|

Ohio Articles of Incorporation For Profit Domestic Corporation | Form 532A |

The Ohio Initial Articles of Incorporation For-Profit Domestic Corporation may be filed either online or by mail with the Ohio Secretary of State. This is a mandatory filing that should be completed by an Incorporator and approved by the Ohio Secretary of State prior to the formation and operation of a Profit Corporation. All the information on this form must be submitted and some will be pursuant to Ohio Law. For instance the Name of your corporation must adhere to Ohio Revised Code §1701.05 by being unique, not misleading, and must contain one of the corporate designating words (Company, Co., Corporation, Corp., Incorporated, or Inc.). This form will satisfy a staunch requirement of the Ohio Secretary of State but, in most cases, it is not the only requirement an Incorporator, and the entity being formed, must satisfy. Other governing entities will hold both of these entities to their own requirements. For instance, the Internal Revenue Service will need to be contacted before, during and after this process in order to satisfy its own process for entity formation. Incorporators are, generally, encouraged to seek legal counsel when necessary (for instance from a qualifying Attorney or Accountant). After all, Incorporators, and the entity being formed, would be held liable should any requirement of the State Government, Federal Government, and other entities with jurisdiction in the matter be left unfulfilled.

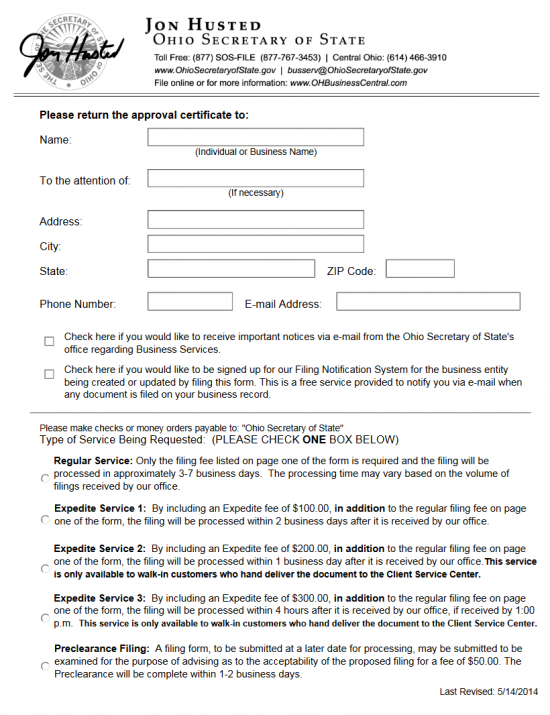

The Ohio Initial Articles of Incorporation For-Profit Domestic Corporation | Form 532A may be filed online or by mail. If filing by mail, you will need to include the cover sheet as well. All documents required with this filing should be submitted simultaneously and may be paid for with a check or money order made out to “Ohio Secretary of State.” If you wish to pay with a credit card, you must file online with the Ohio Secretary of State’s Ohio Business Center at https://bsportal.sos.state.oh.us/(S(mfakocxxfwrbp4j01w3e1j2e))/Login.aspx but you will need a login with this entity.

How To File By Mail

Step 1 – Obtain a blank copy of the Ohio Articles of Incorporation For Profit Domestic Corporation by selecting the link labeled “Download Form” above this statement or by clicking here: Form 532A.

Step 2 – If the Incorporator is a business or organization, this should be reported on the first page, in the box labeled “Name.” Otherwise, if it is an individual, enter the submitter’s Name in the box labeled “Name.”

Step 3 – The second line, beginning with “To the attention of” is optional. If the Incorporator is a business or organization, the Full Name of the individual any material should be sent to should be entered here.

Step 4 – The Full Address of the Incorporator should be entered on the line labeled “Address.”

Step 5 – The next two lines must contain the rest of the Incorporator’s Address (City, State, and Zip Code).

Step 6 – On the line with the two boxes “Phone Number” and “Email” enter some reliable contact information the Ohio Secretary of State may use to contact the filing entity regarding these articles.

Step 7 – The next two paragraphs will each give you a choice. If you would like to receive notices or correspondence at the Email Address listed on the previous line then place a check mark next to the first paragraph. If you would like to sign up for Email Alerts using the Ohio Filing Notification System then place a check mark in the second paragraph as well. You may either check off the paragraphs that apply or you may leave them both blank.

