|

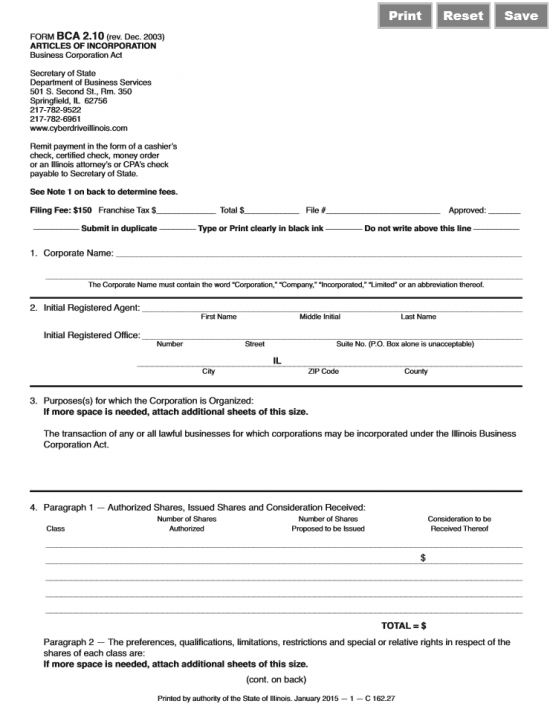

Illinois Articles of Incorporation Profit Corporation | Form BCA 2.10 |

The Illinois Articles of Incorporation Profit Corporation | Form BCA 2.10 is the form used to register a corporation with the Illinois Secretary of State’s Department of Business Services. You may file the Articles of Incorporation for profit corporation by mail or online. You may also choose to expedite the filing process but this must be requested in person. It should be noted that you may only file online if your corporation has only one class of stock (common stock) otherwise the articles must be filed on paper.

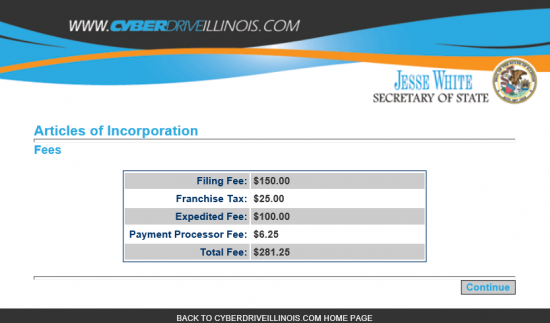

All applicable fees must be submitted with the Articles of Incorporation. If paying by mail you may submit a check or money order payable to the “Secretary of State.” The filing fee is $150.00. You must also pay the initial franchise tax when submitting the articles. This is a rate of 15/100 of 1 percent. That is $1.50 for every $1000.00 on paid in capital. There will be a minimum tax of $25.00.

If filing online, you may pay by American Express, Discover, MasterCard, or Visa at the time of submittal. Due with the submission of the articles will be the Franchise Tax of $25.00, the Filing Fee of $150.00, an Expedited Fee of $100.00, and a Payment Processing Fee of $6.25. If you are filing by mail, you must send the original Illinois Articles of Incorporation Profit Corporation | Form BCA 2.10, a copy of the original Form BCA 2.10, and all relevant documents clearly labeled and attached simultaneously with full payment of all applicable fees to Secretary of State, Department of Business Services, 501 S. Second Street Rm. 350, Springfield, IL 62756. Payment must be in the form of a cashier’s check, certified check, money order, or Illinois attorney/CPA check and should be made payable to “Secretary of State.” The filing fee for Form BCA 2.10 is $150.00 and the Initial Franchise Tax payment must be a minimum of $25.00, however if your calculations show a higher tax rate, it must be paid in full with the filing fee at the time of filing.

How To File By Mail

Step 1 – Go to the Illinois Publications Forms page: http://www.cyberdriveillinois.com/publications/allpubs.html then locate Form BCA 2.10. Select the link labeled “Articles of Corporation” listed on this line. If your browser is compatible, you may be able to fill it out using your browser. Otherwise you may use a PDF program then print it or print it then type or write in your answers (black ink only).

Step 2 – Locate Article 1, “Corporate Name,” then document the Full Name of the corporation being formed. This must be a unique name in this state and must have any of the following words as part of the name: Corporation, Company, Incorporated, or Limited. You may substitute these words with the abbreviated version if you choose.

Step 3 – Article 2 requires the First Name, Middle Initial, and Last Name of the Initial Registered Agent to be entered on the fist line.

Step 4 – On the second and third lines, in Article 2, document the physical Street Address of the Registered Agent. This must be where the Registered Agent is physically located and must be in the State of Illinois.

Step 5 – In Article 3, report the Purpose for the creation this corporation. If you do not have enough room, you may document the remaining information on a clearly labeled sheet(s) of paper.

