|

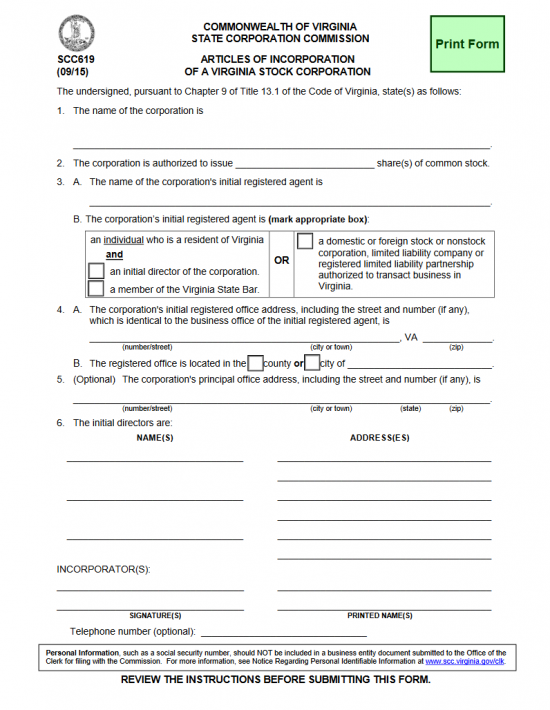

Virginia Articles of Incorporation of a Virginia Stock Corporation | Form SCC619 |

The Virginia Articles of Incorporation of a Virginia Stock Corporation | Form SCC619 represents the minimum amount of information that must be registered with the Virginia State Corporation Commission when an entity wishes to incorporate. In many cases this may not be sufficient and additional information may need to be documented with this governing body. In such cases, you will need to retype the original Virginia Articles of Incorporation of a Virginia Stock Corporation allotting enough room (or articles) for the additional information. For instance, if the corporation has its Shares divided into different Classes, each Class will need to be reported and the Total Number of Shares in that Class will need to be documented. In such a case, you will need to recreate this form adding this information where appropriate. This should be done on 8 1/2″ x 11″ paper and only one side may be used. It should be mentioned the State of Virginia will not accept the original form with attachments. You must submit one complete document that satisfies the information requirements of the Virginia Corporation Commission.

There will be two fees that must be paid with the submission of the Virginia Articles of Incorporation of a Virginia Stock Corporation. The first will be the $25.00 Filing Fee and the second will be a Charter Fee based on the Total Number of Shares this corporation is authorized to issue. The Charter Fee will be $50.00 for every 25,000 Shares if the corporation (being formed by the submitted articles) has less than 1,000,000 Shares. If the corporation has more than 1,000,000 shares, the fee will be $2,500. You have two options for Filing and Paying for the articles you are submitting. If you wish to pay with a check (payable to State Corporation Committee) you must file by mail to State Corporation Commission, Office of the Clerk, P.O. Box 1197, Richmond, Virginia 23218-1197. If you wish to pay by credit card, you must file online by uploading and submitting a completed PDF form at https://sccefile.scc.virginia.gov.

How To File

Step 1 – Download the Virginia Articles of Incorporation of a Virginia Stock Corporation by selecting the “Download Form” link above or by selecting this link: Form SCC619. You may either enter the information onscreen using a PDF program or you may print it then type it. Remember, if you are required to report more than the minimum amount of information, you must retype this form allowing for the space needed for the additional information (in this case, select “Download Word Document”). This includes any additional provisions or rosters.

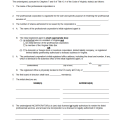

Step 2 – In the First Article, report the Full Name of the corporation being formed on the blank line provided.

Step 3 – In the Second Article, you must document the Total Number of Shares in Common Stock the forming profit corporation may issue. If there is more than one Class of Stock, you must report the Classes and the Total Number of Shares in each Class in the Virginia Articles of Incorporation of a Virginia Stock Corporation.

Step 4 – The Third Article is divided into two sections, both of which concern themselves with defining the Virginia Registered Agent’s Identity. This corporation must have a Virginia Registered Agent, with a Registered Office in Virginia, to receive court documents aimed at the forming corporation. In Section A, report the Full Name of the Virginia Registered Agent on the blank line provided.

