|

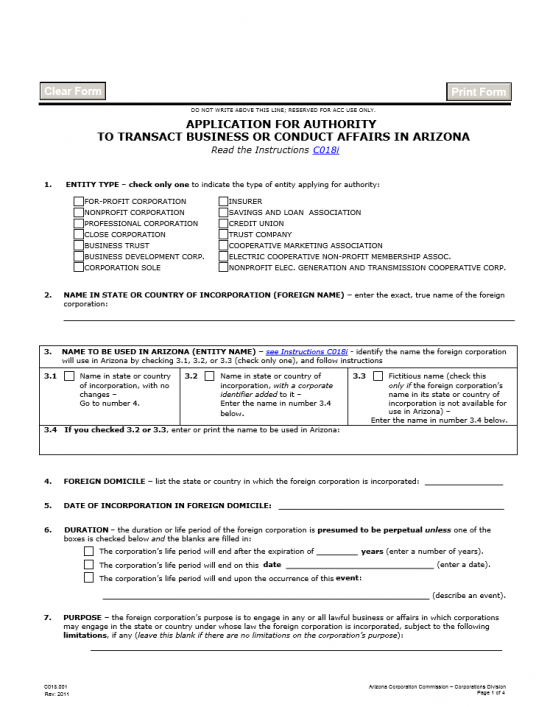

Arizona Application for Authority to Transact Business or Conduct Affairs in Arizona | Form C018 |

The Arizona Application for Authority to Transact Business or Conduct Affairs in Arizona Form C018 is a mandatory filing for any out of state entity wishing to conduct business as any type of corporation within the State of Arizona. This sizeable list includes such entities as for-profit corporations, nonprofit corporations, and professional corporations. The type of corporation that will be formed is strictly up to the developing entity of course, however this is a required document which must be submitted to, and approved by, the Arizona Corporations Commission.

In order to submit a successful application to form a foreign corporation that may conduct business in Arizona, the entity must include a Certificate of Disclosure, a Certified (within sixty days of the filing date) Copy of the Corporation’s Original Articles of Incorporation (from the origin state), Certified (within sixty days of filing) copies of any amendments that have since been filed to the original Articles of Incorporation, a Certificate of Good Standing or Existence (dated within sixty days of the filing date) provided by the original state State’s Department or similar entity, and the Statutory Agent Acceptance form (completed). In many cases, the entity will need to include an approval letter from such bodies as the Arizona Department of Insurance or the Arizona Department of Financial Institutions. In other cases still, it may be necessary to submit licensing authority statements. It is up to the filing entity to be fully informed as to all additional government bodies the forming entity must obtain permission or documentation from. Such knowledge is mandatory if the foreign corporation being formed wishes to remain in full compliance with the law. A payment for the filing fee, of $175.00, must also be included with the filing. If one wishes to expedite the processing, this service would be available with the payment of an additional $35.00 expediting fee. Both the filing fee and expediting fee may be paid for by credit card, money, order, or check if submitting by mail. If one wishes to make a cash payment, the articles must be submitted in person. These documents and payments may be submitted in person or by mail to Arizona Corporation Commission – Corporate Filings Section, 1300 W. Washington Street, Phoenix, AZ 85007.

How To File

Download Statutory Agent Acceptance Form

Download Certificate of Disclosure

Step 1 – In the first section, select the Entity Type of the corporation you are forming by placing a mark in the corresponding box. Only one of the following may be selected: For-Profit Corporation, Nonprofit Corporation, Professional Corporation, Close Corporation, Business Trust, Business Development Corp., Corporation Sole, Insurer, Savings and Loan Association, Credit Union, Trust Company, Cooperative Marketing Association, Electric Cooperative Non-profit Membership Assoc., and Nonprofit Elec. Generation and Transmission Cooperative Corp.

Step 2- In the second item, report the full name of the corporation as it is registered in and operates as in its original state.

Step 3 – In the third section, you must report the name of the corporation as it will be legally known in the state of Arizona. If the original name of the corporation will be used because it satisfies Arizona Statutes and it is available in Arizona, then mark the box next to item 3.1. It the name will be used but must have a corporate identifier added to it, then mark item 3.2 and enter the full name of the corporation in item 3.4. If the name is fictitious, that is a name made up purely so the entity may be formed and operate in Arizona, then mark the box in item 3.3. Enter the fictitious name in item 3.4.

