|

Texas Certificate of Formation For Profit Corporation | Form 201 |

The Texas Certificate of Formation For Profit Corporation | Form 201 is the template form provided by the Texas Secretary of State for Incorporators wishing to legally form and register a for-profit corporation in the State of Texas. This form will grant Incorporators the structural format for the information that must be presented to the Texas Secretary of State though, it will represent only the barest minimum of information that all incorporating entities must have the Texas Secretary of State approve and file as per Title titles 1 and Title 2 of the Texas Business Organizations Code. It should be noted that many corporations will be subject to additional requirements however, Incorporators will be expected to be familiar with these requirements. As such, it is strongly recommended that an Incorporator, incorporating an entity in the State of Texas, consults an attorney licensed to practice in Texas before filling out this document.

Incorporators will have the option of filing the Texas Certificate of Formation For-Profit Corporation in person, by mail, by fax, or online. The Filing Fee of $300.00 must be submitted with this package. This Fee may be paid for with a credit card, Legalease prepaid account, check, or money order. All checks and money orders must be made payable to Secretary or State. If paying with a credit card or Legalease prepaid account, then you must include a completed Form 807. Expedited Service is available upon request for an additional Fee of $25.00/corporate document, $10.00/copy. Mail the documents to Secretary of State, P.O. Box 13697, Austin, Texas 78711-3697, deliver them in person to James Earl Rudder Office Building, 1019 Brazos, Austin, Texas 78701, or fax to (512) 463-5709. You may file online at SOS Direct.

How To File

Download PDF Form

Download Word Form

Step 1 – There are two file formats available depending upon your preferences. If you have a PDF program and prefer entering information onto the Texas Certificate of Formation For-Profit Corporation, then save the PDF file by selecting “Download PDF Form” above. If you prefer to use MSWord to enter this information, then select and save the file from “Download Word Form” above.

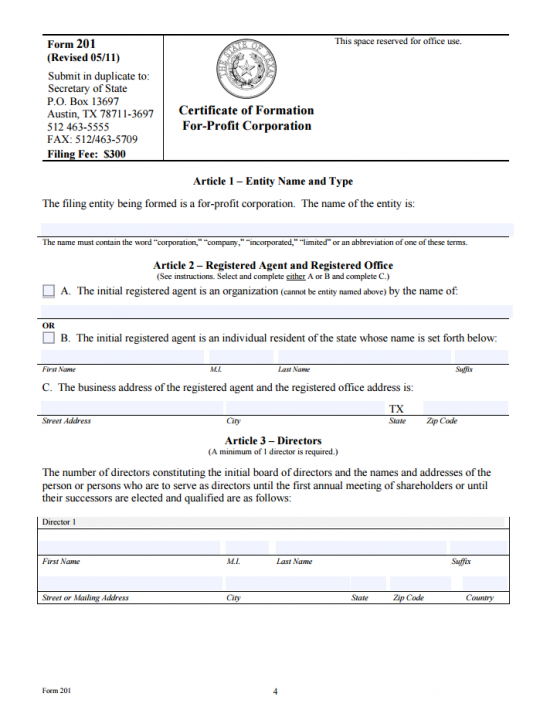

Step 2 – In Article 1, use the blank line provided to report the Full Name of the corporation being formed.

Step 3 – In Article 2, there will be three sections: A, B, and C. You must choose either Section A or Section B to appropriately define the Texas Registered Agent’s Identity. If the Registered Agent is an organization then, check the box labeled “A. The initial registered agent is an organization (cannot be entity named above) by the name of” then enter the Full Name of the organization on the blank line provided. If the Texas Registered Agent is an individual then mark the check box labeled “B. The initial registered agent is an individual resident of the state whose name is set forth below,” then enter the Full Name of the Registered Agent by entering the First Name, M.I., Last Name and any applicable Suffix on the blank line provided.

Step 4 – In Section C of Article 2, report the Street Address, City, and Zip Code of the Registered Agent’s Office. This must be the Complete Actual Address of the Registered Agent and may not contain a P.O. Box Number.

