|

Connecticut Certificate of Incorportion Nonstock Corporation | Form CIN-1-1.0 |

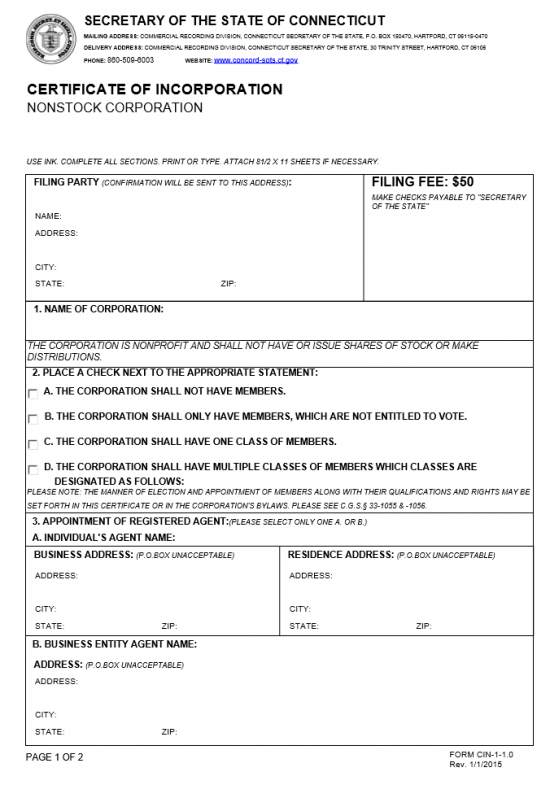

The Connecticut Certificate of Incorporation Nonstock Corporation | Form CIN-1-1.0 must be filed and approved by the Connecticut Secretary of State before an entity may operate as a nonprofit corporation within this state. This form is for domestic entities who will not issue or even possess any shares of stock. In some cases, the nature and purpose of the forming nonprofit corporation may qualify it for tax exempt status however this form will not satisfy such requirements. Other entities such as the Internal Revenue Service will have jurisdictions over granting such status. Regardless of the specific nature of the nonprofit corporation being created it is very likely that other governing entities will need to documentation an provide paperwork (such as licensing) which may be have to be submitted. It will be left as a responsibility of the Incorporator to be familiar with the process of forming the entity he/she/they wish to and satisfy all requirements necessary to remain in compliance with state and federal mandates.

This form should be completed accurately then submitted to the Connecticut Secretary of State with any required paperwork and full payment for the filing fee ($50.00). This may be filed by mail (send to Commercial Recording Division, Connecticut Secretary of State, P.O. Box 15047, Hartford, CT 06115-0470 or physically dropped off at Commercial Recording Division, Connecticut Secretary of State, 30 Trinity Street, Hartford, CT 06106. All checks should be made payable to “Office of the Secretary of State.”

How To File

Step 1 – The Filing Party must be reported in the first section (titled “Filing Party”). The full Name and Address (Street Address, City, State, and Zip Code) of the individual submitting this document must be entered in the first box.

Step 2 – Next in Section 1, enter the full Name of the nonprofit corporation being created by these documents.

step 3 – In the second section, you must define the member status of this non-profit corporation by placing a check mark next to the appropriate statement. If the corporation will not have member place a check mark in the box labeled “A.” If the corporation will have members but not allow them to vote place a checkmark next to the box labeled “B.” If the corporation will have just one class of member then place a check mark next to the box labeled “C.”

Step 4 – Finally, if the corporation being formed will have multiple classes of members then place a check mark in the box labeled “D” and specify the classes in the space provided.

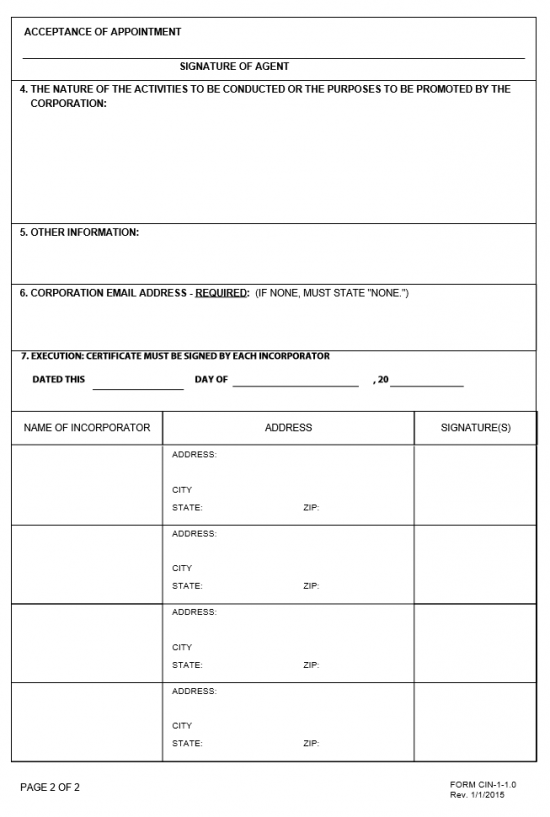

Step 5 – In Section 3, the Registered Agent must be identified and his/her/its location documented. The Registered Agent may either be an adult or a business entity. If it is an adult individual then enter the full name of the Registered Agent on the blank line in item 3A, “Individual’s Agent Name.” then enter both the Registered Agent’s Business Address and Residence Address in the appropriatey labeled boxes. If the Registered Agent is a business, such as a corporation, then enter the full name of this entity in Item 3B, “Business Entity Agent Name.” Below this enter the Registered Business Agent’s full Address. This section must be signed by the Registered Agent under the words “Acceptance of Appointment.”

Step 6 – In the fourth section, starting with the words “The Nature of Activities,” report the purpose or reason for forming this corporation, including how it will operate and conduct business in this state.

Step 7 – The fifth section, “Other,” gives the opportunity to include or attach any relevant information to these articles that would prove helpful to the Secretary of State.

Step 8 – Enter the corporation E-mail Address where correspondence with the Connecticut Secretary of State will be reliably received. If none exist, write the word “None” in the space provided.

Step 9 – Next it will be time to provide the date this certificate has been completed and signed. Do this in section 7, beginning with the words “Execution: Certificate.” Below the date, each Incorporator must print his/her Name, document his/her Address, and Sign his/her name. It there is not enough room for all Incorporators in table provided continue this section on a clearly labeled separate sheet of paper (8 1/2″ x 11″) and attach it.

Step 10 – Gather your completed Connecticut Certificate of Incorportion Nonstock Corporation | Form CIN-1-1.0, any relevant documents that should be attached, all required documents, and payment for the State $50.00 filing fee (made payable to Secretary of State) and submit this package to the Connecticut Secretary of State. This may be done by mail or in person:

By Mail:

Commercial Recording Division

Connecticut Secretary of State

P.O. Box 150470

Hartford, CT 06115-0470

In-Person Drop Off:

Commercial Recording Division

Connecticut Secretary of the State

30 Trinity Street

Hartford, CT 06106