Step 8 – You must now select a level of service by choosing the radio button appropriate for your desired service. There will be several levels to expedite the filing and one which will name this filing as a preliminary filing for review. Each of these services (except for one) will carry a fee separate from the Filing Fee. The first one will be for Regular Service and estimates the process to be 3-7 days. This does not carry an additional Fee. The second choice will expedite the filing to two business days but will require an additional $100.00 Expedite Fee. The third one will expedite the filing to one business day but will require a $200.00 Expedite Fee and must be filed in person. The fourth choice will expedite the filing to four hours after receipt, must be filed in person before 1:00 p.m., and will cost $300.00. Finally, you may choose a preliminary review which will take 1-2 business days and require a $50.00 payment.

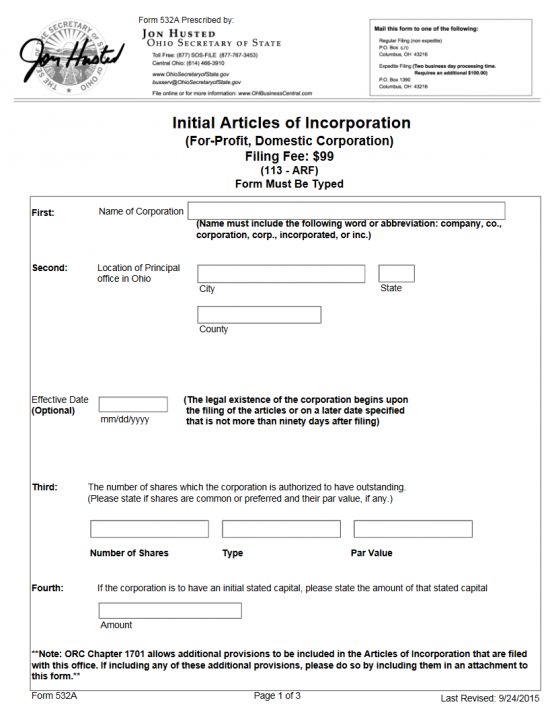

Step 9 – The next page is the Ohio Articles of Incorporation For Profit Domestic Corporation. Locate the First Article, then in the text box provided, report the Full Name of the corporation being formed including one of the required corporation designation words.

Step 10 – In the Second Article, enter the City where the Principal Office is located in the first box. Then, in the second box, report the State where the Principal Office is located. Finally on the next line, in the third box, enter the County where the Principal Office is located.

Step 11 – Next in the section labeled “Effective Date,” you may provide a Delayed Effect to the legal existence of this entity other then the filing date. You may choose any date from the filing date to 90 days after the filing date (Ohio Revised Code §1701.04(E)). You may also leave this section blank should you wish the Effective Date to be the day it has been filed successfully.

Step 12 – In the Third Article, report the Number of Shares Authorized for this corporation in the first box, the Type of Share, and the Par Value. If there are different classes, then you must give the express terms for each class and attach.

Step 13 – In the Fourth Article, report the Total Capital possessed by the forming corporation.

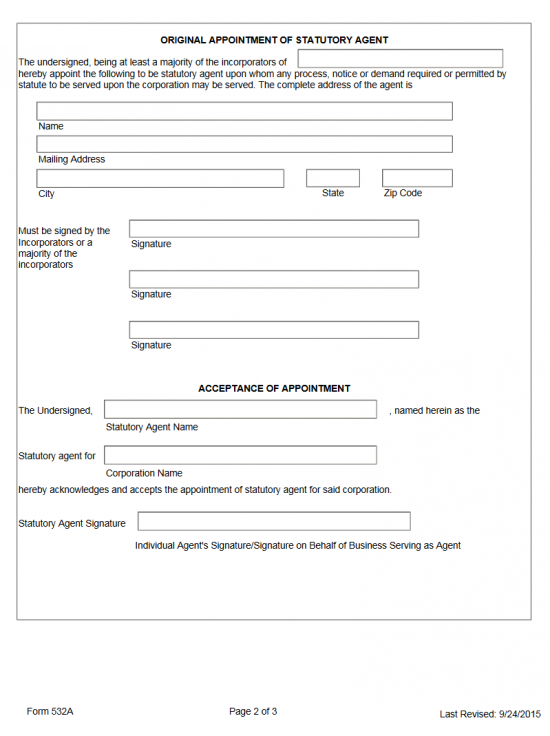

Step 14 – As per Ohio Revised Code §1701.07, an Ohio corporation must obtain a Statutory Agent. Adherence to this requirement must be confirmed in a corporation’s articles of incorporation and will be taken care of on the next page “Original Appointment of Statutory Agent.” In the first box of page 3, enter the Name of the corporation being formed by these articles.

Step 15 – The first paragraph of page 3 will contain wording you should be aware of. Read this paragraph. Then in the boxes below it, enter the Full Name and Full Address of the Statutory Agent.

