paperwork should any employees be hired. Select the second radio button to change the previous answer and indicate the corporation will be hiring employees. For our purposes, select the first radio button then click on the continue button.

Step 46 – On this screen, you must indicate where Payroll records would or will be kept regardless of the employee hiring status. The Principal Location will be the first choice or you may enter an additional address by selecting the second radio button then filling out an Address Screen. For our purposes, select the first radio button then select, “Continue.”

Step 48 – Next you will need to report where Unemployment Compensation Payroll Reports may be sent. You will be given a choice between the Addresses you have previously entered or entering a new location. Choose the appropriate Address then select “Continue.”

Step 49 – On this screen, indicate if you are a scrap metal dealer. If yes, select the first radio button. If not, then select the second radio button. For our purposes, select the second radio button, labeled “No.” When you are ready, select “Continue.”

Step 50 – Read this page carefully. If this is a Veteran owned/controlled nonprofit corporation then you may qualify to be exempt from certain fees. If so, select the radio button labeled “Yes” at the bottom of the page. In such a case, you must fax or mail your completed Form DD214 to 304.558.5758 or Secretary of State, Business & Licensing Division, 1900 Kanawha Blvd. East, Building 1, Suite 157-K, Charleston, WV 25305. You may also email it to business@wvsos.com. For our purposes select “No.” When you are ready select the button labeled “Continue.”

Step 51 – If the nonprofit corporation being formed has a website, you may report it in the text box on this page. If not, you may leave it blank. Once you are ready, select the button labeled “Continue.”

Step 52 – Several agencies are involved with this filing as a courtesy. This means each one will require its own Electronic Signature from the Incorporator. In the West Virginia State Tax Department section, the Submitter must enter his or her Name in the text field labeled “Authorized By (enter name).” Then, the Incorporator must use the drop down menu to indicate the Date of Signing below this. Finally, the Incorporator signing this must indicate his/her Position in the field labeled “Title.”

Step 53 – In the section for the West Virginia Secretary of State, the Incorporator must enter his/her Full Name in the first text box, indicate his/her Position in the field labeled “Capacity,” then provide an Email in the final field of the section.

Step 54 – The last section, for the West Virginia Unemployment Compensation Division, the Incorporator must enter his/her Name in the first text box, then report his/her Position in the field labeled “Capacity.” Once this is done, select “Review Registration.” This will give one opportunity to review and correct any of the information presented. You may navigate easily using the menu on the side or edit links provided for each section. Once you submit the registration, you will be directed to the checkout area where you must pay all applicable fees with a credit card (Filing Fee will be $25.00 + Excess Acreage Fee of $0.05/acre for every owned acre over 10,000 acres, and any applicable taxes as a result of past activities).