|

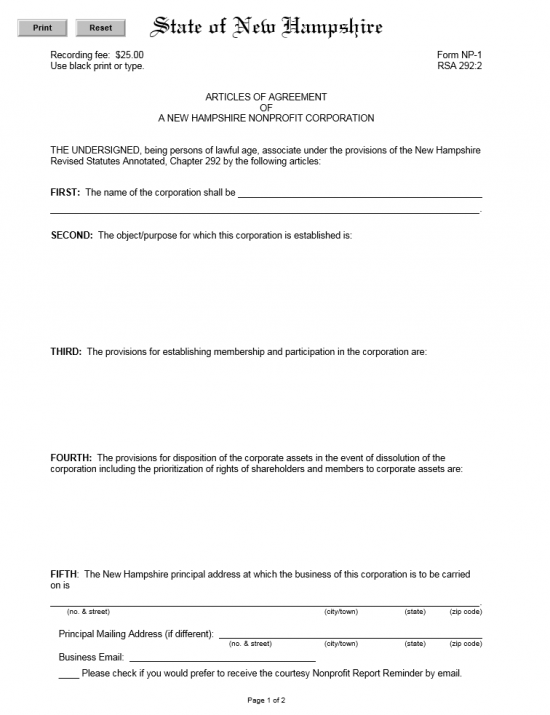

State of New Hampshire Articles of Agreement of A New Hampshire Nonprofit Corporation | Form NP-1 |

The State of New Hampshire Articles of Agreement of A New Hampshire Nonprofit Corporation | Form NP-1 is required form filing that must be submitted to the New Hampshire Secretary of State. In order for this entity to form and operate in compliance with New Hampshire State Law, this filing must be submitted and approved before this entity may operate as such. This is because several pieces of information must be registered with the New Hampshire Secretary of State regarding the forming corporation. That is, the Name of the corporation, its Purpose, its Membership Requirements, rules for Dissolution, and a few other facts must be reported. This is the minimal amount of information that must be reported but, depending upon the nature of the nonprofit, additional information may be required. Additionally, it should be noted, that if the forming corporation intends to apply for Tax-Exempt status then 501(c)(3) compliant language must be used. This does not satisfy all the requirements the Internal Revenue Service will require to grant such status. Hence, it is imperative that Incorporators contact the I.R.S. separately before submitting this document to the New Hampshire Secretary of State.

The State of New Hampshire Articles of Agreement of A New Hampshire Nonprofit Corporation | Form NP-1 must be sent with all required documents and a Full Payment for the $25.00 Filing Fee. The Filing Fee may be paid for by check (made payable to “State of New Hampshire.” You may mail this package to Corporation Division, NH Dept. of State, 107 N. Main Street Room 204, Concord, NH 03301-4989.

How To File

Step 1 – You may download the State of New Hampshire Articles of Agreement of A New Hampshire Nonprofit Corporation by selecting the “Download Form” link above or by clicking here: Form NP-1

Step 2 – Write out the Full Name of the nonprofit corporation being formed as it will be known to the public and to governing bodies such as the New Hampshire Secretary of State. Do this on the blank lines provided in the First Article.

Step 3 – In the Second Article report the Object or Purpose of forming this corporation. This must be an accurate statement and if interested in applying for Tax-Exempt Status may require specific language.

Step 4 – You will need to document any provisions that must be satisfied in order to establish membership and/or participation in this nonprofit corporation. This too, must contain specific language. Do this in the space provided in the Third Article.

Step 5 – The Fourth Article should have the provisions, regarding corporate assets, if or when this nonprofit is dissolved. Make sure to include such subjects as the prioritization and rights of shareholders and members.

Step 6 – In the Fifth Article, you must report the Principal Mailing Address on the first blank line. This must be a complete Address and must be the actual location. If there is a separate Mailing Address where the Principal Office receives mail on the second line. Below this, report the Email the nonprofit corporation uses as a the means of reliable communication. If you would like to receive courtesy Nonprofit Report Reminder at this email address check the blank space present below the Email Address.

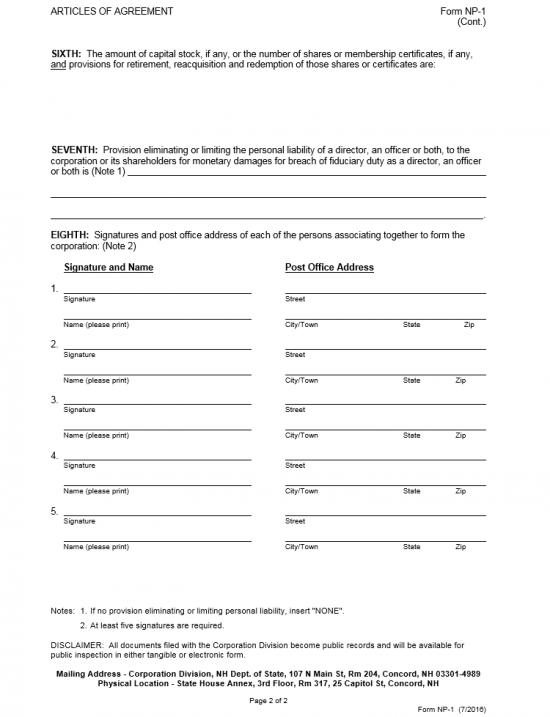

Step 7 – The Sixth Article requires that you report any Stock Shares authorized for this nonprofit corporation, Membership Certificates available, Provisions for Retirement on the blank space provided. This must include any specifics to reacquisition and redemption of such shares and certificates.

Step 8 – The Seventh Article document any provision that would limit or eliminate personal liability to Directors and or Officers, the corporation, and the shareholders in the event there has been a breach of fiduciary duty by a Director and or Officer.

Step 9 – In the Eighth Article, at least five Incorporators must provide their Signature, Printed Name, and Address.

Step 10 – Gather the State of New Hampshire Articles of Agreement of A New Hampshire Nonprofit Corporation | Form NP-1, its supporting documentation, and a check in the amount of $25.00 (Filing Fee) made payable to State of New Hampshire. You must mail this in to file. If approved, you will receive the articles stamped by the New Hampshire Secretary of State within thirty days.

Mail to:

Corporation Division

NH Dept. of State

107 N. Main Street, Room 204

Concord, NH 03301-4989