|

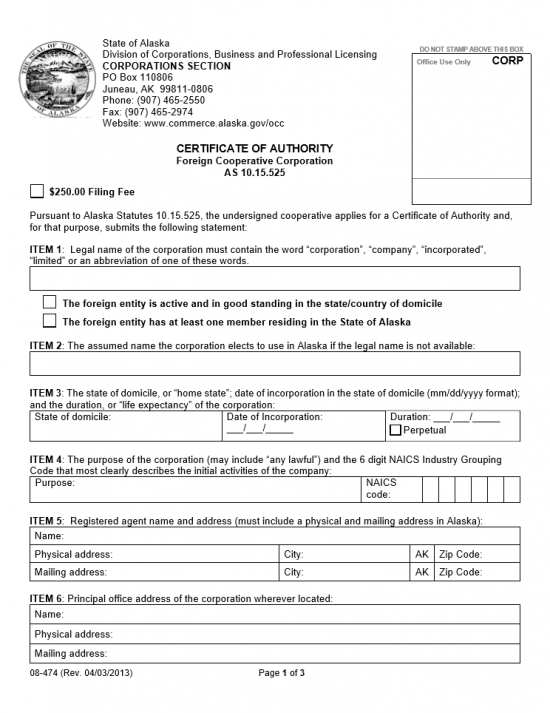

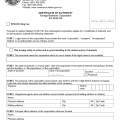

Alaska Certificate of Authority Foreign Cooperative Corporation | 08-474 |

The Alaska Certificate of Authority Foreign Cooperative Corporation | Form 08-474 must be submitted when a cooperative corporation that exists outside of the State of Alaska wishes to operate as a cooperative corporation within the State of Alaska. These articles will be considered necessary paperwork which must be approved by the Alaska Corporate Section before any business may be conducted in this state. This paperwork should be submitted in duplicate to the State of Alaska Corporations Section, P.O. Box 110806, Juneau, AK 9981-0806 with a state filing fee of $250.00. In addition, to these articles, all other requirements the State of Alaska places on such entities must also be fulfilled. For instance, any business wishing to operate must gain a business license and, in some cases, a professional license may be required depending upon the nature of the entity. It will be up to the incorporators who wish to operate in Alaska to be fully abreast of the requirements that must be fulfilled with every government entity that would apply. It is always advisable to seek legal counsel to make sure one is in compliance with Alaska State Law during the formation of a cooperative corporation and periodically during its existence.

How to File

Step 1 – In the first item, enter the legal name of the corporation. Keep in mind that a legal corporate name in this state must contain one of the following words: corporation, company, incorporated, or limited either written out or abbreviated in an acceptable manner. This name must be unique.

Step 2 – Item 2 will require the name of the corporation’s name as it is known in its home state if it is different from that used in the State of Alaska.

Step 3 – Item 3 will also require information regarding this entity in its home state. Here, enter the state where this entity was first formed, the date of incorporation in the entity’s original state, and the last date this corporation will be active (next to “Duration”). If there is no set date where this corporation will cease to be active then mark the box labeled “Perpetual.”

Step 4 – In Item 4, document the purpose of this entity. Also enter the NAICS Code.

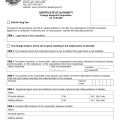

Step 5 – Item 5 will need the name physical address and (if different) mailing address of the registered agent nominated by this corporate entity.

Step 6 – Report the name, physical address, and mailing address of the cooperative corporation’s principal office in Item 6.

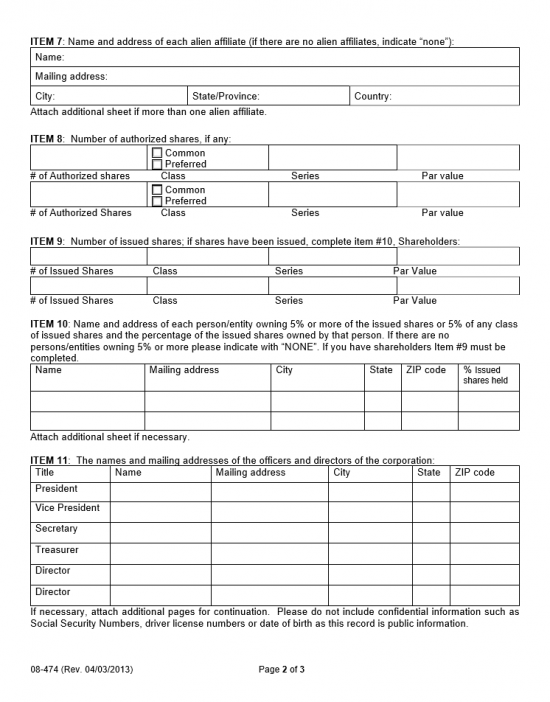

Step 7 – In Item 7, enter the full name and address of each alien affiliate of this corporation.