Step 4 – In item 4, enter the state, or country, where the corporation was originally formed.

Step 5 – In item 5, report the date of incorporation in its original state. That is, enter the calendar date this entity’s original articles of incorporation were approved by the governing body of the origin state.

Step 6 – In item 6, report on the lifespan of the corporation according to the original Articles of Incorporation in it’s original state. If the corporation’s life span will terminate after a number of years, check the first box then enter the number of years in the space provided on the blank line. If the corporation’s life span terminates as of a certain date, check the second box and fill in the date this corporation shall expire on the space provided. If the corporation’s lifespan ceases upon a particular event then check the third box and describe what that event is on the space provided.

Step 7 – In item 7, list the purpose of the corporation if it there are limitations placed upon the purpose of the corporation. Otherwise leave this space blank. If so, describe the purpose and the limitations in the space provided.

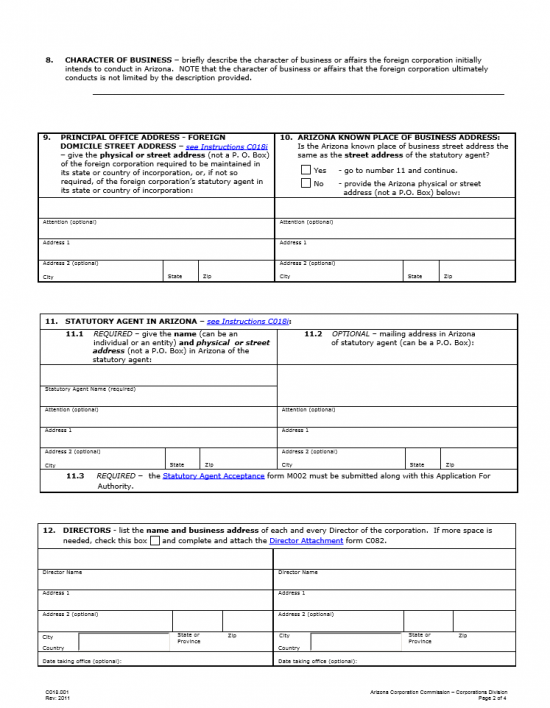

Step 8 – In the eighth item, describe the character of this business. That is give a brief description as to how it will conduct business in the State of Arizona.

Step 9 – List the principal office street address in its state of origin. In some cases, the original state may only require a statutory agent’s street address to be on record, if this is the case then list the statutory agent’s street address in this entity’s original state. Do this in item 9.

Step 10 – In item 10, you must list the Arizona street address of the corporate entity being formed or, if same, the statutory agent’s street address. If these two addresses are the same then mark the box labeled “Yes” in item 10 and proceed to item 11. If these addresses are different then mark the box labeled “No” then list this street address in the spaces provided.

Step 11 – Every corporation in the State of Arizona must have a designated individual or entity that may receive legal notices on its behalf. This individual or entity is known as the “statutory agent.” List the identity and street address of the statutory agent for the corporation these articles concern themselves with in item 11.1. If the statutory agent has a mailing address that differs from the street address, then list the mailing address as well in item 11.2. Item 11.3 shall require the Statutory Agent Acceptance Form be attached. The Statutory Acceptance Form may be downloaded here: Form M002

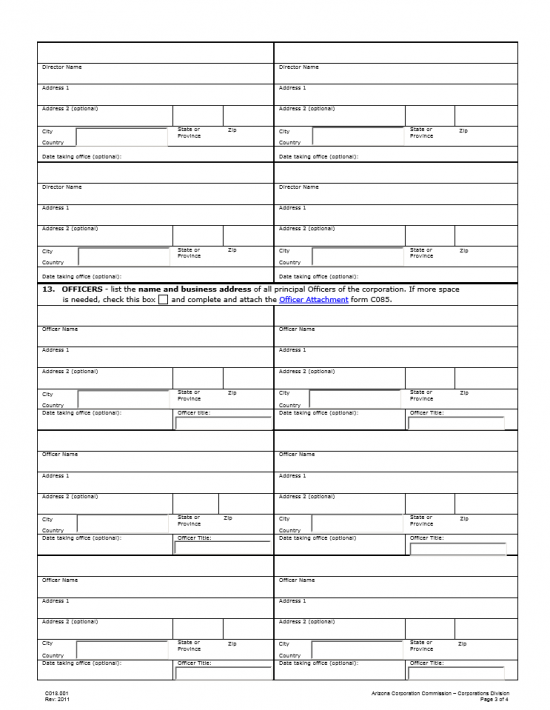

Step 12 – In item 12, you must document the identity and address of each corporate Director for this entity. You may also report the date this entity takes office though this is optional. Initially there will be enough room to document six Directors, if more space is needed mark the box in the first paragraph, download the Director Attachment, then continue this list on this attachment. This must be submitted simultaneously with the articles. The Directors Attachment may be downloaded here: Form C082.