Step 6 – Next, in Article 4, you must report information regarding the Authorized Shares this corporation has at its disposal. A brief table will give guidance by providing the headings: Class, Number of Shares Authorized, Number of Shares Proposed to be Issued, and Consideration to be Received Thereof. There will be several rows provided to report this information however you may continue on a separate sheet of paper (that is clearly labeled). Below the table, enter the Total value of the Consideration to be Received Thereof column. Do this next to the term “Total=$”

Step 7 – The next items are optional however, they are commonly addressed in some articles. The Illinois Articles of Incorporation provides items where one may enter this information but the Incorporator is not required to fill this section out when submitting this document. Article 5a contains a space where you may report the number of initial directors sitting on this corporation’s board. Then, Item 5b will give an area to document the Full Name, Address, City/State/Zip Code for each of these Board Members. This list may be continued on a separate sheet of paper.

Step 8 – In Article 6a, report the total dollar amount for the value of all the assets the corporation will own in the next year(estimated) on the space provided.

Step 9 – In Article 6b, report the total dollar amount for the estimated value of all assets the corporation shall own in the next year that is in the State of Illinois in the space provided.

Step 10 – In Article 6c, report the gross amount of business the corporation is estimated to transact, in the following year, on the space provided.

Step 11 – In Article 6d, report the gross amount of business the is estimated to transact only in Illinois on the blank space provided.

Step 12 – Article 7 allows for additional provisions or information to be attached to these articles.

Step 13 – In Article 8, ente the Month, Day, and Year these articles are being signed o the first space provded, next to the word “Dated.”

Step 14 – The Signature section will allow three Incorporators to Sign and Print his/her Name then enter his/her Full Address. If this corporation is being formed by a business entity (such as another corporation) its name must be shown and the signature(s) should be of authorized officer(s).

Step 15 – Note 1 will document how the Franchise tax is to be calculated ($1.50 per $1000.00 on paid-in capital). The minimum franchise tax is $25.00. The filing fee for these articles is $150.00. Calculate then arrange to submit full payment of the calculated or minimum franchise tax and the filing fee with the articles. This should be in the form of a check or money order made payable to the Secretary of State.

Step 16 – In Note 2, document where the Firm Name, an Attention Line, and the Mailing Address where these articles should be returned.

Step 17 – You may organize your submittal to the Secretary of State with the original Illinois Articles of Incorporation Profit Corporation | Form BCA 2.10, a copy of the original Form BCA 2.10, any additional or required information that is attached. and a cashier’s check, certified check, money order, or Illinois attorney/CPA check made payable to “Secretary of State.” This check should cover full payment for all applicable fees (mandatory $150.00 Filing Fee) and the require Initial Franchise Tax you calculated (you must pay a minimum $25.00). You may mail this to:

Secretary of State

Department of Business Services

501 S. Second Street, Rm. 350

Springfield, IL 62756

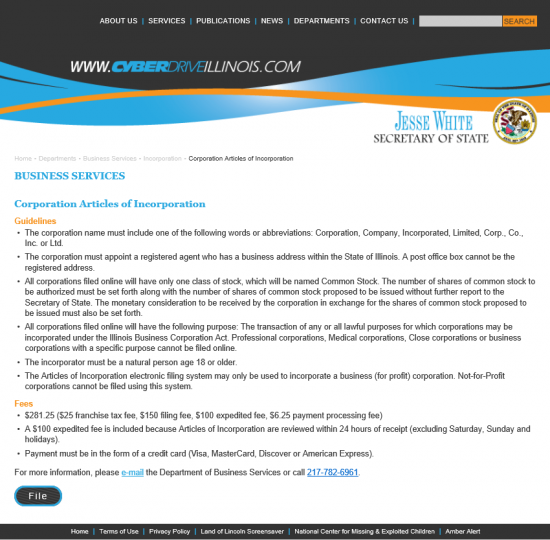

How To File Online

Step 1 – Go to the Illinois Secretary of State’s Department of Business Services Articles of Incorporation web page here: http://www.cyberdriveillinois.com/departments/business_services/incorporation/corp_instructions.html.

Step 2 – Read all the information present on this page, then click on the word “File,” in the lower left hand corner of the page.