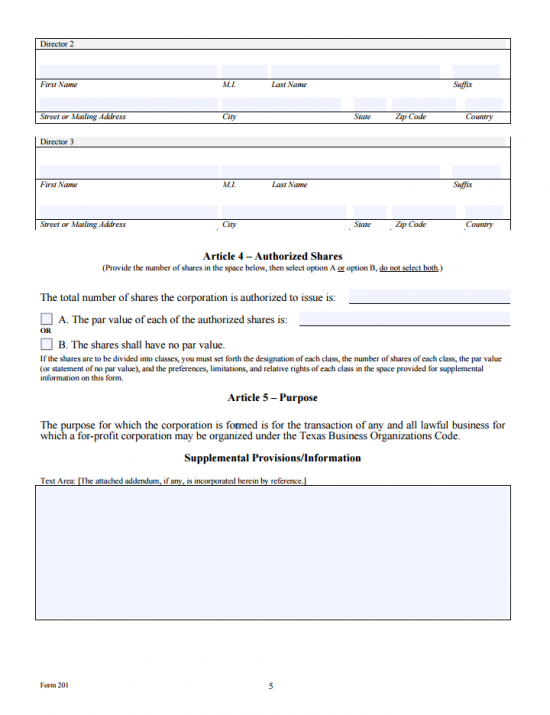

Step 5 – In Article 3, you must report the initial Directors of this corporation (minimum of 1). Each Director must have their information reported in his/her own section. To begin, locate the box labeled “Director 1.” On the first line, report the First Name, Middle Initial, Last Name and Suffix of one Director. Then on the next blank line document the Street or Mailing Address, City, State, Zip Code, and Country of the Director being reported. There is enough room for three Directors, however if there are more you may add additional sections (properly labeled) using either a PDF editing program or MSWord, as appropriate.

Step 7 – Article 4 is reserved so that Incorporators may report information regarding the Authorized Stock of this corporation. If the Authorized Shares have Par Value then mark Box A then enter the Par Value on the blank line provided. If not then select the check box labeled “B. The Shares shall have no par value.” Note: If the shares are divided into Classes then you must report each Class of Share, the Number of Shares in each Class, their Par Value. If there is no par value in the divided Class, then you must include a statement verifying this.

Step 7 – Article 4 is reserved so that Incorporators may report information regarding the Authorized Stock of this corporation. If the Authorized Shares have Par Value then mark Box A then enter the Par Value on the blank line provided. If not then select the check box labeled “B. The Shares shall have no par value.” Note: If the shares are divided into Classes then you must report each Class of Share, the Number of Shares in each Class, their Par Value. If there is no par value in the divided Class, then you must include a statement verifying this.

Step 8 – Article 5 will bind the Incorporator and the entity being formed to the Texas Business Organization Code.

Step 9 – The next section, “Supplemental Provisions/Information” is reserved for additional relevant and required information that must be included in this form. You may enter such information directly into the box or you may enter the title of any attachments that will accompany these articles.

Step 10 – In the section title “Organizer,” report the Full Name and Complete Address of the Incorporator or Organizer of the forming entity.

Step 11 – In the “Effectiveness of Filing” section, you will have three choices for determining when the articles will take Effect. If the articles take Effect when the Texas Secretary of State files these articles then place a check mark in the first box. If there is to be a specific Date of Effect for these articles then mark the second check box and enter the Date of Effect on the blank line provided (must be within 90 Days). If the articles take effect upon an occurrence then mark the box labeled “C,” note the 90th Day after the Signature Date on the blank line, then report this occurrence in the box provided.

Step 12 – In the section labeled “Execution,” the Incorporator must enter the Date of Signing on the blank line ,found on the left, then, on the right, Sign his/her Name and Print his/her Name on the line labeled “Signature of Organizer” and “Printed or typed name of organizer,” respectively.

Step 13 – Next you will need to organize a package consisting of the Texas Certificate of Formation | Form 201 and all required paper work to the Texas Secretary of State. This must be accompanied by payment of the Filing Fee ($300.00). If paying by check or money order make sure it is payable to Secretary of State. If you are faxing this in you may not pay by check and must pay with a credit card or Legalease account (make sure this is accompanied by Form 807).