Step 16 – Below the Statutory Agent’s Name and Address, locate the first set of Signature Lines. These Signature Lines are for the Incorporators to provide a Signature in acknowledgement of this Statutory Agent. The majority of Incorporators must sign this document in order for it to be satisfactory.

Step 17 – In the next section, “Acceptance of Appointment,” locate the first box then enter the Statutory Agent’s Full Name. Then in the second box, enter the Full Name of the Corporation being formed. The Statutory Agent must sign the last box of this section in acknowledgement that he/she has accepted this position.

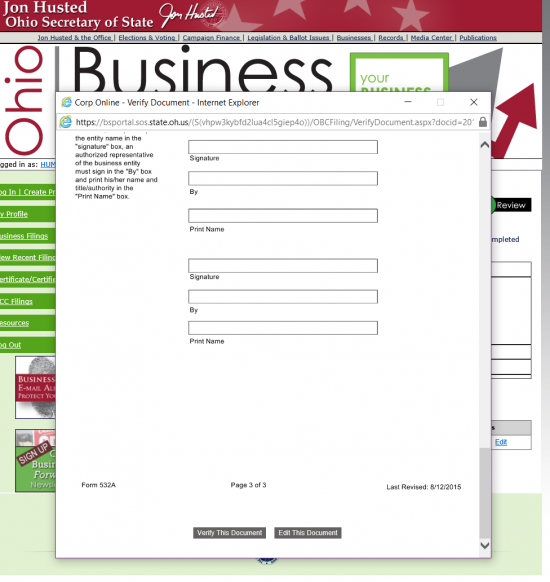

Step 18 – The final page of this packet must contain the Incorporators’ Signature and Full Name. There will be enough for three Incorporators to sign their Names, however if there are more this Signature Section may be continued on another clearly labeled sheet of paper then attached. Each individual shall have three boxes to tend to: Signature, By, and Print Name. If the Incorporator is an individual, he/she must Sign the box labeled “Signature,” leaving “By” empty, then Print his/her Name in the box labeled “Print Name.” If the Incorporator is a business then you must enter the Entity Name in the Signature Box, an Authorized Representative may then Sign his/her Name in the box labeled “By” and Print his/her Name in the box labeled “Print Name.” At least three Incorporators must sign this document before it may be submitted.

Step 19 – Next gather all the documents that must accompany the Ohio Articles of Incorporation For Profit Domestic Corporation | Form 532A and a check or money order made out to “Ohio Secretary of State” for the Filing Fee of $99.00 plus any other applicable Fees and submit for approval by mail.

Mail To:

Ohio Secretary of State

PO Box 670

Columbus Ohio 43216

If Expediting, Mail To:

Ohio Secretary of State

PO Box 1390

Columbus, OH 43216

How To File Electronically

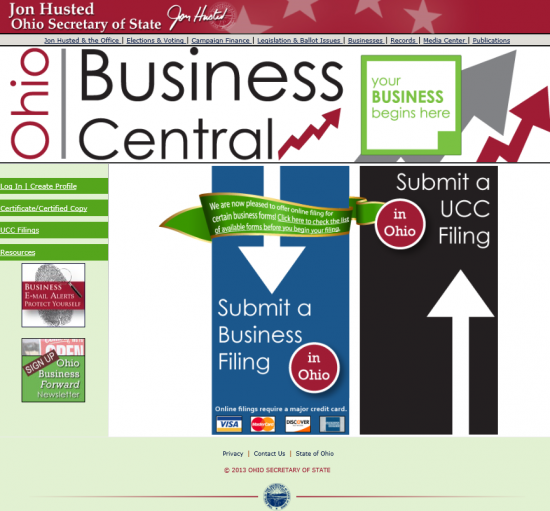

Step 1 – Go to the Secretary of State website at: http://www.sos.state.oh.us. Here, locate the menu item “Businesses.” When you select this item a drop down menu will appear with several headings. From the “Business Services” heading, select “File Online with Ohio.”

Step 2 – Select the button labeled “Submit A Business Filing in Ohio” from the main area of the web page.

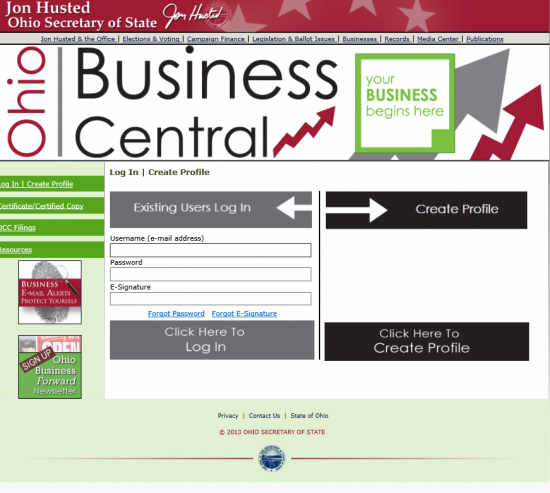

Step 3 – Log in to this site using your login information.