Step 5 – Section B of the Third Article will seek to define what type of Registered Agent was obtained. There will be a one row/two column table in this section. You must fill out one of these columns (do not fill out both). If the Registered Agent is an individual (must be a resident of Virginia) then you will address the first column by either checking the box labeled “an initial director of the corporation” or the box labeled “a member of the Virginia State Bar.” If the Registered Agent is a domestic or foreign business entity (corporation, L.L.C., or registered L.L.P.) registered to do business in the State of Virginia then place a check mark in the second column.

Step 6 – The Fourth Article will seek to pinpoint the Registered Office of the Registered Corporation on a map. In Section A of the Fourth Article, report the Building Number, Street, Unit Number, City, and Zip Code on the blank line provided. Then in Section B, report the County or City the Registered Office is located in on the blank space provided. If reporting the County, then place a check in the first box. If it is the City you are reporting then place a check mark in the second box.

Step 7 – If there is a Principal Office upon formation, this should be reported in the Fifth Article. There will be a blank line provided to report the Building Number, Street, Unit Number, City, State, and Zip Code of the Principal Office.

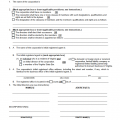

Step 8 – If the Registered Agent named in the Third Article is a Director, he or she must be listed as a Director in the Sixth Article. Corporations may only form with initial Directors, if all the Initial Directors are reported in the Virginia Articles of Incorporation of a Virginia Stock Corporation | Form SCC619. Each Director must have his or her Full Name and Complete Address listed. If there is not enough room you will need to retype these articles with enough room for this section to be report a Full Roster.

Step 9 – In the “Incorporators” section, at least one Incorporator must Print then Sign his or her Name in the spaces provided. If more than two Incorporators wish to Sign this document, then you must retype this form with enough space for this.

Step 10 – The last line of this form gives the opportunity to provide a Contact Telephone Number for the Virginia State Corporation Committee to use in the event any issues regarding these articles needs to be solved or clarified.

Step 11 – Next you will need to calculate your Charter Fee. If the corporation formed by these articles has less than 1,000,000 Authorized Shares to issue, then divide the Total Number of Shares by 25,000 and multiply this number by $50.00. This will be the Charter Fee (minimum of $50.00). If there are more than one million shares of Authorized Stock, the Charter Fee will be $2,500.00. Add the $25.00 Filing Fee to the Charter Fee. This will be the total payment due upon submission of these articles.

Step 12 – You may mail the Virginia Articles of Incorporation with a check payable to State Corporation Commission in the amount of the Total Payment (Charter Fee + Filing Fee) directly to the State Corporation Commission in the Office of the Clerk.

Mail To:

State Corporation Commission

Office of the Clerk

P.O. Box 1197

Richmond, Virginia 23218-1197

How To File Online

Step 1 – Open the Virginia State Corporation Commission New Entity Formation page here: https://sccefile.scc.virginia.gov/NewEntity.

Step 2 – Locate the link labeled “Form a Virginia Stock Corporation” under the words “eFile Express.” This will enable you to fill in the form online.

Step 3 – A pop up window will appear asking for your Email Address and Password. You must enter this information to continue, or select the “Create an Account” to sign up. Enter your login information then select the button labeled “Log In.”

Step 4 – In the first field, “Enter the proposed entity name,” type in the Full Name you wish to give the corporation being formed. If this is a unique Name, the statement “Proposed Entity Name is distinguishable” will appear just below this field. If the Name is not distinguishable, enter your next choice until you find one that is.

Step 5 – Next to the words “List the total number of shares the corporation is authorized to issue. If there is a par value to these shares, mark the radio button labeled “Yes” below this field then enter the Par Value of each Share in the text box that appears. Note: If this corporation has its authorized shares divided by Class, you must submit the PDF form with a definition and Total Number of Shares for each Class.