Mail To:

Secretary of State

P.O. Box 13697

Austin, Texas 78711-3697

Deliver To:

James Earl Rudder Office Building

1019 Brazos

Austin, Texas 78701

Fax To:

(512) 463-5709

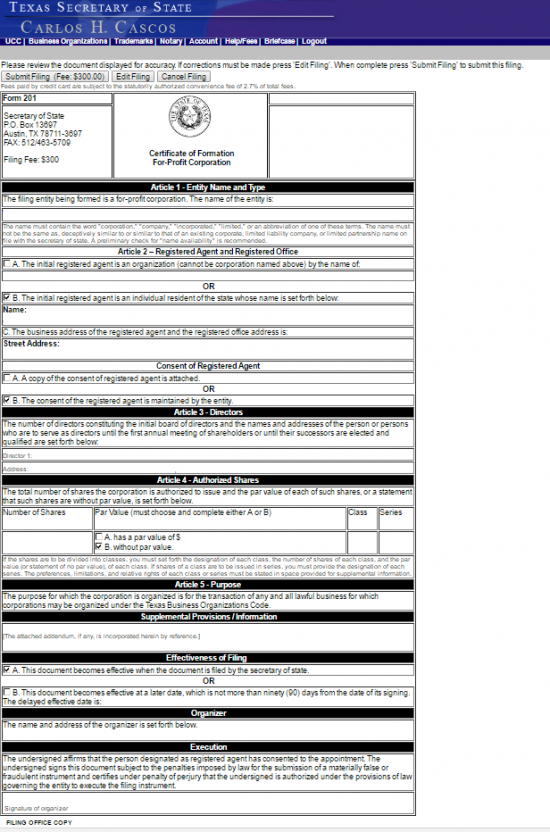

How To File Online

Step 1 – Go to the SOSDirect home page ( http://www.sos.state.tx.us/corp/sosda/index.shtml). Read the information present then select the button, near the bottom of the page, labeled Enter.”

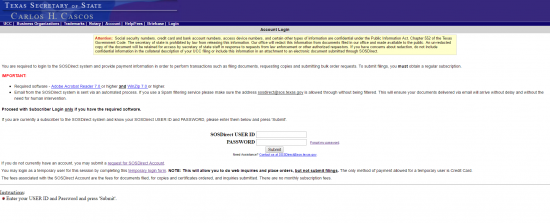

Step 2 – Enter your Login Username and Login Password, then select “Log in”

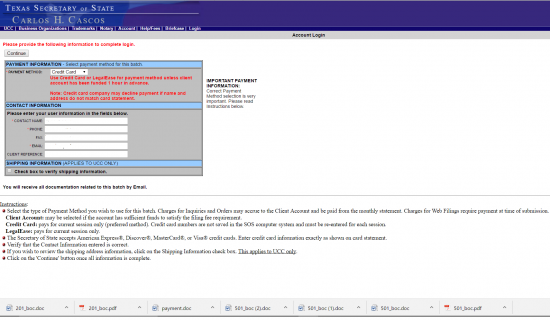

Step 3 – Verify your method of payment and personal information (it will be auto populated) then select the button labeled “Continue.”

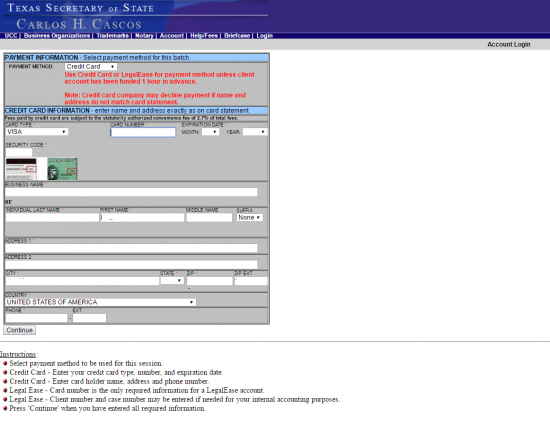

Step 4 – Enter your payment information. Note all credit card payments will require a %2.7 convenience fee.

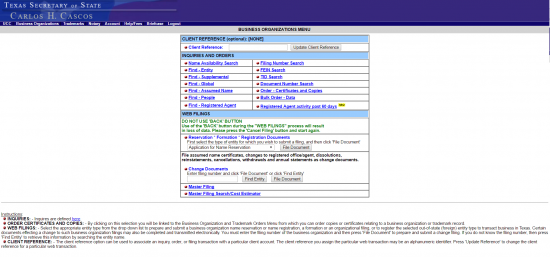

Step 5 – Read this paragraph, make a note of your session number, then select the menu option labeled “Business Organization.”