Step 8 – The authorized shares for this corporation must be reported. Do this in the table presented in item 8. This will require the number of authorized shares, the class, the series, and the par value to be defined.

Step 9 – If any shares have been issued then you must report this in Item 9. If this is the case, then enter the number of issued shares, their class, their series, and their par value.

Step 10 – If any individual or entity owns more than 5% of the shares, then report his/her/its name, address, and the exact percentage of shares held in Item 10.

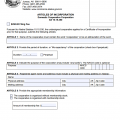

Step 11 – In Item 11, enter the name and mailing address of the President, Vice President, Secretary, Treasurer, and Directors.

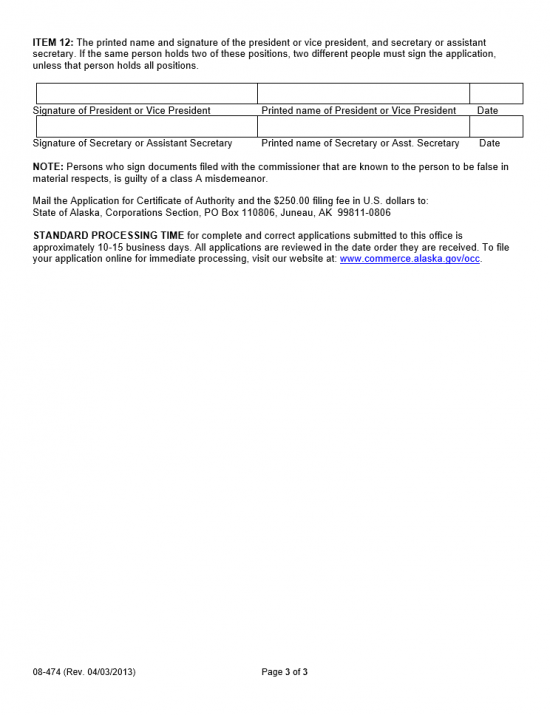

Step 12 – If there are any attachments, such as continuations for questions or supporting documentation, attach them before signing. Remember any and all attachments should be clearly labeled and on standard letter sized paper.

Step 13 – In Item 12, the President or Vice President and the Secretary or Assistant Secretary must sign and print his/her name as well as date their signature. This should be two unique entities.

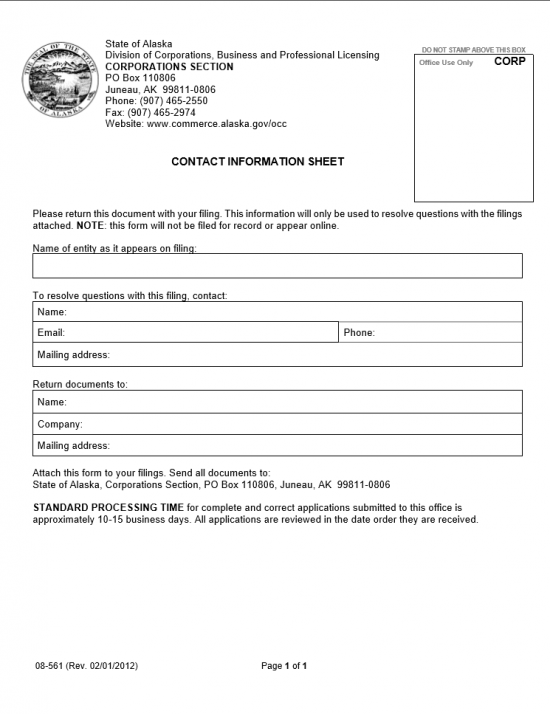

Step 14 – You must fill out the Contact Sheet included. It will require the name of the entity, the name and contact information for an individual who may be contacted to resolve Article issues, and the mailing address where documents may be returned.

Step 15 – This document must be submitted in duplicate (original plus one exact copy), with a $250.00 filing fee to State of Alaska Corporations Section, P.O. Box 110806, Juneau, AK 9981-0806. If you are paying by check you must make the check payable to: Division of Corporations, Business and Professional Licensing. If paying by credit card you must select the appropriate credit card form for your area from this page: https://www.commerce.alaska.gov/web/cbpl/CreditCardPayments.aspx