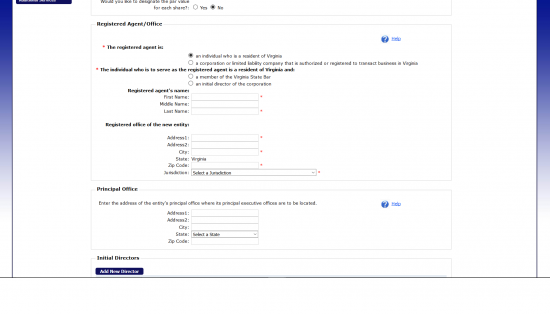

Step 6 – Next you will need to report information regarding the Registered Agent that has been obtained for this corporation. First you will need to define the type of entity which has agreed to serve as the Registered Agent. You have several choices, each one next to a radio button. You may only choose one of these: An individual who is a resident of Virginia or a corporation or limited liability company that is authorized or registered to transact business in Virginia. For our purposes, select the radio button labeled “an individual who is a resident of Virginia.” This will create two more choices to further define the individual. Choose the radio button next to either “a member of the Virginia State Bar” or “an initial Director of the corporation.” For our purposes select “an initial Director of the corporation.”

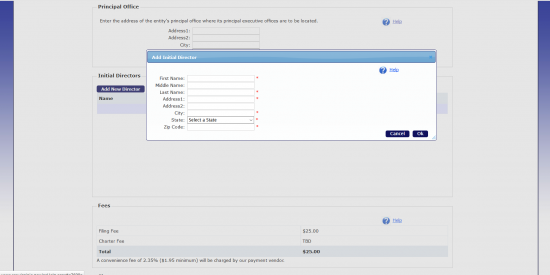

Step 7 – Several fields will appear as a result of this choice. Under the heading “Registered agent’s name,” use the First Name, Middle Name, and Last Name fields to report the Full Name of the Registered Agent. Then under the heading “Registered office of the new entity,” use the “Address 1” and “Address 2” fields to report the physical street location of the Registered Office. The State will be filled in for you, but you must enter the Zip Code in its appropriate field, then use the drop down list next to “Jurisdiction” to report the applicable County for where the Registered Office is located.

Step 8 – Next, you will need to report the location of the Principal Office of the forming corporation. You may use the “Address 1” and “Address 2” field to report the Street Address, then the City, State, and Zip Code fields to document the remaining information in this postal address. This section may be left blank. Note: This system does not accommodate foreign addresses thus, if the Principal Office is in a foreign country, you must leave this section blank.

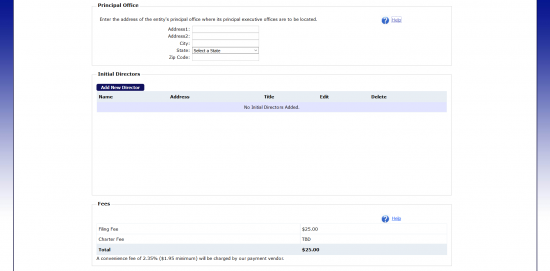

Step 9 – Next, you will need to report any initial Directors serving this corporation. This corporation will not form with any Directors in power unless they are documented. To do this, select the button labeled “Add New Director.” This will generate a pop-up window with the following fields: First Name, Middle Name, Last Name, Address 1, Address 2, City, State, and Zip Code. Utilize these fields to report this requested information. Each entry will appear in the Directors table where you will have the option to edit or delete it if necessary.

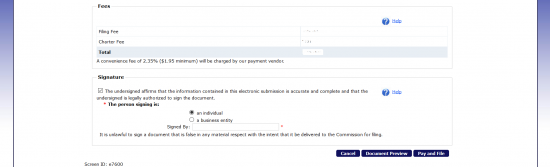

Step 10 – Notice the fees for this submission has been calculated in the “Fees” section. Below this, you will need the Signature Party to select the box next to the acknowledgement statement then select the radio button labeled either “an individual” or “a business entity.” For our purposes we will assume the Signature Party is an individual. This individual must enter his/her Full Name in the field labeled “Signed By” which will act as an electronic Signature. You may review the information as it will appear by selecting the “Document Preview.” When you are ready, select the button labeled “Pay and File.” This will guide the browser to the page where you may enter your credit card information to pay the Filing and Charter Fee for these articles and submit the articles.