Step 6 – Under the heading “Web Filings” select “Domestic For-Profit Corporations” then click on the button labeled “File Document.”

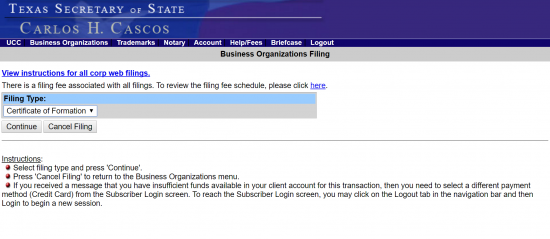

Step 7 – Under the heading “Filing Type,” select “Certificate of Formation” from the drop down list.

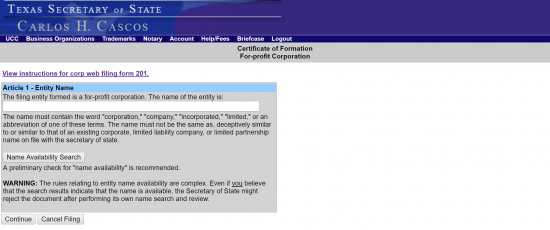

Step 8 – Enter the Name you wish to give your corporation in the text box. There will be an option to select the “Name Availability Search” button. This will allow you to perform a Name search if you wish. For our purposes, select the button labeled “Continue” to begin filing.

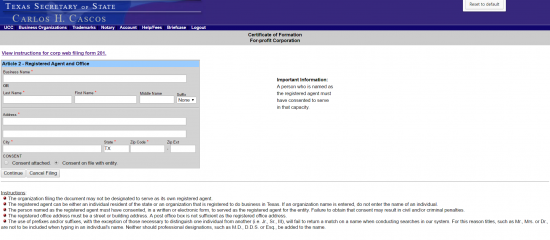

Step 9 – Next you will need to input information regarding the Texas Registered Agent the corporation has obtained. If the Registered Agent is an organization then enter the Full Name of this entity in the field labeled “Business Name.” If the Registered Agent is an individual then report the Last Name, First Name, Middle Name, and Suffix in the appropriate fields. You may only fill out one of these sections.

Step 10 – Use the “Address” fields to enter the actual Street Address where the Registered Agent may be physically found. Then enter the City and Zip Code in the appropriately labeled fields. There will be an optional field to enter a Zip Code Extension labeled “Zip Ext.” All Registered Offices must be physically located in Texas, thus the State field is auto populated with “TX.”

Step 11 – At the bottom of the page, indicate if the Texas Registered Agent Consent will be uploaded and attached to this online submission by selecting the radio button labeled “Consent Attached.” If this is not necessary for your circumstances and it will not be attached then select the radio button labeled “Consent on file with entity.” When you are ready, select the “Continue” button at the bottom of the page.

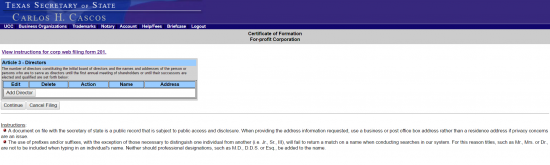

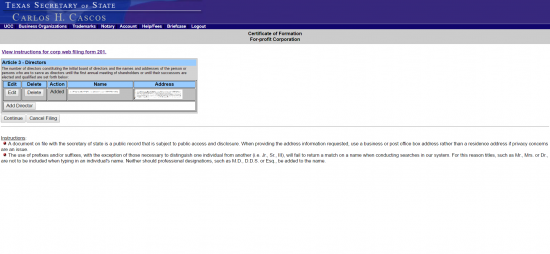

Step 12 – You will need to enter information regarding at least one initial Director. To do this, select the button labeled “Add Director.”

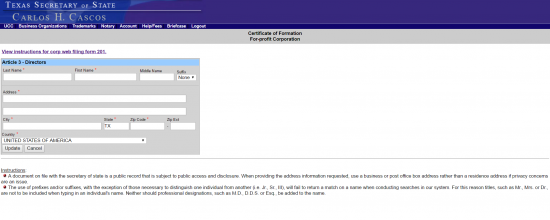

Step 13 – Use the “Last Name,” “First Name,” “Middle Name,” and the drop down list in the “Suffix” field to report the Identity of the Director being reported. Note: the “Middle Name” and “Suffix” fields are optional.