Step 4 – Select the blue button in the center of the page labeled “File a New Business or Register a Name”

Step 5 – Locate the statement “Forms available to file online.” Below this will be a drop down menu. Choose “For Profit (Ohio) $99.00.”

Step 6 – Below this will be an opportunity to choose the level of service you wish to use. This will cost an additional sum of money if you choose to expedite it. This section is under the statement “Choose a processing time” and will use radio buttons as a method of choose which service you prefer. You may choose “Regular Processing” with no fee attached by selecting the first radio button labeled Regular Processing.

Step 7 – Enter the Full Name of your corporation in the text box provided. This will perform a search to see if this Name is available. Then hit the “Search” button. If the Name is currently available, the words “No records found with this name” will appear below the text box. When this happens, select the button at the bottom labeled “Begin Filing.”

Step 8 – This page will require the Full Name of the corporation being formed to be entered in the first text field. Then in the field labeled “City” enter the City where the Principal Office is located. Beside this is a drop down list labeled “County.” Select the County of the Principal Office using this drop down. Finally, if you wish to have a Delayed Effective Date of this filing, enter this date in the last text field of this page. If not you may leave this field blank. Once you are done, select the button labeled “Continue.”

Step 9 – Next, you must enter the Authorized Stock information for your corporation. You must enter the Total Number of Shares in the first text field. This will calculate the Sum to be added to the Filing Fee. Then in “Type of Shares,” you may select “Common Stock” or “Preferred Stock” (keep in mind that Ohio requires you divulge specifics if there are different classes in an attachment if you have Preferred Stock. Then, enter any Par Value for the stock. If the corporation shall have an initial stated capital, you must enter this in the last text field. Once all the information you can report on this page is entered, select “Continue.”

Step 10 – Enter the Statutory Agent’s Name in the first field, the Statutory Agent’s Address in the fields on the two lines below it. If available you may enter the Statutory Agent’s Email Address in the appropriate area. Then the Statutory Agent must type in his/her Name.

Step 11 – This page will allow you to add any attachments you wish to include with this online form. If you do, select “Save and Continue” if not, then select the button labeled “No Attachments Needed, Continue.”

Step 12 – Next, you must enter the Full Name of all the Incorporators. If any are a business entity, then enter that business’s Name in the first field then in the “By” field, enter the Name of an authorized representative for this business. Otherwise, if the Incorporator is an Individual enter the individual’s Name in the first field. Once you select “Add” this will display the Incorporator in a table. You may add as many Incorporators as you wish. Once you are done, select the button labeled “Save and Continue.”

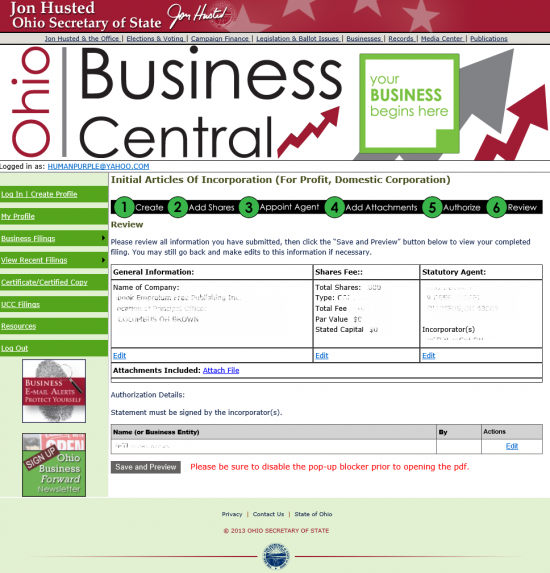

Step 12 – Now you may review the information you have entered. This will be divided into sections. Each will have an “Edit” Button so you may change any erroneous information. When you are ready to proceed, select “Save and Continue.”

Step 13 – A pop up window containing a PDF with this information will appear. This is your Ohio Articles of Incorporation For Profit Domestic Corporation. Review the information in the pop up window then at the bottom select “Verify This Document.” Once you do this you will be given an opportunity to pay for the Filing Fee of $99.00, any Expediting Fee applicable, and the Share Fee calculated earlier using your credit card. All fees must be paid in full, in order for this filing to be reviewed by the Ohio Secretary of State.