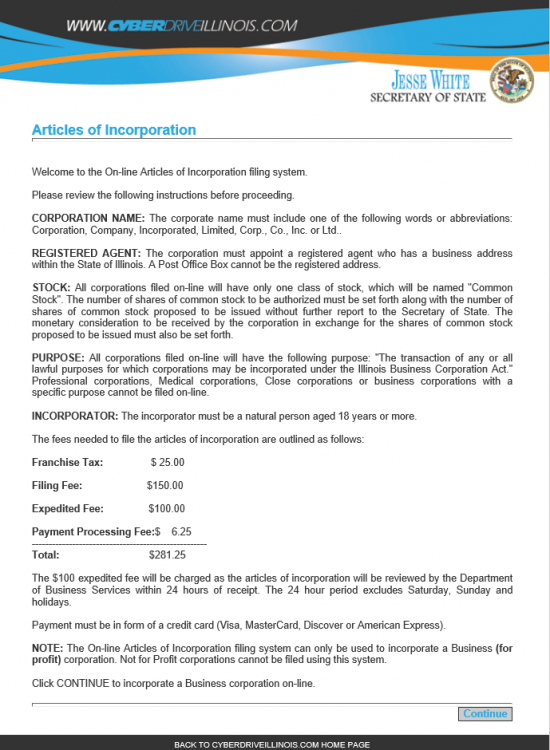

Step 3 – Read the information and review the fee information. When you are ready, select the button labeled “Continue,” in the lower right hand corner of the web page.

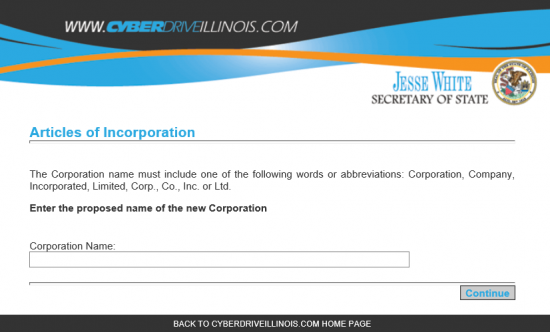

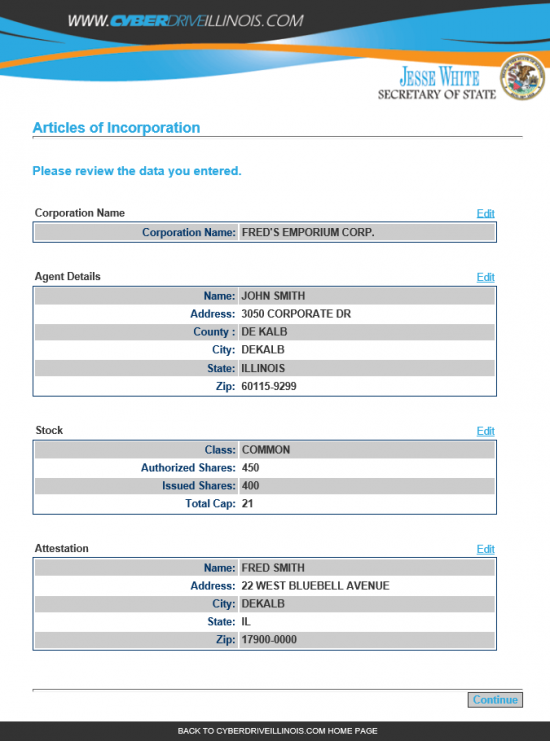

Step 4 – The first field requiring information in the Illinois Articles of Incorporation online form is the Corporate Name field. In the text box labeled “Corporate Name,” enter the Full Name your corporation will exist as and operate under in the State of Illinois. This must be a unique name in the State of Illinois and must have Corporation, Corp., Company, Co., Incorporated, Inc., Limited, or Ltd. in the name. Note: the word “and” may not precede the word (or abbreviation of) “Company.” Select the button labeled “Continue” once this is done.

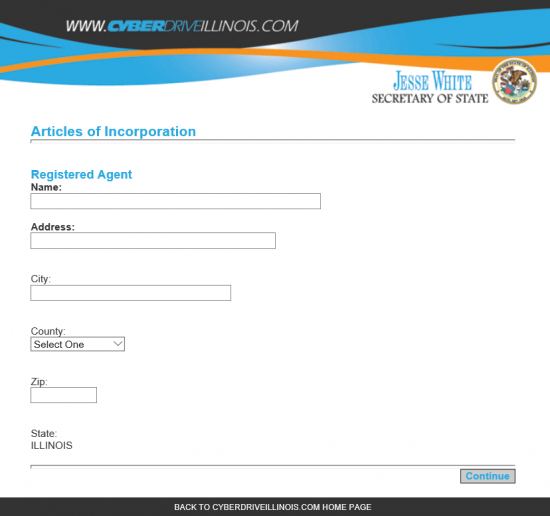

Step 5 – Next, you must enter the identity of the Registered Agent for this corporation. That is, the individual or business entity (whose sole purpose is to act as a registered agent) who has been authorized and accepted the responsibility in receiving the service of process documents generated by a court if this corporation is sued. Enter the Full Name in the first text box. Then under the heading “Address,” report the Illinois Address maintained by the Registered Agent. Once done, select the button labeled “Continue.”

