|

Arizona Articles of Incorporation Nonprofit Corporation | Form C011 |

The Arizona Articles of Incorporation Nonprofit Corporation | Form C011 must be submitted to the Corporate Filings Section of the Arizona Washington Street, Phoenix, Arizona 85007. The filing fee may be paid for by credit card, check, or money order. As a note, cash payments will be accepted if the Articles are submitted in person (only). The minimal submittal package must contain the Arizona Articles of Incorporation Nonprofit Corporation Form C011, Cover Sheet, Certificate of Disclosure, and Statutory Agent Acceptance plus payment for the filing fee. Needless to say, any supporting documentation present and required should also accompany this submittal.

The submittal for Articles of Incorporation Nonprofit Corporation will result in an approval letter. Other governing bodies, such as relevant licensing commissions or the Internal Revenue Service, will have their own submittal requirements which must be fulfilled before one can operate a nonprofit corporation that is considered in full compliance with Arizona State and Federal Laws. It is generally highly recommended to seek consultations with appropriate professionals (i.e. a Certified Public Accountant) as a method of being fully abreast of the incorporator’s responsibilities to the forming nonprofit and the State of Arizona.

How to File

Download Statutory Agent Acceptance Form

Download Certificate of Disclosure

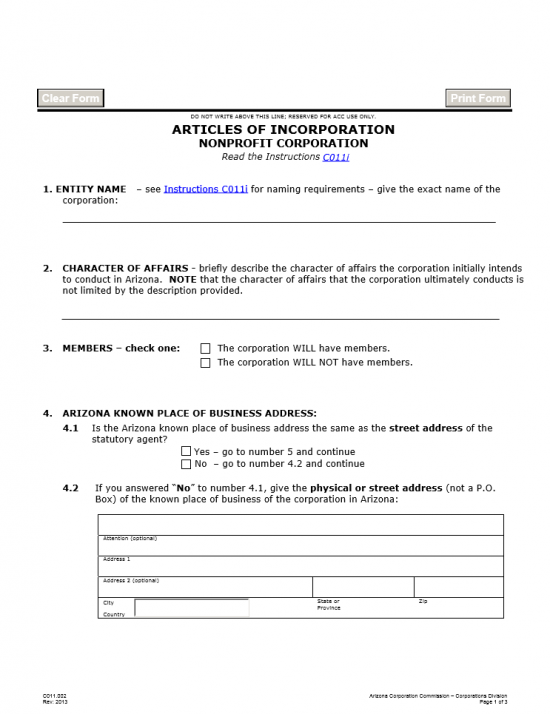

Step 1 – Enter the exact name of the non-profit corporation these Articles of Incorporation concern themselves with in item 1.

Step 2 – in item 2, give a brief description of the character or intended activities of this non-profit corporation.

Step 3 – Indicate if the corporation will have members or not by placing a check mark next to the appropriate box.

Step 4 – If the non-profit corporation’s address is the same as that of the appointed statutory agent, mark the first box (labeled “Yes”) in item 4.1, then proceed to item 5. If not then mark the second box (labeled “No”) and enter the physical street address of where this non-profit will operate in the State of Arizona in item 4.2.