Step 14 – The “Address” section will contain two separate fields to accommodate long Addresses. Enter the Director’s Address in these fields. Then report the City, State, Zip Code, and (if applicable) Zip Extension in the appropriate fields. You may use the drop down list labeled country to report the Country where this Address is found. When you are ready, select the button labeled “Update.”

Step 15 – This page will display the Director information you are reporting (in a table). You may Edit or Delete any of the entries, Add a Director, or Continue to the next section. When you are ready, select the button labeled “Continue.”

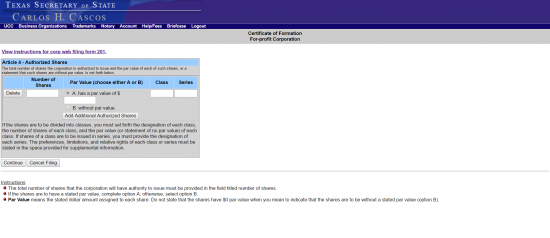

Step 16 – The next screen will concern itself with Article 4. Here you must report on the Authorized Stock the Texas for-profit corporation may issue. There is a table provided for this purpose. In the column labeled “Number of Shares,” enter the Total Number of Shares in one Class of Stock. Then, in the column labeled “Par Value (choose either A or B),” mark the first radio button if the Shares, in the Class being reported, has Par Value then use the field below to enter this Par Value. If the Shares in the reported Class has no Par Value then mark the second radio button. In the next column, labeled “Class,” report the Class this row concerns itself with. If the Classes are divided into Series then enter the Series in the column labeled “Series.” If there are more Classes to report (or more Series) select the button labeled “Add Additional Authorized Shares.” When you are ready, select the button labeled “Continue” to proceed to the next section. Note: If the Classes are divided into Series, then you must report Designation, Preferences, Limitations, and Relative Rights in the Supplemental Information screen.

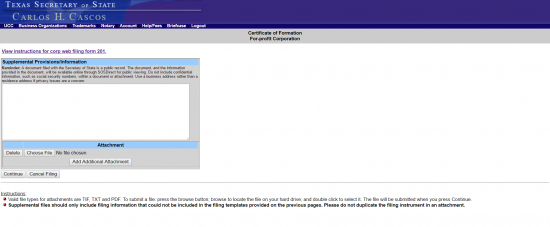

Step 17 – This screen will allow you to enter any additional Supplemental Information in the text box provided. In addition, you may upload any attachments necessary for these articles to be filed properly by selecting the button labeled “Add Additional Attachements” ( an upload button will be generated). When you are ready, select the button labeled “Continue.”

Step 18 – On this screen you must enter the Full Name of the Organizer (or Incorporator) in the field labeled “Name.” Then enter the Complete Address of the Organizer (or Incorporator) in the field labeled “Address.” When you are ready, select “Continue.”

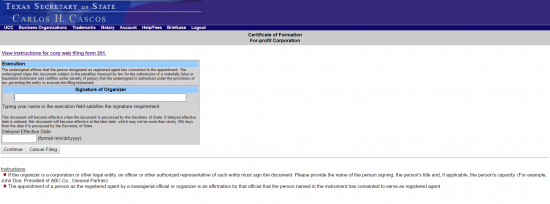

Step 19 – The Electronic Signature of the Organizer (or Incorporator) must be entered. This is done by having the Organizer (or Incorporator) typing in his or her Name in the field labeled “Signature of Organizer.” Once this is done, select the button labeled “Continue.”

Step 20 – This next page will display all the information previously entered. Read this page carefully as all the information must be accurate. If you need to edit any of these sections, use the “Edit Filing” button at the top of the page to navigate to the desired section (do not use the back button on your browser). When you are ready select the button labeled “Submit Filing (Fee $300.00). Once you select this button, you may not edit the information selected and will be guided to a Confirmation page. You will receive an email from the Texas Secretary of State with a packing slip confirming the successful payment and receipt of these artiles.