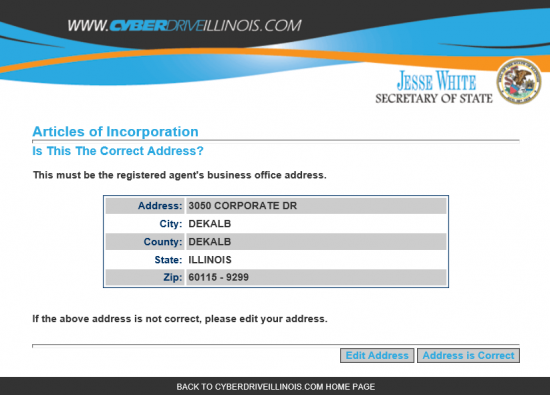

Step 6 – Verify the information you have entered for the Registered Agent, then select the “Continue” button to proceed to the next section.

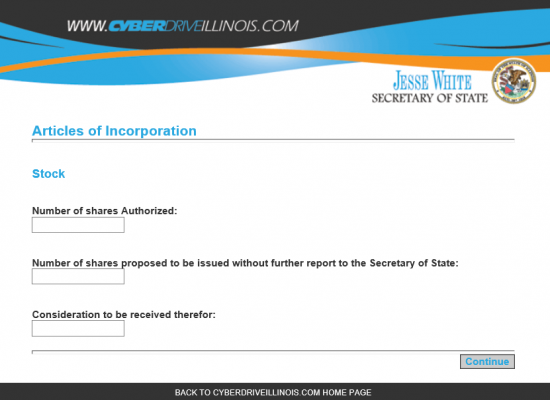

Step 7 – You must now enter the stock information fort this corporation. First enter the Total Number of Authorized Shares this corporation may distribute in the first text box. In the second text box, report the number of shares that may be issued before having to contact the Secretary of State. In the third text box, enter the Consideration to be Received Therefore. This must be a whole number. When you have entered all the information and verified it as true, then select the “Continue” button.

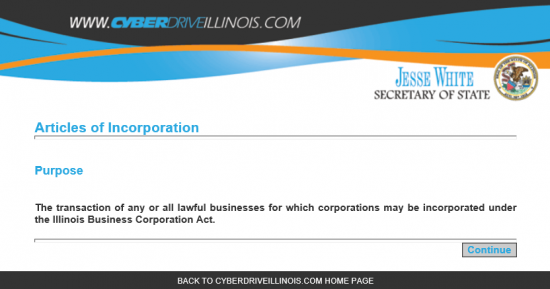

Step 8 – This page will bind the purpose of the corporation to the statement: The transaction of any or all lawful businesses for which corporations may be incorporated under the Illinois Business Corporations Act. Once you have read the statement, click on the button labeled “Continue.”

Step 9 – This page will bind you to the online fee of $281.25. Acknowledge the acceptance of this fee for the articles by selecting the word “Continue,” in the lower right hand corner of the page.

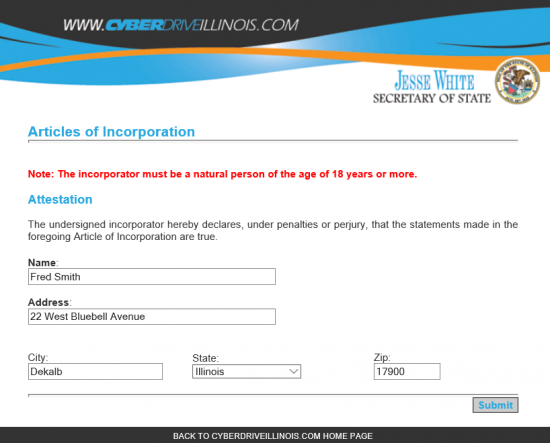

Step 10 – The Attestation page will bind the Incorporator to the Articles of Incorporation being submitted. Enter the Full Name of the Incorporator in the text box labeled “Name.” Then in the area labeled “Address,” enter the Building Number, Street, and Suite Number (if applicable) in the first text box of this section. Then enter the City, State, and Zip Code in the next three text boxes. Once this is done, select the word “Continue.”

Step 10 – The Attestation page will bind the Incorporator to the Articles of Incorporation being submitted. Enter the Full Name of the Incorporator in the text box labeled “Name.” Then in the area labeled “Address,” enter the Building Number, Street, and Suite Number (if applicable) in the first text box of this section. Then enter the City, State, and Zip Code in the next three text boxes. Once this is done, select the word “Continue.”

Step 11 – Review all the information you are submitting before continuing. If it is correct select the word “Continue.” You will be prompted to pay all applicable fees ($281.75) by American Express, Discover, MasterCard, or Visa after confirming your payment information.

Step 11 – Review all the information you are submitting before continuing. If it is correct select the word “Continue.” You will be prompted to pay all applicable fees ($281.75) by American Express, Discover, MasterCard, or Visa after confirming your payment information.