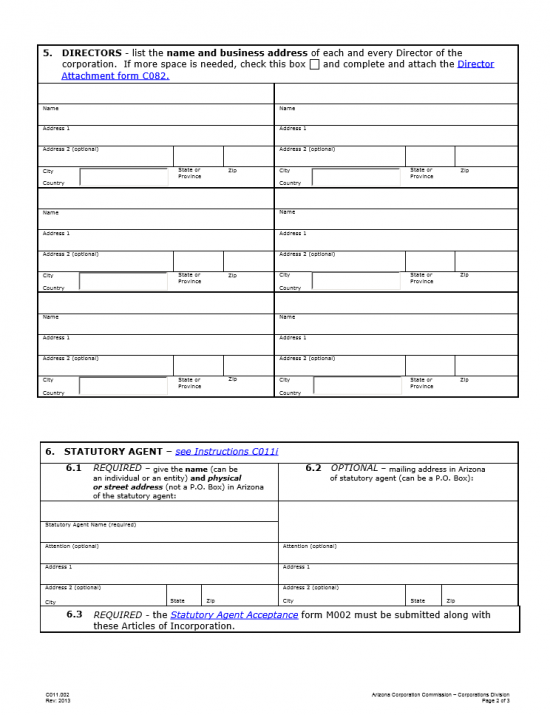

Step 5 – Report the name and address of each corporate Director. Each one must be reported, if there is not enough room then download form C082 here” Director Attachment. Fully document each of the remaining Directors here then attach to the articles. The Directors Attachment may be downloaded here: Form C082

Step 6 – The identity and physical address of the individual or entity, listed in as the statutory agent in the Statutory Agent Acceptance form, must be listed in item 6.1. If this entity has a mailing address that is different from its street address, this must be listed in item 6.2. Note: You must attach the Statutory Agent Acceptance form. The Statutory Agent Acceptance Form may be downloaded here: Form M002

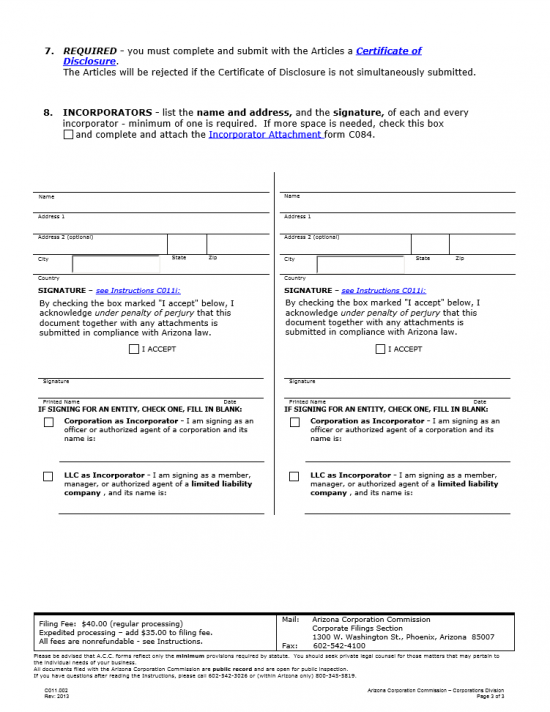

Step 7 – Item 7 requires you attach your Certificate of Disclosure. The Articles of Incorporation will be rejected if this not done. The Certificate Disclosure may be downloaded here: Form C003

Step 8 – The Incorporators who are responsible for forming this nonprofit corporation must provide their names, addresses, and signatures. If the corporation is being formed by an entity this must be indicated by checking the appropriate boxes. If the signature party represents a corporation, check the first box (below the signature area) and list the corporation’s name. If the entity is an LLC, then check the second box and list the name of the LLC forming this nonprofit. Each Incorporator must report his/her name, address, and provide a signature. if there is not enough room, place a check mark in the first box, in the first paragraph, and provide this on the Incorporator Attachment form. The Incorporator Attachment Form may be downloaded here: Form C084

Step 9 – Submit the completed Cover Sheet, Arizona Articles of Incorporation Nonprofit Corporation | Form C011.002, Statutory Agent Acceptance, Certificate of Disclosure, and all required documents, by mail or in person to:

Arizona Corporation Commission

Corporations Division

1300 W. Washington Street

Phoenix, Arizona 85007

You must include a payment for the filing fee of $60.00 with the submittal package. If you wish to have this expedited, include payment for the additional $35.00 expediting fee. If submitting by mail you may pay by check or money order. Checks and money orders must be made payable to “Arizona Corporation Commission.” It should be noted that checks must have the name and account imprinted on the check (i.e. temporary checks issued by a bank do not have this and thus would not be accepted). If submitting in person you may pay by cash, money order, check, or credit card.