Step 13 – Item 13 will require a listing of this corporation’s Officers. Each Officer will need to have his/her name, business address, and Officer Title listed. You may also report the date they will take office though this is optional. This must be a full report of every Officer who will be active in the State of Arizona for this corporation. Thus, if there is not enough room, mark the box in the first paragraph, download the Officer Attachment and continue the report. This must be submitted simultaneously with the articles. The Officer Attachment may be downloaded here: Form C085

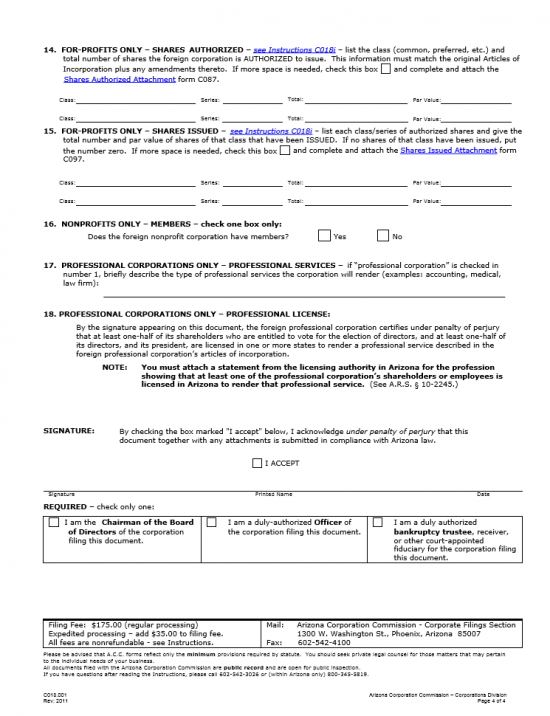

Step 14 – If this will be a For-Profit corporation, you must report the shares issued in item 14. Report the class, series, total number authorized, and the par value. this should be a complete list and a specific form is provided to continue if necessary. If there is not enough room to list all authorized share classes and series, then mark the fox in the first paragraph, download the Shares Authorized Attachment, fill it out, and attach it to this document. The Shares Authorized Attachment may be downloaded here: Form C087.

Step 15 – If this will be a For-Profit corporation and shares have been issued, you must report on the class, series, total number of shares issues, and the par value for these shares. Again since this must be a complete listing, if there is not enough room mark the box in the first paragraph of this section. Then, fill out the Shares Issued Attachment and attach it to these articles. The Shares Issued Attachment may be downloaded here: Form C097

Step 16 – If this is a nonprofit corporation, indicate if there will be members by checking the box labeled “Yes” or the box labeled “No.”

Step 17 – If this is a professional corporation then describe the services the entity will provide in item 17.

Step 18 – Item 18 requires that a statement from the appropriate licensing authority confirming at least one shareholder or employee carries a valid professional license for the services this corporation shall provide be attached to these articles if this is a professional corporation.

Step 19 – In the area labeled “Signature,” check mark the box labeled “I Accept” which will verify the authenticity of the information contained. Then on the line below sign your name, print your name, and provide a date for the signature. You must also identify your relation to the corporation filing the document. If you are the Chairman of the Board of Directors mark the box on the left. If you are a duly authorized Officer place a mark in the middle box. If you are a duly authorized bankruptcy trustee or a court appointed fiduciary place a mark in the box on the right.

Step 20 – Submit the completed Cover Sheet, Application for Authority, Statutory Acceptance Form, any other relevant or required documentation, and a payment for $175.00 to:

Arizona Corporation Commission

Corporation Division

1300 W. Washington Street

Phoenix, Arizona 85007

This may be done in person or by mail. If done in person, you may submit payment in cash, check, money order, or by credit card. If submitting by check you may provide payment by check. Checks must be made payable to “Arizona Corporation Commission.” If you would like the application procedure to be expedited, include a payment for the $35.00 expediting fee.